How to draw-up 3-part Financial Statements from your CRE Financial Model

Sometimes, your investors will want to see financial statements. Though this is usually something left to accounting, it’s not a difficult thing for you to draft up on your own. It actually just takes the simple steps of familiarizing yourself with the broad framework of financial statements, learning the basic rules of accounting, and creating formats in Excel. To give you all the information you need to succeed, this article will talk about the two approaches to financial modeling, the need for financial statements, creating financial statements, the types of assets in your balance sheet, and the accounting basics.

Note from Spencer and Michael: This is another post in a growing series that we call ‘International CRE’. Written by CRE professionals based outside of the United States, this series is a collection of deep dives into various CRE topics relevant to real estate professionals all over the world. One of the reasons we love the International CRE series is that things are not done the same in one country to the next, and this series highlights those differing perspectives.

This particular post is written by our friend Padmaa Iyer. Padmaa is an India-based Real Estate Fundraising Strategist and Chartered Accountant. She is also a long-time A.CRE reader and graduate of our Accelerator Program. A huge thank you to Padmaa for sharing her knowledge with the A.CRE community!

Picture it. You’re feeling upbeat, and rightfully so. Your meeting is going exactly the way you wanted it to. You just made a solid pitch for your deal. And to back up your convictions, you now lay out your A.CRE-style financial model on the table. The numbers have made your story come alive. The input assumptions and the timing of various events reveal your meticulous planning and foresight.

Your investor audience is already sold on you. They have never seen a financial model like this one before – neat and well structured, great flow, easy-to-understand formulas, comprehensive, sharp. Simple yet elegant.

Still, one of them asks: “But where’s the depreciation? Where’s the tax amount?”

You’re like, “How will depreciation ever feature in a financial model that’s driven by the cashflows?”

You would be right in thinking that. Depreciation doesn’t belong in a cash-based financial model. It’s an accounting thing. An expense item is charged to the P/L account. Even tax for that matter is payable out of the profits recorded in the books of account.

So how do you tackle this confusion?

Definitely not by stringing half-hearted tweaks into the model triggered by the knee-jerk demands of the other side.

It’s better to first draw up basic 3-part financial statements (viz, the Balance Sheet, Profit/Loss account, and the Cashflow Statement) from the financial model and then add accounting adjustments as necessary. This will set things straight.

The good part is even if you’ve never had to do accounting before, drawing up the forecast financials from the financial model is a fairly simple job.

First, you should familiarize yourself with the broad framework of financial statements and how they apply to your business. Next, pick up (or refresh) the basic accounting rules as well as any specific guidance available for accounting your CRE asset. Lastly, create formats in Excel (that has your financial model), fill them up and you’re done!

In this article we’ll go over 5 concepts about financial statements:

- THE 2 APPROACHES TO FINANCIAL MODELING

- NEED FOR THE FORECAST FINANCIAL STATEMENTS

- FINANCIAL STATEMENTS: PRIMER

- 3 TYPES OF RE ASSETS IN THE BALANCE SHEET

- SOME QUICK ACCOUNTING 101

Let’s start.

6 EASY STEPS TO DRAW UP THE FINANCIAL STATEMENTS

THE 2 APPROACHES TO FINANCIAL MODELING

| The Pure Cashflow Approach | The Balance Sheet Approach |

| Investment is purely analyzed in terms of CASH. | Data from past years’ Balance Sheets is extrapolated with estimates for the future to understand the impact of new investments. |

| Meaning:

The Financial Model documents the entire lifecycle of the Investment Proposition. |

Meaning:

The Financial Model strives to show how the new Investment Proposition adds value to the existing business situation. |

| Best suited for:

Project Finance. E.g., most CRE deals, Cash cow investment opportunities. |

Best suited for:

Corporate Finance. E.g., M&A deals, Expansion plans of a growing corporation. |

| Goal:

Does the Investment make sense and deliver the investor’s expected returns? The investor would want to know only 2 things –

|

Goal:

What synergies (e.g.: (2+2) > 4) will the merger offer? How will the increased investment add to the bottom line of the Firm? |

| Process:

Cash is analyzed through a simple and logic-driven layout – 1. Investment Cashflows – (Outflows) 2. Operating Cashflows – (Net Inflows) 3. Exit Cashflows – (Net Inflows) |

Process:

Fresh inputs, as well as past insights, are channeled through the Balance Sheet and P/L Statement so as to see what the future periods in the investment analysis period will look like. |

| What is left out?

