Static Debt Yield or Dynamic Debt Yield?

We recently received an intriguing question in the Q&A section of the A.CRE Real Estate Financial Modeling Accelerator regarding the calculation of debt yield. As such, I’d like to take the opportunity to discuss it.

First of all, I must tell you that the Q&A is a fascinating and great learning area of the A.CRE Real Estate Financial Modeling Accelerator where participants send us their questions related to the academic and professional training offered by this program.

A LOOK AT THE INDICATOR KNOWN AS “DEBT YIELD”

When it comes to debt yield, there are various factors to consider. In essence, it is a metric that enables one to estimate the size of a mortgage loan, calculated as the ratio of Net Operating Income (NOI) to the mortgage loan amount. Debt Yield is calculated as NOI ÷ Loan Amount.

Debt Yield = NOI ÷ Loan Amount

Lenders use this metric to measure the risk involved in making a loan. It is a kind of percentage return on the property that the lender would receive if the borrower defaulted on the loan payment. The higher the debt yield, the lower the risk the lender assumes, while the lower it is, the higher the risk.

LOAN SIZING

Inevitably, lenders rely on the market to determine the amount of a loan. The market, in this case, refers to the competition between lenders, such as banks.

Suppose you are part of an investment team interested in purchasing a shopping center. To begin with, you create an unlevered discounted cash flow model. Next, you add debt to the model to evaluate the return and risks on a levered basis. This implies that you must calculate the loan amount at the beginning of the analysis.

A DEBT YIELD CASE STUDY

The question now is how to do this. In essence, you must contact the bank or lender to enquire about interest rates on a given leverage level (i.e., “Loan to Value”). Then you must inquire about what debt yield and minimum debt service coverage ratio to expect.

I recommend you consult the Bite-Sized Real CRE Lessons – A.CRE 30 Second Video Tutorials and our Glossary of Terms to clarify any doubts regarding a certain term.

STATIC DEBT YIELD?

After computing the discounted cash flow model of the shopping center, you find out that it generates a Net Operating Income (NOI) of about $1,500,000 annually. You must now contact the bank or lender to enquire about interest rates on a given leverage level (i.e., “Loan to Value”). Then you must inquire about what debt yield and minimum debt service coverage ratio to expect.

This is where calculating the debt yield statically comes into play. So how do we calculate the loan amount? We must use the NOI produced by the shopping center in year 1. In other words, we will calculate the loan amount using the value of the NOI from the proforma.

Loan Amount = NOI ÷ Minimum Debt Yield

Assuming the NOI value was $1,500,000 in year 1

Loan Amount = $1,500,000 ÷ 10% = $15,000,000

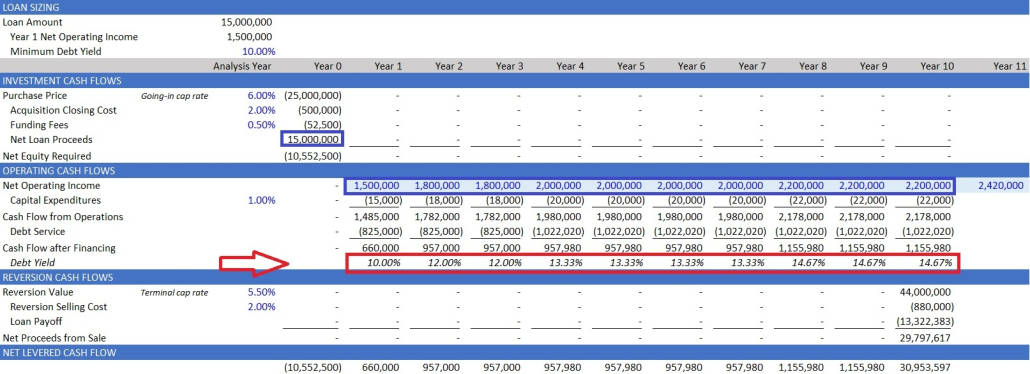

So why is it called static? To answer this question, I would like to show you a Discounted Cash Flow model:

It is called “static” because each period has been calculated using the NOI generated in each period divided by the Net Loan Proceeds, that is to say, by the Initial Loan Amount.

Debt Yield = NOI ÷ Loan Amount (Initial)

At first sight, we can say that the static calculation helped size the initial loan, besides it could be that the investor is interested in knowing the debt yield as a function of the initial loan amount without considering the changes in the loan amount or static debt yield.

