Understanding Taxes Series: Part 1 – Depreciation

Investing in real estate provides some tremendous tax incentives in the USA compared to other investments and is an important component to understanding real estate investing. Given the positive response I’ve received to my Understanding Leases Series, I thought I’d begin a new series on taxes in real estate.

Important Note: This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

Part 1 – Real Estate Depreciation

There are numerous subtopics we will cover in the future on the subject of taxes, but this first blog post in this series will focus on establishing depreciation expenses of an existing property at acquisition, how to go about doing it, and how it can provide significant tax savings for a real estate investor.

Before We Begin: How Income Tax is calculated from Rental Property

Before diving into the subject, I just wanted to lay out the simple calculation for taxable income. The basic setup to calculate taxable income on an investment property is as follows:

NOI

Less: Interest

Less: Depreciation

Taxable Income (Loss)

x Tax Rate

Tax Owed (Deducted)

If this property is owned by an individual investor, every dollar of positive taxable income would be subject to his or her income tax rate. However, if he or she can show a taxable paper loss and (1) he or she has other taxable income from passive investments or (2) meets the qualifications for a deduction in active income from passive investment losses, he or she can benefit from some interesting and advantageous tax savings. These qualifications will be discussed in another post soon to follow.

Straight Line Depreciation

Establishing a Depreciable Basis

A depreciable basis is the dollar amount assigned to a property at the time of purchase that will be depreciated over a specific period of time. If it is a commercial property, the depreciation period is 39 years and with residential buildings it is 27.5 years.

To establish a depreciable basis, the owner of the property must first establish a cost basis. This is done by adding the purchase price together with all the costs associated with the purchase such as inspections, broker fees, appraisal fees, etc. Once the cost basis is established, the owner must then figure out what percentage will be allocated to the physical building(s) and what percentage will be allocated to the land. The portion that is allocated to the buildings is called the depreciable basis and is the part of the cost basis that can be depreciated. The portion of the cost basis allocated to the land is the portion that cannot be depreciated, so there is tremendous incentive for property owners to allocate as much of the cost basis as possible to the buildings.

Some Common Methods

There is no official IRS recommended way to determine the depreciable basis of a property. In reality, an investor can claim whatever he or she wants as the depreciable basis to the IRS because the IRS sets no guidelines on this matter. However, if the investor were to be audited they would have to justify how they came to that number and if the IRS determines it’s too low then he or she will have to pay back some of the depreciation plus interest and penalties.

There are a few common methods that are used throughout the industry to calculate the depreciable basis. Two of the most common methods to determine the depreciable basis are to use either the property’s tax assessment or the bank’s appraisal for the property. The property tax assessment provides the assessed value for tax purposes and shows what percent of the value is allocated to land and what percent is allocated to the building. You can use this ratio and impose it on the cost basis.

However, the tax assessment ratio is almost always on the low side for the percent allocated to the building(s) and can either be an arbitrary calculation or they may use a one size fits all approach. It is irrelevant to the assessor what portion of the total value is allocated to what because they tax you on the whole property regardless.

The bank’s appraisal that is done before the purchase, however, shows a replacement cost for the building(s), or what it would cost to rebuild the building(s) today from the ground up. You can use this cost and directly impose it on the cost basis to determine the depreciable basis. This ratio is usually more favorable, but could sometimes be too aggressive. In the end, it is up to you what you use for your depreciable basis, but it may be best to use some sort of blend between both methods and be able to justify it.

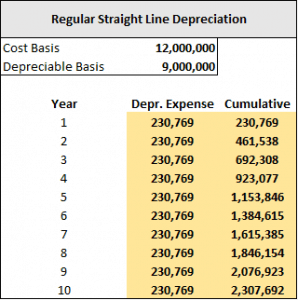

Straight Line Depreciation Example

In this example, there is a purchase of a commercial property for $12 million, $9 million of which has been allocated to the building. Using straight line depreciation is simple in that all you do is take the depreciable basis and divide it by 39 years for a commercial building. In this example, we divided $8 million by 39 to get an annual depreciation expense of $230,769.

Segmented Depreciation and Cost Segregation – A Valuable, but Complicated Depreciation Method

Establishing Depreciable Bases

Rather than simply splitting the cost basis up between the building and the land like we do with the straight line depreciation of a building, a property owner can alternatively break the property and its contents down further using the segmented depreciation method and cost segregation.

With segmented depreciation, the cost basis is broken down into four categories: (1) the building/structure, (2) land improvements, (3) personal property, and (4) land. The reason for doing this is that both land improvements and personal property can be depreciated at a much faster rate than the building(s) and allows for more tax savings early on.