The non-cash item of depreciation, income tax expenses, and credit is given for sales/ incomes and received for purchases/expenses don’t get calculated. However, discounts for any bad debts and necessary expense provisions are duly considered in calculating the net cashflow estimates. |

What is left out?

In order to calculate return and valuations metrics such as NPV/ IRR/ Enterprise Value/ Equity Value, we have to pull back into pure Cashflow Analysis formats. |

THE NEED FOR FORECAST FINANCIAL STATEMENTS

Based on the premise of a Project Finance Structure, we always follow the clean and sharp “Pure Cashflow Approach” to prepare our CRE financial model.

If needed, a projected balance sheet will still have to be drawn out from the financial model.

Here are a few good reasons that might be the case:

- Legal and regulatory requirements

Many times, we may be required to annex a projected balance sheet as part of the legal documents forming part of the fundraiser. The formal channels such as bank lenders often ask for projected 3-part financial statements.

- After-tax analysis

Having a projected set of financial statements enables us to calculate the tax impact more easily.

Tax is payable out of income. To know the income, we must have the P/L account that is part of the Balance Sheet.

- Investors’ expectations

Investors may want to see what the modeled numbers look like on the Balance sheet.

- Planning your working capital requirements

A projected Balance sheet can help you better understand our working capital needs and arrange for short-term funds accordingly.

FINANCIAL STATEMENTS: PRIMER

Really, the crux of the article is this:

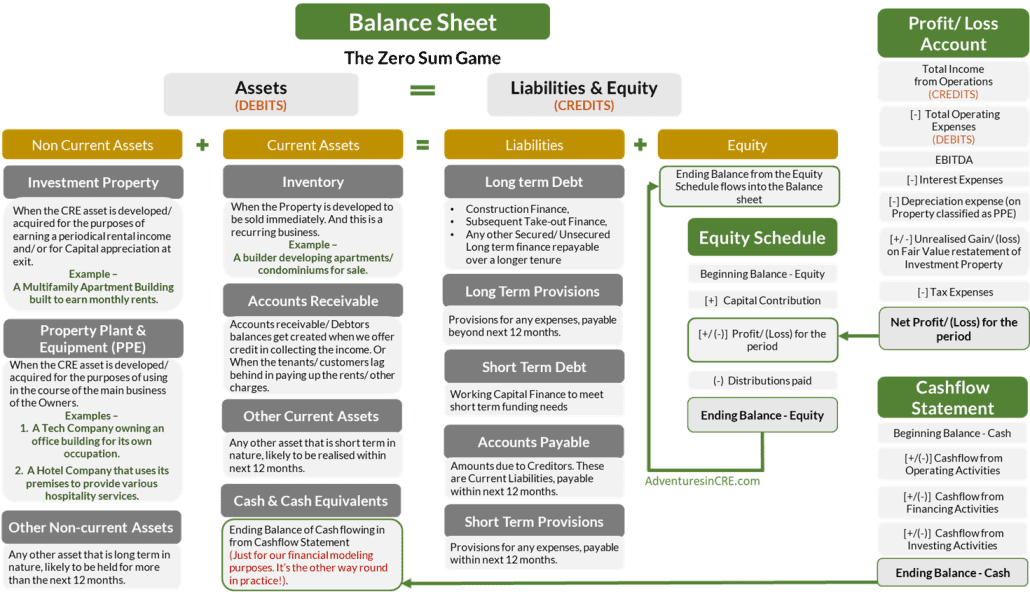

The 3-part Financial Statements consist of –

- The Statement of Financial Position a.k.a. Balance Sheet

Shows the financial health of a business at any point in time.

