Understanding Taxes Series: Part 2 – Exceptions to The PAL Rules

The PAL Rules – A Brief Background

The PAL Rules, or Passive Activity Loss Rules, were enacted in 1986 to curb rampant abuses from people using real estate and businesses to generate huge losses to offset income taxes. It used to be that you could take any losses generated from passive income and use them to offset taxes owed from nonpassive income. The benefits from the tax deductions were tremendous and many times were far more valuable than the actual investment in the asset or business itself. When the PAL Rules came into effect, taxpayers were no longer allowed to use losses from passive income to offset taxes owed on nonpassive income.

However, there are still many tax advantages to owning real estate and some special exceptions to the PAL Rules. Part 2 of the Understanding Taxes Series is going to go over two ways participating in real estate activities can help significantly reduce your taxable income if you happen to qualify. They are (1) the $25,000 deduction for actively participating in rental real estate and (2) the real estate professional exemption.

Before we get into ways you can write off losses from real estate income, let’s cover some basics that we need to understand before moving into the specific topic.

Important Note: This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice.

How the IRS Defines Income

The IRS divides income reported on tax returns into two categories: Passive and Nonpassive.

Passive Income

Passive income is generated from two kinds of activities: (1) rentals of both real estate and equipment and (2) businesses where a person does not materially participate (material participation is discussed in depth later in this post) such as when a person is a limited partner in a business venture.

Nonpassive Income

Nonpassive income comes from the following activities:

- Salaries, wages, and 1099 commission income

- Guaranteed payments

- Interest and dividends

- Stocks and bonds

- Sale of undeveloped land or other investment property

- Royalties derived in the ordinary course of business

- Sole proprietorship or farm in which the taxpayer materially participates

- Partnerships, S-Corporations, and limited liability companies in which the taxpayer materially participates

- Trusts in which the fiduciary materially participates

As stated previously, due to the PAL Rules, normally, you cannot use losses from passive income to write off income from nonpassive activities. However, the two exceptions for real estate investments discussed in this post will enable a person to do so if they qualify.

Positive Cash Flow with a Recorded Taxable Loss

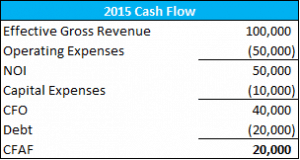

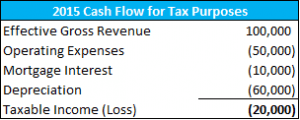

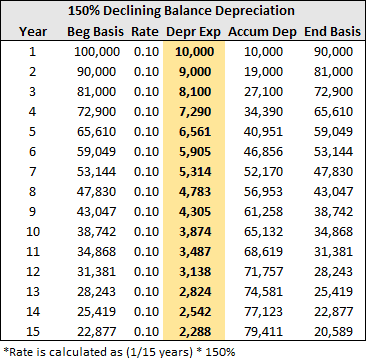

Thanks to depreciation, which I covered extensively in the first part of this series, many rental properties can have taxable losses, while still having a positive cash flow. Take the following example:

As we can see in the cash flow statement above, the before tax cash flow is $20,000. Well, let’s look at how we calculate this same cash flow for tax reporting purposes below.

In addition to operating expenses, the IRS allows us to subtract both interest from mortgage payments as well as depreciation expenses (which is an expense that does not effect actual cash flow) from our effective gross revenue. With the addition of depreciation, the property is now operating at a loss for tax purposes. Before the PAL Rules, we could automatically report this as a loss against nonpassive income taxes. Now, this loss will only qualify as a suspended loss that can be used only as a deduction against taxes on passive income at a later date, including at the sale of this property; unless the taxpayer qualifies for one of the exceptions, which in that case it can be used immediately for tax deductions against nonpassive income.

Exception 1: Exception for Rental Real Estate with Active Participation

A real estate owner can use taxable passive losses from real estate to write off nonpassive income taxes through an IRS provision known as the Exception for Rental Real Estate with Active Participation. This rule allows an owner of commercial real estate to deduct up to $25,000 or less if (1) the owner actively participates in the real estate activities related to a rental real estate property and (2) makes less than $100,000 in modified adjusted gross income (MAGI) if he or she is single or married and filing jointly (combined income less than $100,000) OR makes less than $50,000 if he or she is married, filing separately, and has lived with their spouse at any time over the year.

- To actively participate in real estate activities, according to the IRS, means that a person (a) owns at least 10% of the real estate and (b) made management decisions or arranged for others to provide services (such as repairs) in a significant and bona fide sense. Management decisions that may count as active participation include approving new tenants, deciding on rental terms, approving expenditures, and other similar decisions (https://www.irs.gov/publications/p527/ch03.html). This means you cannot simply be hands-off with the property and leave it to a property manager. You must, at the minimum, have final say on all major issues before the property manager goes ahead with an objective.

- If you make less than or equal to $100,000 and are single or married and filing jointly, then you can claim up to $25,000 of passive real estate losses against any other taxable income. However, you must actually have $25,000 in passive losses from real estate. For example, if you only have $6,000 in passive losses, then that is the max you can claim. Additionally, for every dollar of MAGI you make above $100,000, your max deduction eligibility of $25,000 is decreased by 50 cents. So, for example, if you earn $115,000 in MAGI and have $30,000 in passive losses from real estate, you are only eligible to claim 17,500 [25,000 – (15,000 * 0.50)]. Therefore, once you get close to earning $150,000 and above, this deduction is effectively worthless.The same rules apply for those who are married and filing separately, but have lived with their spouse at any time during the year. The only difference is that the max write off you can take is $12,500 and for every dollar you earn above $50,000, you decrease your max write-off by 50 cents.