(1) The Building/Structure – Cost Segregation

Additionally, the owner can further break down the building/structure portion into individual components using cost segregation. Doing this is a bit more complicated and will require a qualified CPA. Cost segregation uses an engineer report to break down the individual components of a building and determine their individual depreciation rates, which are always much shorter in duration than the building.

For example, HVAC may have a 7-year depreciable life, carpeting can have a 5-year depreciable life, and roofing can have a 15-year depreciation period. As you can imagine, the depreciation becomes heavily frontloaded compared to just using the standard 39-year, or 27.5-year straight line depreciation method.

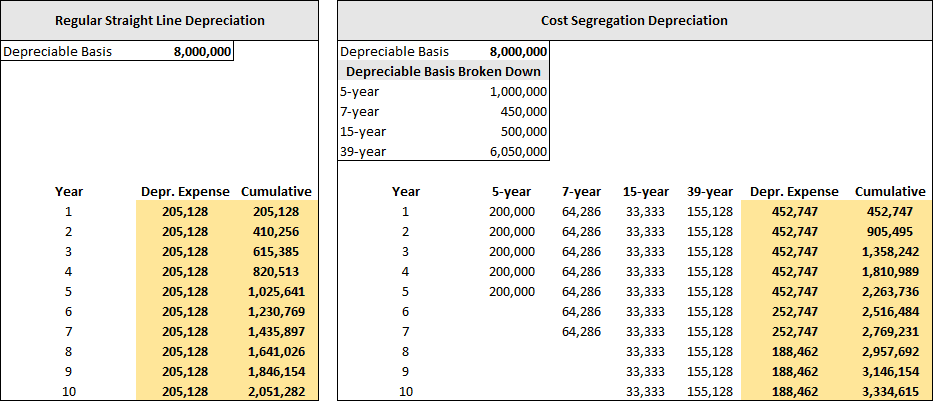

Cost Segregation Example

Below is an example of how cost segregation of the building/structure can tremendously benefit an investor.

The example shows a made up building/structure value of $8 million. The left hand side shows the depreciation without using cost segregation and the right side shows the same building with cost segregation. With the straight line depreciation method over 39 years there is a steady $205,128 that can be written off every year, but with the segmented depreciation put in place we can see that $452,747 can be written off in the first five years, which is more than double, and then after the first five years this number decreases significantly.

By understanding the basic principle of time value of money, which states that a dollar is worth more today than in the future, we can understand that this is much more beneficial for the investor if he or she can actually take advantage of these tax savings.

Present Value Comparison

To concretely illustrate this concept further, I ran a present value calculation on both depreciation expense flows. I used an income tax rate of 28% and a discount rate of 10%. With straight line depreciation, the property owner would generate a PV of $560,400 over the 39 years on the building and with segmentation and cost segregation the property owner would realize a PV of $794,708. That is an additional $234,308 in PV.

What about Depreciation Recapture?

Upon sale of the property, the IRS taxes the depreciation taken over the hold period at 25%. That is if the building is sold for more than both the depreciation taken over the hold period and the adjusted basis combined, both of which will be discussed more in a later post on depreciation recapture.

However, this should not be an issue for most people. If you can postpone paying 25%+ on income taxes now and push it down the road 10 years, that same dollar amount is worth less 10 years down the road than it is today, so it is ultimately worth it. It is even more worth it if you are in a higher than 25% tax bracket.

Additionally, and probably most importantly for any serious real estate investor, you can do a 1031 exchange and push paying any capital gains or depreciation recapture taxes down the road indefinitely. The 1031 exchange will be discussed in a future post.

(2) Land Improvements

There are two categories of land improvements: (a) land changes and (b) additional structures on the land that are not part of the main building(s).

(a) Land Changes

Land changes can be depreciated as long as they are in direct correlation with the building(s). For example, you cannot claim that planting trees on the edge of the property away from the building is depreciable under land improvements because it does not directly interact with or impact the building. The cost for the trees in this scenario would actually be added to the land basis.

However, if you planted trees directly next to the building or in a way that they have an impact on the building and its users they can be considered land improvements. Other examples of land changes are grading, clearing, excavations, and landscaping as long as they are directly related to the structure.

(b) Additional Structures

Additional structures built on the property can be depreciated whether they directly interact with the building or not. These include sidewalks, roads, canals, waterways, drainage facilities, sewers (not including municipal sewers), wharves and docks, bridges, fences, or radio and television transmitting towers as stated in Rev. Rul. 72-403, 1972-2 C.B. 102.

