Real Estate Financial Modeling Accelerator (Updated January 2026)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

¡Lanzamiento del Complemento “Excel 4 CRE” Completamente en Español! (Actualizado Octubre 2025)

Hace aproximadamente un mes colocamos a disposición de nuestros usuarios el complemento “Excel 4 CRE” junto con un tutorial en español de cómo utilizarlo, sin embargo, en aquel momento el complemento seguía estando totalmente en inglés.…

Retail Real Estate Development Model (Updated Oct 2025)

I'm excited to share my Retail Development Model in Excel. This pro forma analysis tool comes as I've continued to build and share specialty real estate models, tailor-made for specific investment scenarios and property types.

This model…

Industrial Real Estate Development Model (Updated Oct 2025)

Allow me to share my Industrial Development Model in Excel. Over the past few years, I've been working to add more specialty real estate models to our library. While our All-in-One model certainly has its place, oftentimes really digging into…

Install an AI LLM on Your Computer: A Step-by-Step Guide (Updated Oct 2025)

This week, I’ll be hosting my monthly A.CRE Ask Me Anything (AMA) where we dive into various technical topics, and AI in CRE often comes up. Last month, someone asked me to show the group how to install a Large Language Model (LLM) on their…

Domina la IA en 30 Días: Ruta Práctica para Profesionales

Estamos en un momento clave para dominar la IA y transformar tu perfil profesional, especialmente en sectores como los bienes raíces. La ventaja de incorporar estas herramientas es desproporcionadamente alta y el esfuerzo, sorprendentemente…

The Definitive Guide to Microsoft Excel for Real Estate (Updated Oct 2025)

Microsoft Excel is the primary tool used by real estate financial modeling professionals. Even while numerous non-Excel alternatives have attempted to de-throne Excel, the 35+ year-old software has shown to be surprisingly resilient to competition.…

The Best AI Tools for Excel in 2025

At A.CRE, we offer what we believe to be the best AI training program for real estate and the best real estate financial modeling training program - period! From both sides of that training, we consistently hear the same question:

“What…

Contracts and Lien Waivers: What Our RV@Olympic Experience Taught Us About Protecting Your Project

Every real estate developer eventually runs into an issue that reinforces, in vivid and, if unlucky, expensive detail, as to why good contracts and clean closeout processes exist.

For me, RV@Olympic, our ground-up development of an RV park…

TIR vs Tasa De Descuento: Dos Caras De La Misma Moneda (Caso De Estudio + Modelo)

En el ámbito del modelado financiero inmobiliario, existen ciertos principios fundamentales que sustentan todo análisis de valoración, adquisición e inversión. Entre estos, pocos conceptos son tan universales, pero a la vez tan comúnmente…

Excel Shortcuts For Real Estate Financial Modeling (Updated Oct 2025)

One of the lesser talked about, yet most impactful, skills in real estate financial modeling is keyboard efficiency. If you’ve ever watched one of our tutorials or Accelerator sessions, you’ve probably seen the models flying by, with formulas…

Announcing the Winners of the AI.Edge Founder’s Build Competition

When we launched our AI course and community for real estate: AI.Edge, the idea of building together was part of the plan from the start.

AI is evolving quickly, and our early adapter members (ie the founding group of AI-native professionals…

The AI.Edge – Become an AI Leader in CRE (Updated Oct 2025)

It’s been the go-to line ever since ChatGPT exploded onto the scene in 2022 and AI became a talking point in every office:

"AI won’t take your job, but someone using AI will."

I’ve said that - or some variation of that - myself in dozens…

IRR vs Discount Rate: Two Sides of the Same Coin (Case Study + Model)

In the discipline of commercial real estate financial modeling, certain principles serve as foundational pillars, essential across all valuation, acquisition, and investment analyses. Few concepts are as omnipresent, yet as frequently misunderstood,…

A.CRE 101: Guía para Evaluar el Crédito en la Suscripción de Propiedades con Inquilinos Privados

Recientemente, un miembro de nuestro programa -Acelerador- nos planteó una pregunta sobre cómo determinar con precisión una calificación crediticia y una tasa de descuento de ingresos especulativos para un inquilino privado en un acuerdo…

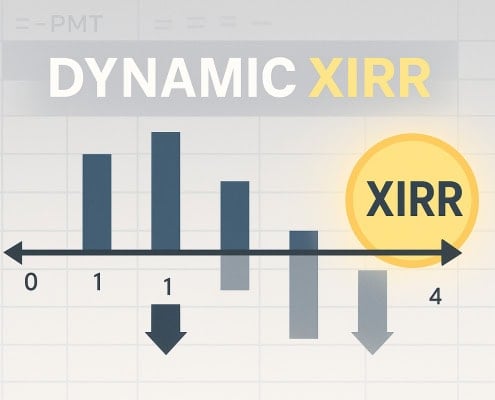

Fix the 0% XIRR Issue in Excel Using XIRR + FILTER

Over the course of my career, I’ve modeled hundreds of real estate investments, from large portfolio roll-ups to complex mixed-use developments. And one issue I’ve consistently run into, especially when modeling portfolio or mixed-use cash…