Guide to Using ChatGPT for Commercial Real Estate Professionals (Updated Nov 2025)

When I first published this guide in early 2023, ChatGPT felt like a novelty. It was impressive, experimental, and even a little unnerving. But for most in CRE, it was still just a toy. Fast forward two and a half years, and that’s no longer the case.

Today, AI is embedded in the way serious real estate shops do business. From underwriting and asset management to investor communication and deal sourcing, ChatGPT is one of the tools that sits at the center of it all. And it’s no longer “just a chatbot.” It’s a robust productivity platform that can search, analyze, reason, and even listen or see. And recently, the underlying large language model that powers it was upgraded to GPT-5.1.

So, I figured it was time to refresh this guide. This version reflects what ChatGPT is today, and how commercial real estate professionals can use it to get real work done.

Here’s what I’ll cover:

- What ChatGPT actually is in CRE terms.

- How to set it up and prompt it effectively.

- Modern, repeatable CRE workflows anyone can use today.

This is written from the perspective of someone who spent two decades in the business and now spends most of his time building AI for it.

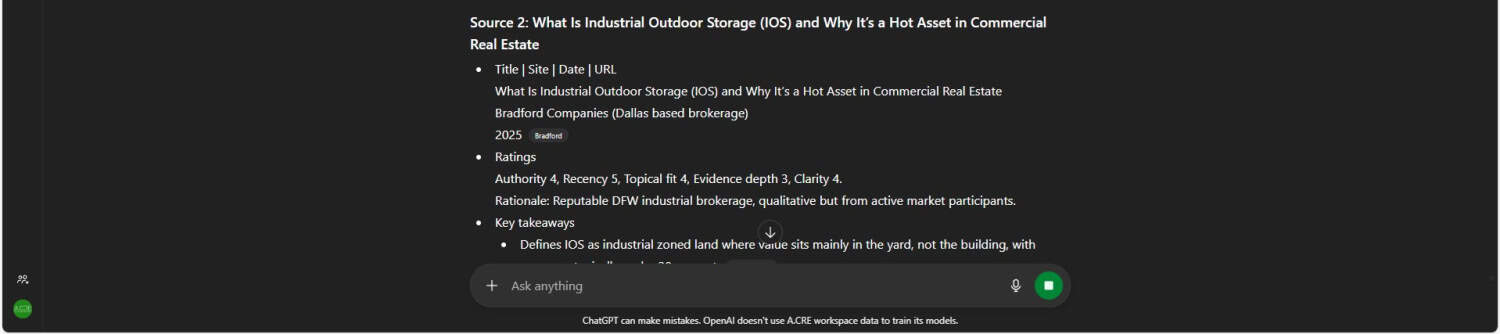

A discussion about IOS with ChatGPT

What ChatGPT Has Become

In 2023, the landscape was simple. GPT was the model. ChatGPT was the chat interface.

That framing is outdated.

In 2025, “ChatGPT” means a stack of capabilities layered on top of incredibly powerful models. The foundation models today: GPT-5.1 Instant and GPT-5.1 Thinking handle everything from basic email drafts to deep underwriting reviews and legal nuance. You choose based on speed or depth.

But it’s not just the models.

ChatGPT can search the live web, analyze Excel files and PDFs, interpret charts and images, and even engage in live voice conversations. It remembers your preferences across sessions, integrates with your files and systems (e.g., Outlook, SharePoint, Slack, Google Drive), and supports team collaboration.

Workspaces like “Projects” and “Canvas” allow you to group files, instructions, and threads for each deal, fund, or client.

And perhaps most important for CRE: you can now treat ChatGPT as a digital assistant, a shared team tool, or to experiment with agentic capabilities for your firm.

Setting It Up Right for CRE

Most people still under-use the basics. Here’s how I recommend setting it up:

1. Create or log into your ChatGPT account

Don’t use a free account for work. ChatGPT saves and uses your data to train and improve its model. Instead, pay the $20-$30/mo for a Plus or Teams account where OpenAI by default does not use your conversations to train its models.

2. Enable the right features

Turn on Memory, add custom instructions, and connect integrations (e.g. Gmail, Google Drive, Hubspot). This unlocks a lot of the value.

3. Create a Project for Each Real-World Deal or Assignment

I recommend creating a new Project in ChatGPT for each live deal, asset, fund, or recurring assignment you’re working on.

Think of Projects like digital folders with memory and instructions attached. When you start a new deal, drop in the related files: OM, T-12, rent roll, underwriting model, lease, term sheet, etc.

Then add instructions describing your role and the type of help you need. For example:

“You are my commercial real estate analyst. We are evaluating a value-add multifamily deal in Dallas. Help with underwriting assumptions, risk review, and IC prep. Use concise explanations, prefer bullet points, and always show your reasoning.”

This setup instructs ChatGPT to act like a context-aware teammate inside each Project. Each deal gets its own context, and the assistant tailors its responses accordingly.

4. Learn to use the model and thinking-time picker

ChatGPT’s GPT-5.1 comes with what’s called “adaptive reasoning”. Meaning, it toggles between GPT-5.1 Instant (i.e. used for quick tasks) and GPT-5.1 Thinking (i.e. for heavier work like underwriting support or investment memo drafting). Based on the prompt you give it, ChatGPT will automatically choose the level of reasoning required. However, you can always choose Instant or Thinking if you want it to use one or the other.