However, what would happen if instead of selling at a given time we consider the option of refinance?

DYNAMIC DEBT YIELD?

This may be done when the investor is considering the option to refinance in year 10, so it would no longer make much sense to calculate the static debt yield.

In this case, the investor would be interested in knowing the debt yield as a function of the outstanding loan balance (existing debt). This is what is known as “dynamic debt yield”.

In this case, it would be a dynamic operating performance metric to measure refinancing risk.

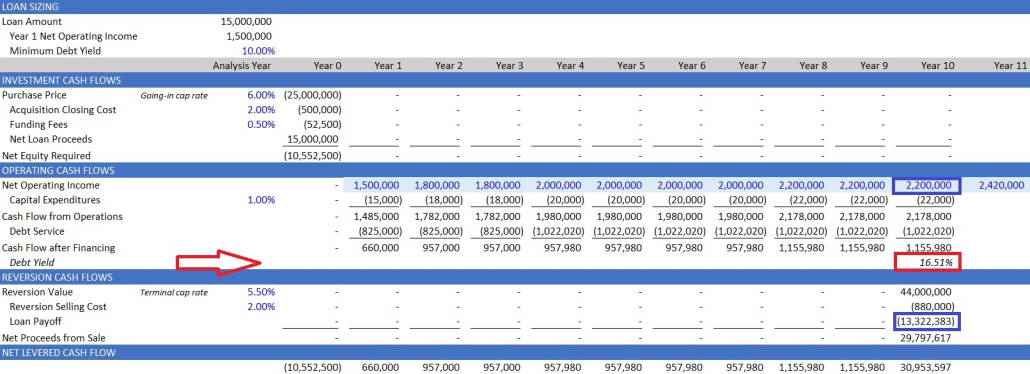

Let’s visualize that in the Discounted Cash Flow model:

You can appreciate how the debt yield increased from 14.67% to 16.51%, that is because it was calculated based on the outstanding loan balance and not on the initial loan.

BOTH DEBT YIELD CALCULATIONS ARE CORRECT

These calculations are a loan metric and should be treated as such. It is a tool that provides information to help us make the best investment decision.

In this sense, static debt yield and dynamic debt yield calculations are correct, however, the choice of calculation method is going to depend on the context in which you are going to use each of them.

Frequently Asked Questions about Static vs. Dynamic Debt Yield in Real Estate

What is Debt Yield and how is it calculated?

Debt Yield is calculated as the Net Operating Income (NOI) divided by the loan amount:

Debt Yield = NOI ÷ Loan Amount

It is used by lenders to measure loan risk. A higher debt yield implies lower risk to the lender.

What is Static Debt Yield?

Static Debt Yield uses the initial loan amount in its calculation regardless of future loan balance changes. It is calculated as:

Debt Yield = NOI ÷ Initial Loan Amount

It is typically used at loan origination to size the loan and assess initial risk.

How is Dynamic Debt Yield different from Static?

Dynamic Debt Yield uses the outstanding loan balance in each period rather than the original loan amount. This approach reflects changes over time and is more suitable for evaluating refinancing scenarios or ongoing loan risk.

When should Static Debt Yield be used?

Static Debt Yield is most useful at the beginning of an investment to help determine the initial loan amount based on a lender’s minimum debt yield requirement. It’s a common tool for loan sizing.

When is Dynamic Debt Yield more appropriate?

Dynamic Debt Yield is especially helpful when evaluating refinancing risk or when an investor wants to track how risk evolves over time. It measures yield based on the current outstanding loan balance.

Are both Static and Dynamic Debt Yields considered correct?

Yes, both methods are correct. The choice between them depends on the context: use static for loan sizing at origination, and dynamic for ongoing risk assessment, particularly in refinancing scenarios.

What does a higher Debt Yield indicate to a lender?

A higher debt yield suggests a lower risk to the lender, as it implies stronger income relative to the loan amount. It indicates that the property generates enough income to cover the loan in case of default.

How do lenders use Debt Yield in the loan underwriting process?

Lenders set a minimum required debt yield and use it to back into the maximum allowable loan amount. For example, with a minimum debt yield of 10% and an NOI of $1.5M, the maximum loan would be $15M.