Real Estate Financial Modeling Accelerator (Updated April 2024)

Prior to launching the Accelerator program, Michael and I fielded email after email requesting a more structured real estate financial modeling training program on the site.

Over the years, we've covered hundreds of real estate modeling…

Pilot-Legacy Private Equity Group – A.CRE Real Estate Sponsor Series

This post is the first in a new series at A.CRE, our Real Estate Sponsor Series. This series aims to catalog the various real estate investors across the country. For this article, we interview Pilot-Legacy Private Equity Group’s Lane Beene.…

Módulo de Flujo de Efectivo en Cascada – Base Anual y Múltiples Niveles de TIR en Excel

Cuando estaba trabajando en la publicación del “Modelo de Desarrollo Industrial”, pensé en la idea de explicar uno de los temas más interesantes del “Acelerador de Modelos Financieros”, se trataba del “Modelo de Cascada” también…

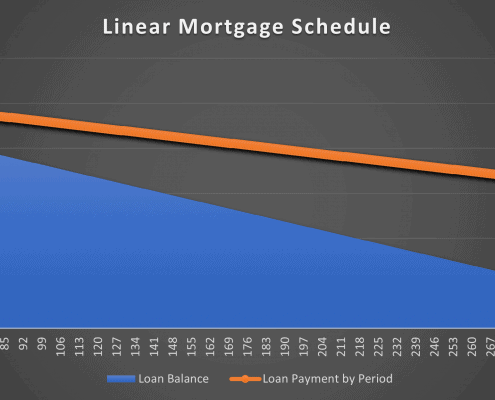

Linear Mortgage Payment Schedule Tool (Updated Oct 2022)

We recently shared a new modeling test to our library of real estate case studies entitled UK Debt Advisory Firm Modeling Test. In that case study, the test asked the real estate professional to analyze the returns of three different debt options.…

Loan Payment Schedule and Balance Tracking Tool (Updated Oct 2022)

A childhood friend called me this week and asked for a favor. He is the lender on a private real estate loan and was wanting a way to personally service the loan. Namely, he needed a tool to issue monthly invoices, track the principal vs interest…

A.CRE on the Road, Come Join Us in Person!

A.CRE will be on the road and hosting events in Los Angeles, San Francisco, and New York City in the next month and we'd love to connect in person with all of you in these cities. We will be hosting some happy hours and the drinks are on us!…

Modelo de Desarrollo Industrial en Excel

Antes de la publicación del “Mírame Construir el Modelo de Flujo de Efectivo Descontado” Spencer Burton ya me había informado que el siguiente reto para mí sería la construcción de un modelo diseñado para analizar oportunidades de…

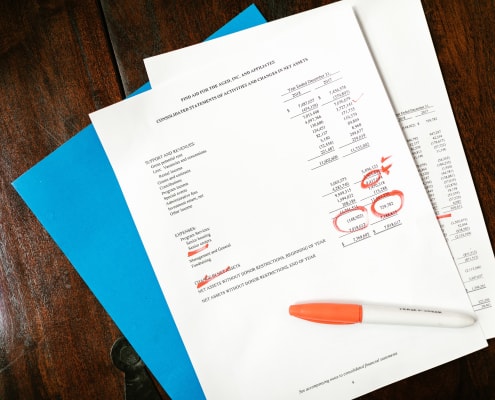

How to draw-up 3-part Financial Statements from your CRE Financial Model

Sometimes, your investors will want to see financial statements. Though this is usually something left to accounting, it's not a difficult thing for you to draft up on your own. It actually just takes the simple steps of familiarizing yourself…

Streamlining Commercial Real Estate Asset Management with Dottid | S3SP11

In this special episode of the A.CRE Audio Series, we feature Kyle Waldrep, founder of Dottid, and Senecca Miller, its CTO and COO. Dottid is a commercial real estate asset management optimization platform. It's an operating tool for office,…

Tips to Nail Your Next Commercial Real Estate Interview

Recently, our team partnered with the Graduate Real Estate Council at Cornell University where we worked with their students in providing mock interviews with Cornell alumni. Our goal in this effort was to help these students at the beginning…

A.CRE Hotel Valuation Model in Excel (Updated Sept 2022)

I am excited to introduce our new Hotel Valuation (Acquisition) Model to underwrite both stabilized and value-add hotel opportunities. This hotel pro forma is designed to allow users to do everything from a quick back of the envelope exercise…

LinkedIn Networking Tips that Get you Results in Commercial Real Estate

Building your network is a proactive way to gain an advantage in the hiring process and to hedge against uncertainty when you are struggling to find a job. This article is part of our LinkedIn 101 networking series, aimed at providing you with…

Why Manufactured Housing Communities (MHCs) are the safest investment in real estate with Brandt Foster | S3SP10

In this special episode of the A.CRE Audio Series, we feature Brandt Foster, Director at Northwestern Mutual Real Estate, one of the largest institutional real estate investors in the nation. In this conversation, Brandt discusses all the various…

Mírame Construir el Modelo de Flujo de Efectivo Descontado en Excel

Luego de un par de semanas de la publicación del “Modelo de Flujo de Efectivo Descontado” el equipo A.CRE decidió que explicara en detalle como construí paso a paso dicho modelo. Apenas escuché la propuesta de Spencer Burton, me encantó…

Leveraging Data & Technology to Streamline Real Estate Debt Procurement With Yaakov Zar and Sammy Greenwall | S3SP9

In this special episode of the A.CRE Audio Series, we feature Yaakov Zar and Sammy Greenwall, the founders of Lev Capital, a commercial mortgage marketplace for capital market advisors. Spencer, Michael, and Sam speak with Yaakov and Sammy about…

Real Estate Portfolio Valuation Model (Updated Aug 2022)

I built, and would like to share, a real estate portfolio model for valuing a portfolio of up to 30 properties. This is a "roll-up" model, meaning you will need to model your unlevered (before financing) property-level cash flows in a separate…