- The Statement of Income a.k.a. Profit and Loss Account

Net profit or loss earned during the period. This balance rolls into the Equity that further rolls into the Balance Sheet.

The schedule that shows cash transactions are broken down into 3 main activities.

- Operating activities

- Investing activities

- Financing activities

For our modeling purposes: The closing cash balance from this Cashflow Statement will roll into the Balance Sheet.

This means we won’t create a separate schedule for cash.

But remember! In practice as with any other item, there is a ledger account for cash also. This will find its way into the period-end trial balance. From the trial balance are prepared the Balance Sheet & P/L account. And lastly, a Cashflow Statement is drawn out of the Balance Sheet and P/L. Call this a rough summary of the accounting process, if you will.

We have 2 more segments that will form part of our projected financials.

- Statement of Changes in Equity, a.k.a. The Equity Schedule

This is the break-up of the Equity Capital balances. It rolls into the Balance Sheet.

- Supporting Schedules

This is to show the movement in the balances of assets and liabilities.

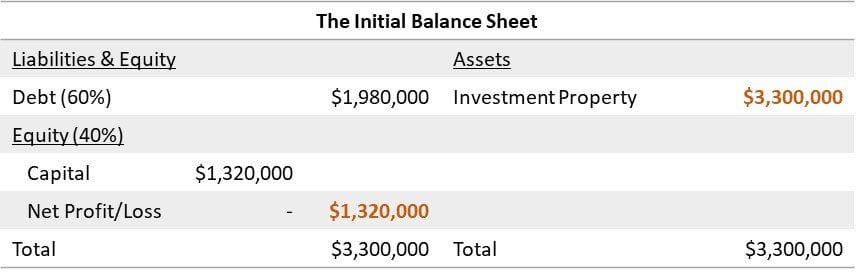

3 TYPES OF REAL ESTATE ASSETS IN THE BALANCE SHEET

The main hero of your financials is your CRE asset.

But, how do you know under which asset category the CRE you are dealing with falls?

Well, there are definitions and guidelines laid out by the various accounting standard boards of the world such as the IFRS to help us with this.

(IFRS is the most preferred set of accounting standards because they seek to unify the financial reporting practices across the world, and are widely followed by most multinational businesses).

For additional reference, please refer to this technical resource from EY.

From the accounting perspective, there are 3 types of Real Estate Assets:

| Investment Property | Property, Plant & Equipment | Inventory Property |

| When you build/acquire the CRE property with the sole purpose of earning rents and later selling it off down the line at an opportune time and price.

Accounting points to remember: The investment (until it is sold off) should be restated at its fair values (FV) in the Balance Sheet at each period end. And any resulting FV gain or loss will get booked in the P/L account. There’s no question of depreciation here! Examples: A multifamily apartment building meant for renting. An industrial warehouse that comprises several units meant for leasing out to eCommerce retailers, manufacturing firms, etc. |

You own the CRE property, but use it for the purposes of running your main business. It’s a long-term asset that will appear in your books as long as you use the asset. Accounting points to remember: The CRE asset enables you to run your business smoothly. Although you may not directly earn income (such as rent) from it. As the property is consumed in the business, it will entail some wear and tear over its useful years. Only in such a case, you will provide for a depreciation expense in your books. Examples: A tech company owns an office building that is occupied by its own staff. A hotel company that uses its premises to provide various hospitality services. A retailer firm that owns all of its mall premises for own business. |

You develop a CRE property so as to sell it immediately. This is also a recurring business for you. Accounting points to remember: Building and selling are the 2 main business activities for you. You build – not for earning rents, not for consumption in your own business, but for immediate sale. All the costs incurred in the development process will get capitalized under ‘Inventory Property’, an item of current assets in the Balance Sheet until it is sold off. Once the sale is effected, the proportionate costs move into the P/L from the balance sheet. Examples: Apartments/condominiums/single-family homes and even commercial premises developed for immediate sale. |

SOME QUICK ACCOUNTING 101

(Skip this segment if you know the basics of accounting)

All the points enumerated in this section are ones you learn in the basics of accounting. But if you’ve never done any accounting, this handful of basic rules will help drive your thought process when you sit down to draw up your projected financials.

