Preferred Return

A concept common to real estate partnership structures, preferred return refers to the preference given to a certain class of equity partners when distributing available cash flow. The preferred return is generally calculated as either a percentage return on contributed capital or a given multiple on contributed capital, and must first be paid before common equity (i.e. the sponsor / general partner) has a right to promoted interest.

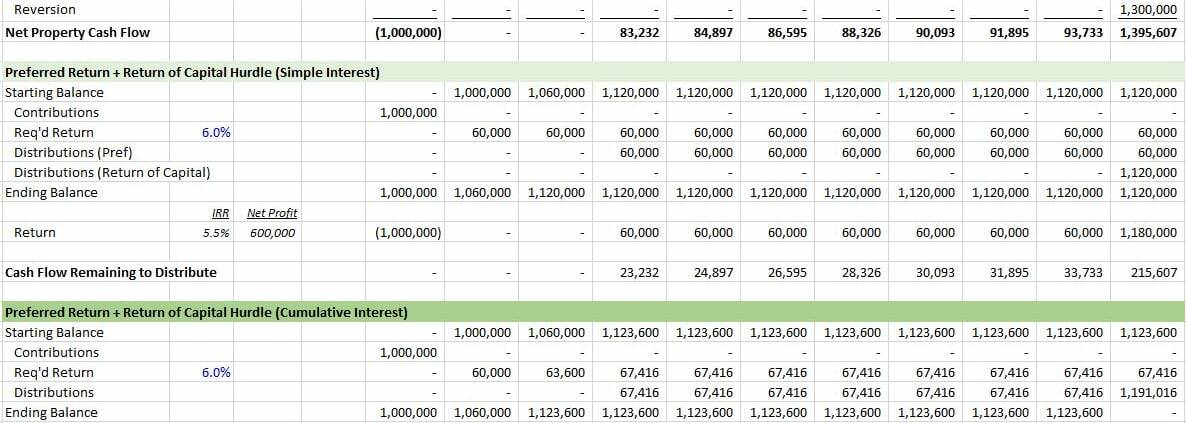

Simple Interest vs. Compound Interest When Calculating Preferred Return

How Preferred Return Fits in the Real Estate Waterfall

In a typical real estate partnership distribution waterfall, the preferred return comes first. For example:

- First, cash flow will be distributed to the partners in accordance with their partnership percentages until the Limited Partner has achieved an annualized, cumulative preferred return equal to 8.0% ; after which

- Second, excess cash flow will be distributed to the partners in accordance with their partnership percentages until each Partner’s capital account balance has been reduced to zero; after which

- Third, excess cash flow will be distributed (a) 75% to the partners in accordance with their partnership percentages, and (b) 25% to the General Partner as a promote until the Limited Partner has achieved a 12% internal rate of return; and

- Lastly, the balance will be distributed (a) 60% to the partners in accordance with their partnership percentages, and (b) 40% to the General Partner as a promote thereafter.

In the above example, all cash flow is distributed to the partners until the Limited Partner has earned an annual, cumulative preferred return of 8.0%. It is not until that preferred return has been hit, that the excess cash flow is available to pay down capital or pay promoted interest to the General Partner.

Check out a few examples of real estate waterfalls in our Library of Real Estate Financial Models

Ramifications of Simple vs. Compound Interest / Cumulative vs. Non-Cumulative

There are various methods and metrics used to calculated preferred return. Preferred return is most often calculated as a percentage of contributed capital, but that return may be figured using simple interest (i.e. calculated on contributed capital to date) or using compound interest (i.e. calculated on contributed capital plus on any unpaid preferred return to date). And the simple interest calculation method may assume unpaid preferred return must be repaid (i.e. cumulative) or unpaid preferred return does not need to be repaid (i.e. non-cumulative).

The resulting internal rate of return to the capital partner can be quite different between the various calculation methods, with the difference more pronounced in scenarios with insufficient cash flow in earlier years to cover the preferred return.

- Click here to download the example file used in this video

Putting ‘Preferred Return’ in Context

Scenario Overview:

Sun Valley Capital Partners, a real estate private equity firm, has acquired Desert Ridge Plaza, a 120,000 SF grocery-anchored shopping center in suburban Phoenix, Arizona. The property was purchased as a value-add opportunity, with plans to increase occupancy and improve the center’s appeal through targeted capital improvements such as updating the facade, enhancing signage, and modernizing common areas.

Investment Structure:

The acquisition was financed with equity contributions from both Limited Partners (LPs) and Sun Valley Capital Partners, acting as the General Partner (GP). The LPs contributed $12 million, while the GP contributed $3 million, bringing the total equity investment to $15 million. The partnership agreement stipulates an 8% annual, cumulative preferred return for both the LPs and the GP, with distributions made pro rata and pari passu. This means that both LPs and GP receive their preferred returns simultaneously and in proportion to their respective capital contributions.

