Real Estate Financial Modeling Accelerator (Updated April 2024)

Prior to launching the Accelerator program, Michael and I fielded email after email requesting a more structured real estate financial modeling training program on the site.

Over the years, we've covered hundreds of real estate modeling…

Marquette Real Estate Strategies Conference Takeaways

Marquette University recently held its 11th annual Real Estate Strategies Conference. Our Co-Founder, Spencer Burton, had the privilege of being the Keynote speaker so a few members of our team came up to support him.

A quote from Jack…

Tenant Sales and Occupancy Cost in Retail Underwriting (UPDATED JUNE 2022)

When underwriting a retail investment, rollover risk is an incredibly important consideration. You, as a prospective debt or equity investor in the property, need to understand how secure the cash flows you're buying are; or in other words,…

Publicly Traded Tenant Analysis Tool (Updated May 2022)

In this post and corresponding video, I am going to walk you through a revamped tenant health worksheet that I shared a long time ago on the site. I spent some time giving it a makeover and decided to put together a video walkthrough for it.

Publicly…

Forecasting After-Tax Cash Flow in Real Estate Analysis (Updated May 2022)

When modeling real estate investments, industry practice is generally to stop at before-tax cash flow. And this makes sense in most instances. No two owners of real estate have the exact same tax situation and no two properties necessarily have…

Using Geometric Mean (or CAGR) as an Alternative to IRR

The internal rate of return (IRR) and compound annual growth rate (CAGR) are both metrics used to analyze investment returns. They're both commonly used in commercial real estate financial modeling, but what's the difference? When should you…

Graduate Real Estate Series: UC Berkeley’s Master of Real Estate Development and Design

Prior to the MRED+D program, I worked for a general contractor in San Francisco. I worked on the repositioning and adaptive reuse of the historic industrial buildings at Pier 70. Pier 70 is a 40-acre urban infill mixed-use development on…

Scenario Analysis Tool using the Equity Waterfall Model (UPDATED MAY 2022)

I received a question this morning asking how to use scenario (or sensitivity) analysis with our Real Estate Equity Waterfall Model. I started to answer the question via email, decided to build an Excel file to go along with my answer, and ultimately…

Day in the Life of Mortgage Lending with Ian Hawk

In this ‘Day in the Life of a Commercial Real Estate Professional’ post, we hear from Ian Hawk, Associate at a real estate mortgage lending company, Dwight Mortgage Trust in New York City.

Ian has been kind enough to share his typical…

©2009 w.b.ledbetter,jr. / imageclectic.com

©2009 w.b.ledbetter,jr. / imageclectic.comThe University of Texas at Austin – Undergraduate Real Estate Profile

As a senior in high school awaiting acceptance offers from schools, I understood that finding my career passion was just as important as the school I attend. I was confident that the University of Texas at Austin would provide a path for…

Real Estate Debt Module in Excel (Updated May 2022)

I thought I'd share the real estate debt module I built for the ARGUS alternative in Excel that I've been working on over the last few months. Most debt modules I've seen in real estate financial models only include the ability to model…

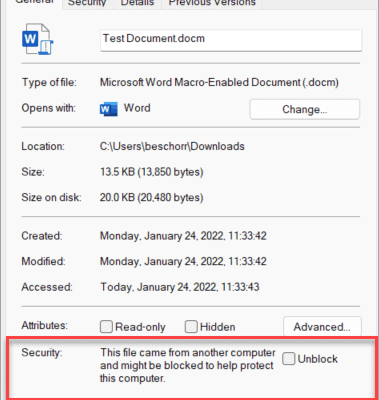

Microsoft has blocked the macros in my A.CRE model – What now?

When downloading and opening an Excel model from A.CRE, some users may get the ominous message: "Microsoft has blocked macros from running because the source of this file is untrusted." If you've received this message, you're probably asking,…

Physical Occupancy Calculation Model for Real Estate (UPDATED MAY 2022)

As many of you know, I'm in the midst of moving my family from Milwaukee to Dallas, and quite frankly I'm getting sick of eating out and sleeping in hotel rooms. So what better way to unwind from hours of whining kids and tiresome travel, than…

4-Tier Equity Multiple Waterfall – Download and Watch Me Build (UPDATED APR 2022)

Here is a simple, yet very powerful, 4-tier equity multiple waterfall module. This post contains both a completed version of the module ready to plug into a real estate financial model as well as a 'Watch Me Build' template and companion video…

3 Tips for When You’re Unhappy in Your Current Job

As a CRE recruiter, I often get questions from people who are unhappy in their current job. This is a very common situation for people to have - in both commercial real estate and in other fields. However, I want to let you know that this isn't…

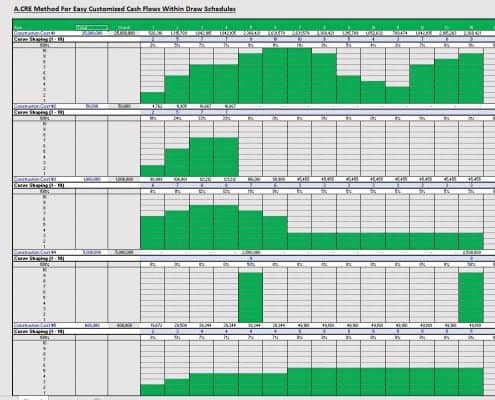

Development Draw Schedule – Visually Customize Each Line Item (UPDATED APR 2022)

Working a lot with development draw schedules, I have always been looking for a catch all solution as to how one could easily model all the unique ways cash actually flows over time during the process. The norm for many is to model cash flows…