Real Estate Financial Modeling Accelerator (Updated January 2026)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

Aumenta tu productividad con IA en 2026: el Marco de Trabajo Multiplicador para Bienes Raíces Comerciales

El 15 de enero, más de 700 profesionales de bienes raíces comerciales se unieron en vivo con Spencer, (casi 1,400 se registraron) para aprender una idea simple pero poderosa: Cualquier profesional de Bienes Raíces Comerciales, sin importar…

AI Network Analysis: Analyze 2,000+ names in one afternoon

This week, I needed to find speakers for an upcoming real estate conference. To do it, I used AI Network Analysis to scan 2,000+ connections on LinkedIn across 15+ panels on topics like Data Centers, Affordable Housing, Office Conversions, and…

Double Your Output with AI in 2026 Workshop: The Multiplier Framework for CRE (Updated Jan 2026)

On January 15, over 700 commercial real estate professionals joined me live (nearly 1,400 registered) to learn a simple idea:

Any CRE professional, regardless of technical skill or AI knowledge, can multiply their output.

Not by working…

Caso de Estudio: Sunset Vista – Análisis de Mantener o Vender Propiedad

EL CONTEXTO

Eres Alexa Rivera, asesora financiera inmobiliaria que trabaja con pequeños inversionistas hispanohablantes (maestros, dueños de pequeños negocios, profesionales independientes y jubilados) que construyen patrimonio a largo plazo…

De la planificación a la práctica: cómo empezar a usar IA en bienes raíces comerciales

Hoy me gustaría presentarles una guía práctica sobre automatización en bienes raíces comerciales para profesionales que son curiosos por la IA pero aún no la aplican efectivamente.

Si trabajas en bienes raíces comerciales, probablemente…

All-in-One (Ai1) Model for Underwriting Development and Acquisitions (Updated Jan 2026)

As many of you recall, in 2015 I set out to build an Excel alternative to the widely-used (and now discontinued) ARGUS DCF. With career moves and a lot of other A.CRE-related side projects, this undertaking has been slow going. Alas, in 2016…

Herramienta de retratos profesionales con IA para bienes raíces: por qué lo hicimos y cómo usarla

En A.CRE, siempre nos hemos enfocado en capacitar a la industria.

Durante la última década, eso ha significado en gran medida modelación financiera. Hemos creado y compartido modelos en Excel que se han descargado más de 600,000 veces,…

Case Study #16: Sunset Vista – The Hold/Sell Decision

THE BACKGROUND

You are Alexa Rivera, a real estate financial advisor who supports small investors, including teachers, business owners, and retirees, who own real estate as part of a long-term wealth-building strategy. Your clients typically…

Self Storage Acquisition Model (Updated Jan 2026)

I've spent the past few weekends working on a purpose-built Self Storage Acquisition Model, and I'm now happy to share the result of that work with you. This is a model that's been requested by quite a few A.CRE readers over the past few years.…

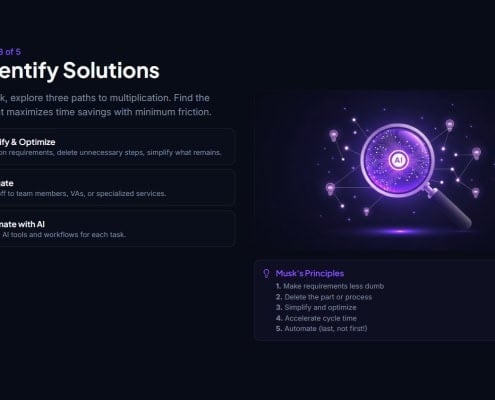

Applying Elon Musk’s Five Automation Principles to The Multiplier Framework

AI is finally good enough that you can now leverage it to realistically multiply your output in CRE.

The AI Multiplier Framework is our method for doing just that. It gives you a structured way to find, rank, and execute automation opportunities…

A.CRE 101: El valor temporal del dinero – fundamentos conceptuales y matemáticos

En bienes raíces comerciales (CRE), casi todas las decisiones de inversión se reducen a una pregunta central del valor temporal del dinero: ¿cuánto vale hoy una corriente de dinero que ocurrirá en el futuro, bajo incertidumbre? La respuesta…

Introduciendo Múltiplo de capital ponderado: una alternativa para inversiones inmobiliarias dinámicas (Actualizado Enero 2026)

En mi trabajo diario, analizar modelos para mejorar las percepciones y proyecciones de inversiones inmobiliarias comerciales es parte importante, y en A.CRE consideramos que parte de nuestro compromiso es asegurar que todos tengan acceso a las…

We Built an AI Headshot Tool for Real Estate, Here’s Why and How to Use It

At A.CRE, we have always been about training the industry.

For the past decade, that has largely meant financial modeling. We've built and shared Excel models that have been downloaded over 600,000 times, because learning to model real estate…

AI Is Closing the Gap on Complex Work Faster Than You Think

If you work in acquisitions, asset management, brokerage, development, portfolio management, or valuation, you probably feel the tension already.

On one hand, today’s AI tools for real estate can draft emails, summarize leases, and pull…