Preferred Return in Action:

In the first year after acquisition, Desert Ridge Plaza generated a cash flow of $750,000. The total preferred return requirement for the partnership is $1.2 million, calculated as 8% of the $15 million equity investment. However, because the property did not generate sufficient cash flow to cover the full preferred return, the cash flow is distributed pro rata between the LPs and the GP.

- LPs’ Share:

- Investment: $12 million (80% of total equity)

- Preferred Return: $960,000 (80% of $1.2 million)

- Cash Flow Distributed: $600,000 (80% of $750,000)

- Unpaid Preferred Return: $360,000

- GP’s Share:

- Investment: $3 million (20% of total equity)

- Preferred Return: $240,000 (20% of $1.2 million)

- Cash Flow Distributed: $150,000 (20% of $750,000)

- Unpaid Preferred Return: $90,000

The shortfall in the preferred return—$450,000 in total ($360,000 for the LPs and $90,000 for the GP)—will be carried forward to the next year due to the cumulative nature of the preferred return.

In the second year, Desert Ridge Plaza’s performance improves, generating $2 million in cash flow. Before any excess distributions are made, the unpaid preferred return from year one plus the preferred return for year two must be satisfied:

- LPs’ Preferred Return:

- Year One Unpaid: $360,000

- Year Two Preferred: $960,000

- Total: $1,320,000

- GP’s Preferred Return:

- Year One Unpaid: $90,000

- Year Two Preferred: $240,000

- Total: $330,000

Thus, $1.65 million ($1.32 million for LPs + $330,000 for GP) is distributed to satisfy the cumulative preferred return, with the remaining $350,000 of cash flow distributed pro rata between the LPs and the GP, reducing their respective capital account balances.

Implications for Both Parties:

In this scenario, both the LPs and the GP benefit from the preferred return, ensuring that each party receives an 8% annual return on their respective investments before any excess cash flow is distributed. The pro rata, pari passu distribution structure aligns the interests of the LPs and GP, ensuring that both parties are treated equitably in terms of cash flow distributions. This approach provides a balanced risk-reward structure, where both the GP and LPs share the benefits and challenges of the investment proportionally.

This hypothetical scenario underscores the importance of preferred return structures in real estate partnerships, particularly in value-add investments where cash flows may be uneven during the early stages of the business plan. The pro rata, pari passu distribution method ensures that both equity partners are fairly compensated for the capital they have invested in the project.

Frequently Asked Questions about Preferred Return in Real Estate Partnerships

What is a preferred return in real estate partnerships?

A preferred return is the preference given to a class of equity partners in distributing cash flow. It ensures they receive a specified return—typically 8%—on their contributed capital before common equity holders (usually the sponsor) receive distributions.

How is the preferred return calculated?

The preferred return is usually calculated as a percentage return on contributed capital (e.g., 8% annually). It may be based on simple interest (no interest on unpaid amounts) or compound interest (interest on unpaid balances), and may be cumulative or non-cumulative.

What does “cumulative” preferred return mean?

A cumulative preferred return means that any unpaid return from prior periods accrues and must be paid in future periods before additional distributions can be made to common equity holders.

How does preferred return work in a waterfall structure?

In a typical waterfall, the preferred return is distributed first. After meeting this return, capital is returned to investors, followed by profit splits (e.g., 75/25) including promote to the General Partner. Only once the preferred return is satisfied can promote distributions begin.

What is the difference between preferred return and preferred equity?

Preferred return is a contractual term within an equity structure ensuring investors receive a certain return before other payouts. Preferred equity, on the other hand, refers to a distinct position in the capital stack with priority claims and may or may not include a preferred return.

How does pro rata, pari passu preferred return work?

In a pro rata, pari passu setup, both LPs and the GP receive preferred returns at the same time, in proportion to their capital contributions. Distributions are shared equally based on invested equity percentages.

What happens when cash flow is insufficient to pay the full preferred return?

If cash flow is insufficient, the unpaid preferred return accrues (in cumulative structures). For example, in year one of the Desert Ridge Plaza case, $450,000 of unpaid return was carried forward to be paid when more cash became available in year two.

Why is preferred return important in value-add investments?

Preferred return ensures investors are compensated for early-stage risk in projects with uneven cash flows. It prioritizes returns to equity contributors before the sponsor earns a promote, offering downside protection during value-add execution periods.

Click here to get this CRE Glossary in an eBook (PDF) format.