What are the Debits and Credits?

In the Balance Sheet: All asset balances are debit balances and all liability balances are credit balances.

In the P/L account: All income items are credits and all expense items are debits.

Remember, whenever there is a cash outflow, it’s mainly to acquire an asset or pay off a liability or incur an expense.

Whenever there is a cash inflow, we have either disposed of an asset, raised an item of debt or other liability, or realized an income.

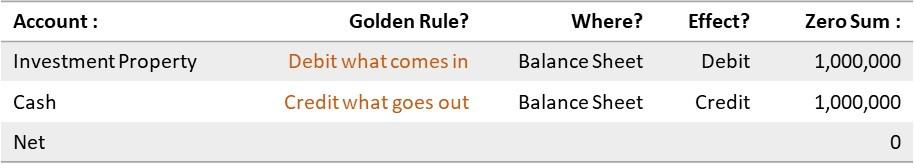

For every debit, there is a corresponding credit

This is the essence of the Double Entry system. It lends completeness to accounting. The Zero-sum equation.

Accounting Sanctity/Entity Concept

If I invest my own equity in my business, the business still has an obligation to return back my money at the end of its lifecycle.

Matching Concept

All the revenues and related expenses are recognized in the same reporting period.

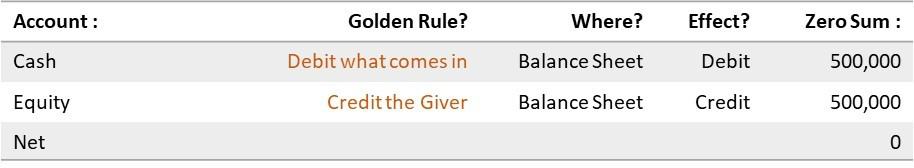

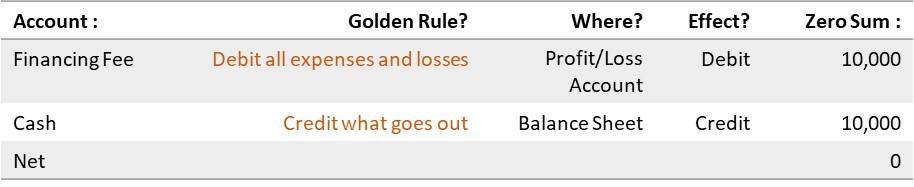

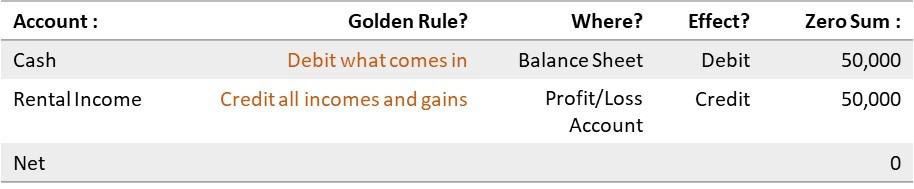

The 3 Golden Rules of Accounting

- Debit the receiver, credit the giver.

- Debit what comes in, credit what goes out.

- Debit all expenses and losses, credit all incomes and gains

Examples:

-

- When an Investment Property is purchased

-

- When Partners contribute Equity Capital to the business

-

- When a Financing Fee is paid to the Lender

-

- When a rental income is received

-

- To Capitalise or not to Capitalise?

This is a frequent question you will encounter in the process of accounting. Of course, it calls for prudence and reference to any accounting guidance available from the regulatory authorities.

Capitalizing on an item of the cost will lead to a higher Net-worth versus a write-off in the P/L.