Instructing ChatGPT for Optimal Results

Prompting isn’t about clever one-liners. It’s about context and iteration.

Define the role

“You are a senior CRE analyst focused on value-add multifamily. You understand Excel, Argus, joint ventures, and lender constraints.”

Attach the context

Upload the OM, T-12, and rent roll. Then give a focused task:

“Identify three inconsistencies between the OM and my underwriting file. Create a table: item, correct value, and a one-sentence rationale.”

Iterate

Ask for a first draft. Refine it. Then have ChatGPT critique its own output:

“Challenge your assumptions and highlight what we may have missed.”

Use thinking time

If it’s important, slow the model down. Speed isn’t the goal. Better answers are.

From Answer Engine to Assistant

The real value of ChatGPT in CRE isn’t about one-off answers. It’s about turning repeatable tasks into faster, more structured workflows.

One-off assistant

For quick wins, ChatGPT is great at handling isolated tasks:

- “Summarize this 80-page lease in 10 bullets.”

- “Translate this LOI into plain English.”

Repeatable workflows

Where things really get interesting is when you build semi-automated workflows using custom GPTs or agents. These tools let you take common CRE tasks and speed them up dramatically.

Examples:

- Create a custom GPT that abstracts leases into a structured table and summary.

- Use an agent that standardizes pipeline updates by pulling key data and formatting it into your Monday deck template.

- Design a tool that reads monthly property reports, flags unusual variances, and drafts a first-pass owner or lender update.

The real power is in end users and subject matter experts (i.e. you), creating bespoke AI tools that support work, reduce manual effort, and help teams focus on the high-value parts of the job.

Real CRE Use Cases (Updated for 2025)

Here’s how I see ChatGPT delivering value today:

Analysts and Associates

- Help with Excel and VBA

- Market research with citations

- Drafting memos and decks

Acquisitions Teams

- Summarize deal emails

- Draft IC materials

- Review deal comps and risks

Asset Managers

- Ingest monthly ops data

- Flag variances and compliance issues

- Draft owner/lender reports

Brokers and Capital Markets

- Create OMs from templates

- Respond to inbound leads

- Draft tenant notices and updates

Property Management

- Handle tenant communications

- Triage maintenance requests

- Refine SOPs and policies

This list is by no means exhaustive. But it’s where I see daily, repeatable value—not just novelty.

Guardrails: Staying Out of Trouble

AI is now core to CRE workflows. That means risk.

Here are my non-negotiables:

- Never paste sensitive info into a free account. Use Enterprise or Teams environments.

- Assume it can hallucinate. Double-check facts. Ask for sources.

- You’re still the decision maker. Let the AI speed you up, not replace your judgment.

- Test on dummy data. Then move to real deals.

Frequently Asked Questions about this Guide to Using ChatGPT for Commercial Real Estate Professionals

What is ChatGPT in CRE terms today?

In 2025, ChatGPT is “a stack of capabilities layered on top of incredibly powerful models.” It now supports functions beyond chatting — like searching the web, analyzing Excel/PDF files, interpreting images and charts, remembering user preferences, integrating with tools like Outlook and Slack, and enabling team collaboration via Workspaces such as Projects and Canvas.

Which GPT models are available and how are they used?

ChatGPT uses two main versions of GPT-5.1: Instant (for quick tasks) and Thinking (for deeper work like underwriting or legal review). The system automatically selects the appropriate mode based on your prompt, but users can manually choose between the two as needed.

How should CRE professionals set up ChatGPT for work use?

Key setup steps include:

Use a paid Plus or Teams account to ensure data privacy.

Enable Memory, custom instructions, and relevant integrations like Gmail, Hubspot, or Google Drive.

Create a Project for each deal or assignment, upload related files, and give clear instructions about your role and expectations.

What are ChatGPT Projects and why are they useful in CRE?

Projects are like “digital folders with memory and instructions attached.” Each Project holds files and contextual instructions for a specific deal, asset, or assignment. This enables ChatGPT to act like a context-aware teammate that tailors responses based on deal-specific data and your role.

What are best practices for prompting ChatGPT in CRE tasks?

Good prompting is about context and iteration, not cleverness.

Steps include:

Define ChatGPT’s role (e.g. “You are a senior CRE analyst…”)

Upload relevant files and assign focused tasks

Refine the output and ask it to critique its own assumptions

Use “Thinking” time for important tasks to ensure depth

How can ChatGPT support repeatable workflows in CRE?

Beyond one-off tasks, ChatGPT enables semi-automated workflows using custom GPTs or agents. Examples include:

Structuring leases into summaries and tables

Auto-formatting pipeline updates for Monday decks

Reading monthly property reports and drafting owner/lender updates

What are real-world CRE use cases for ChatGPT as of 2025?

Use cases by role include:

Analysts – Help with Excel, market research, memo drafting

Acquisitions – Summarize emails, draft IC materials, assess deal comps

Asset Management – Review ops data, flag variances, draft reports

Brokers/Capital Markets – Create OMs, manage inbound leads

Property Management – Handle tenant comms, SOP refinement, maintenance triage

What risks should CRE teams consider when using ChatGPT?

Key guardrails include:

Never use a free account for sensitive data

Assume potential hallucination and verify facts

You remain the decision maker — ChatGPT should enhance, not replace, your judgment

Test on dummy data first before applying to real-world deals