Exception 2: Exception for The Real Estate Professional

The tax shelter provided for qualified real estate professionals is much more attractive and significant. The benefits are:

- There is no maximum loss limit

- All the losses from real estate can be treated as active losses.

- There is no maximum income limit.

- The 3.8% Medicare tax that is imposed on rental income for owners whose AGI is greater than $200,000 for single tax payer, greater than $250,000 for a married tax payer filing jointly, or greater than $125,000 for a married taxpayer filing separately, is exempt.

To qualify as a real estate professional, you must meet both of the following requirements:

- More than half of the personal services you perform in all trades or businesses during the tax year are performed in real property trades or businesses in which you materially participate. This includes working in brokerage, acquisitions, construction, development, renovations, sales, leasing, management and operations, etc. However, you do not qualify if you are an employee of a real estate firm. If that is your case, then you must be at least a 5% owner.

- You perform more than 750 hours of services during the tax year in real property trades or businesses in which you materially participate.

Material Participation –

Participation Defined

Participation, as define by the IRS, is any work you do in connection with an activity in which you own an interest. Additionally, any participation from your spouse, whether an owner or not, also counts towards your own participation hours for tax purposes.

Exclusions

Work you do when you are acting as an investor in your activity does not count toward participation. This can mean studying financial statements, doing analysis for your own use, or analyzing the finances in a non-managerial capacity. Additionally, if you are doing work that is not usually done by an owner solely for the benefit of gaining tax benefits, it will not qualify.

Participation Tests

According to Publication 925 – Passive Activity and At-Risk Rules, in order for a person to have material participated in a real estate activity, the person must pass any of the following tests for the taxable year:

- Participate in the activity for more than 500 hours.

- You substantially did most of the work. According to Every Landlord’s Tax Deduction Guide, you should make an attempt to prove that you worked at least 71% of the total hours worked by all people on the activity.

- Participated in the activity more than 100 hours and participated at least as much as any other individual, including non-owners.

- Participated in two or more real estate related activities where participation was greater than 100 hours for each activity and the total amount of hours that you participated in all activities was over 500.

- You satisfied any of the pervious requirements for five of the last 10 tax years.

Proof

The IRS is not too particular or explicit when it comes to requiring proof of participation. You do not have to keep stringent records and can use estimates as long as you can loosely prove accuracy. For example, you can use an informal notebook and record activities and hours spent working on them.

Own & Participate in Multiple Properties? – Elect!

If you own and materially participate on multiple properties, it is critical that you file a statement with your tax return stating that you are electing to treat all of your interests in various real estate activities as one. After you elect to do this, you do not need to do it again in the following years. If you forget to elect, then you will have to materially participate in each and every property in order to claim losses from all of them, otherwise, you will be ineligible for this extremely valuable benefit. Additionally, you can’t pick and choose which interests you want to include, you must include all of your real estate interests once you elect.

Caution – if you elect to treat all your real estate activities as one, you may face problems claiming suspended losses from prior years when you sell a property. Consult with a qualified legal professional to figure out your unique situation.

Frequently Asked Questions about Exceptions to the Passive Activity Loss (PAL) Rules

What are the PAL (Passive Activity Loss) Rules?

The PAL Rules were introduced in 1986 to prevent taxpayers from using passive income losses, especially from real estate, to offset nonpassive income. Under these rules, passive losses can generally only be used to offset passive income, not income from wages, investments, or active businesses.

Can real estate losses ever be used to offset nonpassive income?

Yes. There are two key exceptions: (1) the $25,000 active participation deduction for rental real estate, and (2) the real estate professional exemption, both of which allow qualifying individuals to apply passive losses against nonpassive income.

What qualifies someone for the $25,000 rental real estate deduction?

To qualify, you must:

Own at least 10% of the property

Actively participate in decisions such as approving tenants, rents, or repairs

Have a modified adjusted gross income (MAGI) of $100,000 or less (or $50,000 if married filing separately and living with your spouse)

The deduction phases out by $0.50 for every dollar of MAGI above those thresholds.

What are the benefits of qualifying as a real estate professional?

Qualifying real estate professionals may:

Deduct all real estate losses without limit

Treat those losses as active (usable against nonpassive income)

Avoid the 3.8% Medicare tax on rental income (if AGI thresholds are met)

Have no MAGI limit on deductions

What are the requirements to be a real estate professional?

You must:

Spend more than 50% of your personal service time in real property businesses

Work at least 750 hours annually in those real estate activities

Materially participate in the activity (based on IRS criteria such as hours worked or degree of involvement)

Note: Spousal participation counts, and employees must own at least 5% of their employer’s business to qualify.

What does “material participation” mean?

Material participation means you are significantly involved in the activity. IRS tests include:

Working 500+ hours

Doing most of the work yourself

Working at least 100 hours and more than any other participant

Meeting one of several IRS-defined participation tests

You must document activities and hours, though estimates are allowed.

Can I combine multiple properties to qualify as a real estate professional?

Yes, but you must file an election with your tax return to treat all real estate interests as one activity. This allows your total hours across properties to count toward the 750-hour threshold. If you fail to elect, you must qualify separately for each property.

Are there any risks or downsides to making the multiple property election?

Yes. If you make the election and later sell a property, it may be harder to claim previously suspended losses for that specific property. You should consult a tax advisor to assess your situation before filing the election.