Example:

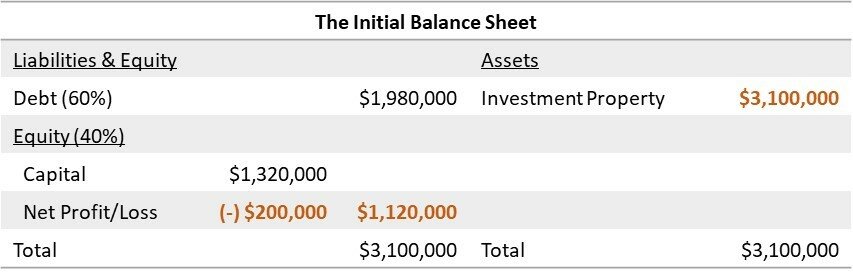

In the Books of one SPE, the break-up of a CRE Investment Property Cost is as follows:

Scenario 1: If these XYZ fees are capitalized –

Scenario 2: If these XYZ fees are not capitalized –

Now, here comes the main part…

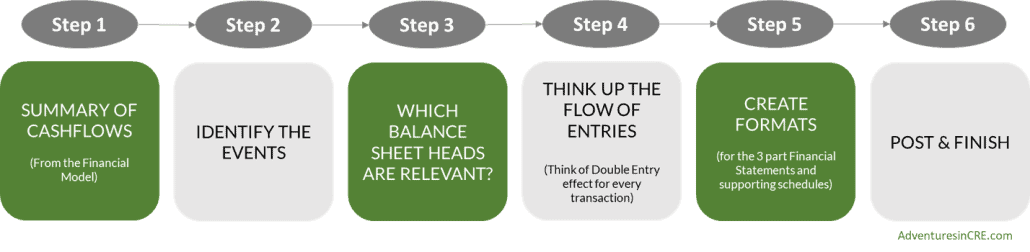

6 STEPS TO THE FORECAST FINANCIAL STATEMENTS

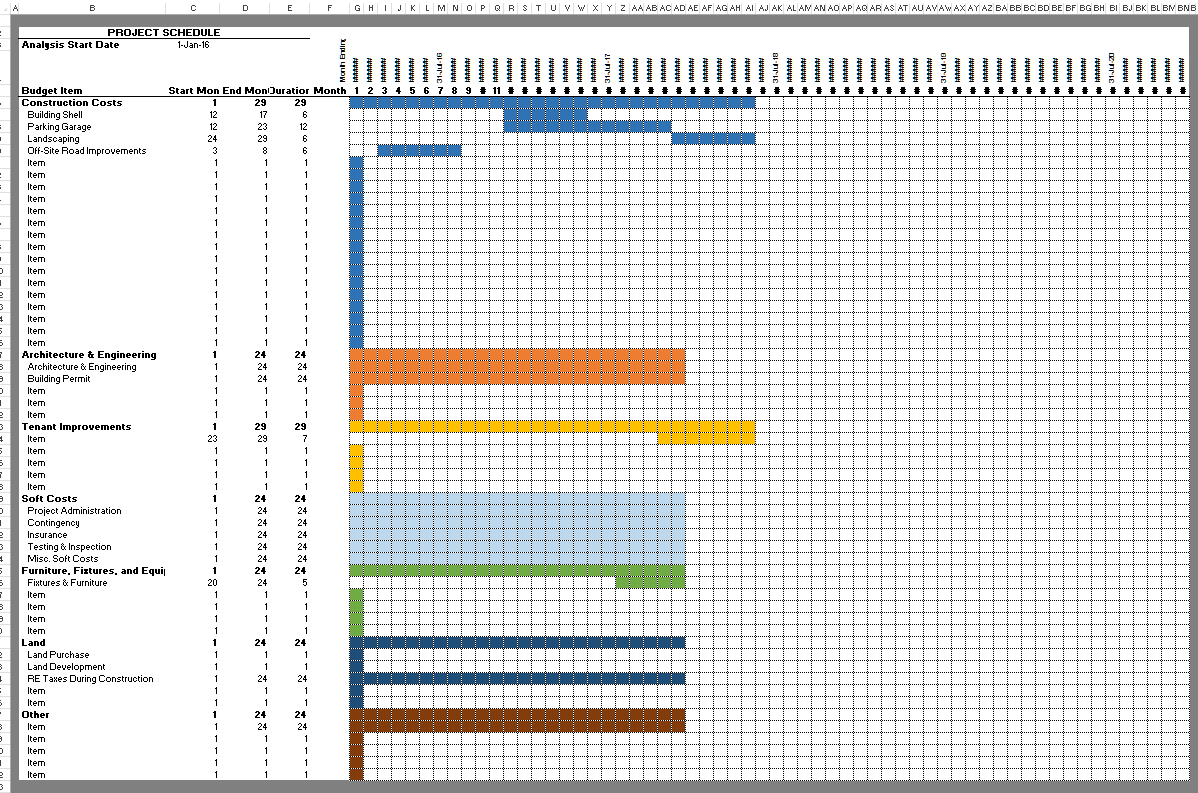

Example #1: Where the CRE asset is an Investment Property

When the CRE asset is an investment property you raise capital for, buy/build, lease out for some years and then exit at an opportune time.

Let’s look at the 6 steps in detail and a short video walkthrough inside Excel.

Video Walkthrough

Example #2: Where the CRE asset is a Property, Plant, and Equipment

Coming soon.

Example #3: Where the CRE asset is an Inventory Property

Coming soon.

WORDS OF CAUTION!!

We are not doing elaborate accounting here. The limited purpose of such forecast financial statements is to understand broadly what the balance sheet will look like, assess the need for any short-term funding, or provide a basis for calculating the likely tax impact on the proposed investment.

By nature, books of account are maintained post events. If your investor audience wants a great deal of accuracy, ask them to first get invested in your project and ride the investment in real time. And see firsthand how things turn out. :)

Frequently Asked Questions about Creating 3-Part Financial Statements from a CRE Financial Model

Why do I need to prepare financial statements if I already have a cash-based CRE model?

Because stakeholders such as banks or investors may request projected financials for regulatory compliance, tax planning, working capital estimation, or to simply evaluate the business beyond pure cashflows. As noted: “If needed, a projected balance sheet will still have to be drawn out from the financial model.”

What are the three parts of the financial statements?

The three main parts are:

Balance Sheet (Statement of Financial Position) – shows financial health at a point in time.

Profit & Loss Account (Statement of Income) – shows net income for a period.

Cash Flow Statement – shows cash movements categorized into operating, investing, and financing activities.

What are the two approaches to financial modeling mentioned in the article?

Pure Cashflow Approach – Used in project finance; focuses entirely on investment, operating, and exit cashflows.

Balance Sheet Approach – Used in corporate finance; incorporates past balance sheet and P&L data to forecast impact.

What are the three types of real estate assets in accounting terms?

Investment Property – Held to earn rent and capital appreciation.

Property, Plant & Equipment (PPE) – Used for own operations, depreciated over time.

Inventory Property – Developed for immediate sale, costs capitalized under current assets.

Is depreciation relevant in a CRE financial model?

No, not in a pure cashflow model. As the article states: “Depreciation doesn’t belong in a cash-based financial model. It’s an accounting thing.”

What is the purpose of creating a forecast balance sheet?

To assess tax impacts, fulfill regulatory or lender requirements, estimate working capital needs, and provide a full financial picture to investors. It helps you “better understand working capital needs and arrange for short-term funds accordingly.”

What is the role of supporting schedules in the statements?

Supporting schedules show the movement of balances in assets and liabilities and help explain the calculations behind each item in the financial statements.

Are the financial statements from a model meant to be GAAP-compliant?

No. The article clarifies: “We are not doing elaborate accounting here.” These forecasts are meant for planning and high-level analysis, not full regulatory compliance.

How does the Cash Flow Statement integrate into the Balance Sheet?

The closing cash balance from the Cash Flow Statement rolls into the cash line item of the Balance Sheet.