Could You Be Exiting Too Early? Don’t Forget to Analyze Your Reinvestment Rate

When attempting to maximize the value of your money invested in real estate, the timing of your exit is key to maximize your return. Exit too early, and you might leave money on the table. Exit too late, and you might have better used that capital on other opportunities. In this quick post, I discuss how to use the Reinvestment Rate to help assess the proper point to exit a real estate investment.

Example of Timing Your Exit

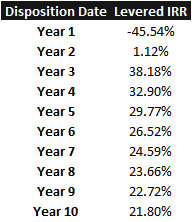

As an example, let’s take a look at the base case from my Multifamily Redevelopment Model that I shared to our library of real estate models years ago. This particular example is for the 123 Fake St property. Below is the projected levered IRRs for that property:

Based on the table above, it is clear that exiting in year 3 would maximize the return on our money. Every year we keep our money in after year 3, we are seeing a diminishing return on our initial investment. This is provided our assumptions for our model hold true, of course. So it would seem like a no brainer that the best option would be to redevelop and exit.

Add Reinvestment Rate to the Analysis

However, a key issue one needs to consider when planning an exit strategy is what will he or she reinvest this money in after the exit. Will there be investment opportunities that will achieve returns on par with 123 Fake St in years 4 through 10?

If you have not planned your reinvestment strategy and have not identified opportunities that meet or exceed the returns in the subsequent years, than it would not be in your best interest to exit in year 3 if maximizing your return on investment is the primary goal.

Example of Using Reinvestment Rate to Analyze Exit Timing

To illustrate, let’s say the maximum holding period on 123 Fake Street was 4 years and the exit is 32.90% in year 4 as stated in the table. You have the option to dispose of the property in year three or four. The only other investment opportunity you have with your proceeds from the sale in year three is a 10% fixed income return in year 4, which will pay monthly. Using this example and reinvesting the proceeds at 10%, the IRR over the four year period is 31.48%. This is 1.43% lower than if we just stayed in the deal until the end of year 4. The attached excel model will show the calculations for our IRRs.

In sum, this is why it is critical to understand what reinvestment options you have when deciding upon exiting a deal. Although you may see diminishing returns by extending the hold of your investment, without another opportunity available that presents equal or better returns the best option will be to stay in the deal.

- Click here to download the file used in the above example

Frequently Asked Questions about Reinvestment Rate Analysis in Real Estate Exits

Why is exit timing critical in real estate investing?

Exit timing determines whether your capital is optimally deployed. “Exit too early, and you might leave money on the table. Exit too late, and you might have better used that capital on other opportunities.” The goal is to maximize your return over the entire holding and reinvestment period.

What is the Reinvestment Rate in real estate analysis?

The Reinvestment Rate refers to the return you expect to earn on capital after exiting a real estate investment. It helps determine whether it makes financial sense to exit an investment early if no other investment offers comparable or better returns.

How can ignoring the Reinvestment Rate affect your returns?

If you exit a deal early without a reinvestment plan, you may earn a lower overall return. For example, exiting in year 3 and reinvesting at 10% yields an IRR of 31.48%, lower than the 32.90% IRR from holding the original investment through year 4.

How does the 123 Fake St example illustrate this concept?

In the example, exiting in year 3 appears optimal based on IRR alone. But when factoring in a reinvestment at 10% in year 4, the total IRR over the 4 years drops below what would be earned by simply staying in the investment until year 4.

What should investors do before deciding to exit?

Investors should assess potential reinvestment opportunities. “If you have not planned your reinvestment strategy… it would not be in your best interest to exit in year 3 if maximizing your return is the primary goal.”

Is staying in a deal longer always better?

Not necessarily. Holding longer can lead to diminishing returns, but exiting too early without a solid reinvestment plan can reduce total return. The key is comparing the return from holding with the expected return from reinvestment.

Where can I find the IRR calculations used in the example?

You can download the Excel file that contains the example and all associated IRR calculations using the link provided in the original post.