Depreciation of Land Improvements

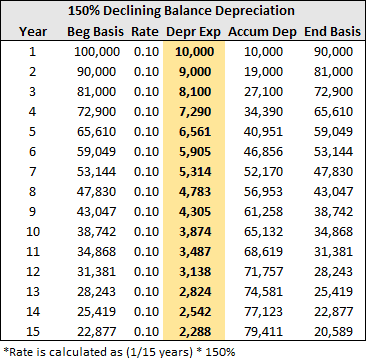

Land improvements require a 150% declining balance method and a 15 year depreciation period. Below is an example of a depreciation schedule for a $100,000 land improvement using the 150% declining balance method.

(3) Personal Property

Personal property is anything within the building or attached to the building that is not a structural component. The following six questions listed in the Cost Segregation Techniques Audit Guide provided by the IRS with their answers will help determine if the item in question is personal property or a structural component.

- Can the property be moved and has it been moved? YES

- Is the property designed or constructed to remain permanently in place? NO

- Are there circumstances that show that the property may or will have to be moved? YES

- Is the property readily movable? YES

- How much damage will the property sustain when it is removed? NOT MUCH

- How is the property affixed to land? IT CAN BE REMOVED FAIRLY EASILY WITH LITTLE OR NO DAMAGE

Some Common Personal Property Items

- Washers and dryers

- Stoves

- Refrigerators

- Furniture owned by building owner

- Window coverings

- Plants

How Personal Property is Depreciated

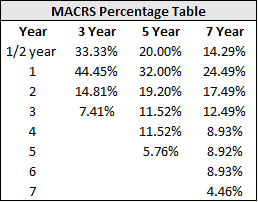

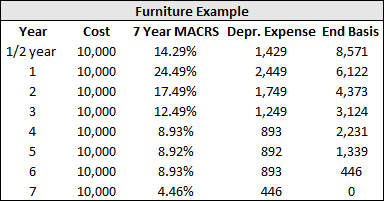

Personal property is usually depreciated using a MACRS (Modified Accelerated Cost Recovery System) and will have either a 3-year, 5-year, or 7-year depreciation period. However, it is assumed that all property is purchased and placed in service in the middle of the previous year. Below shows the MACRS Percentage Table:

An Example

We have new office furniture totaling $10,000. Office furniture is usually depreciated over 7 years, so the depreciation schedule would be as follows:

Segmented Depreciation and Cost Segmentation – A Final Word

Using segmented depreciation and cost segmentation is only worth it if you can immediately take advantage of the tax savings; if you can’t, then this process is costly and unnecessary. In short, it is worth it if it will either lower your tax payments on the property significantly, or if it creates a significant taxable loss on the property’s taxable income that can be transferred to other taxable income such as other real estate investment income or even personal income if you qualify.

As mentioned previously, we will discuss how this works in the follow up post. One important thing to note though, is that if you currently own property and didn’t use cost segregation in the beginning and realize now that you may benefit from it, you can apply it retroactively to your property. Consult with your CPA or tax advisor to find out if this would benefit you.

In Sum

Handling depreciation with real estate investments can become very complicated very fast. As I’ve said over and over in this post, it is best to consult with a CPA or tax attorney who specializes in this topic. This post was written to be a sort of in depth introduction to real estate tax deductions in the United States.

Taxes are an extremely important and valuable topic to understand with real estate and we will continue to post more about this topic in the future. Future posts regarding this subject will cover depreciation on capital improvements, 1031 exchanges, depreciation recapture, and much more.

If you have any comments, questions, or concerns, please feel free to contact me.

Frequently Asked Questions about Real Estate Depreciation

What is depreciation in real estate investing?

Depreciation is a tax deduction that allows a real estate investor to recover the cost of a property over time. It reduces taxable income even though it doesn’t involve actual cash outflows. “To establish a depreciable basis, the owner… must then figure out what percentage will be allocated to the physical building(s)…”

How is the depreciable basis of a property determined?

Start by calculating the total cost basis (purchase price + closing costs). Then allocate that cost between the land and the buildings. Only the building portion can be depreciated. “There are a few common methods… to use either the property’s tax assessment or the bank’s appraisal for the property.”

What is straight-line depreciation and how is it calculated?

Straight-line depreciation spreads the depreciable basis evenly over the asset’s useful life—27.5 years for residential and 39 years for commercial properties. Example: “We divided $8 million by 39 to get an annual depreciation expense of $230,769.”

What is cost segregation and how does it increase tax savings?

Cost segregation breaks down the building into components (e.g., HVAC, carpet) with shorter depreciation lives, frontloading deductions. “Cost segregation… uses an engineer report… and determine their individual depreciation rates… depreciation becomes heavily frontloaded.”

What is segmented depreciation?

Segmented depreciation separates the cost basis into: (1) structure, (2) land improvements, (3) personal property, and (4) land. The first three can be depreciated at different (often faster) rates. “Land improvements and personal property can be depreciated at a much faster rate…”

What qualifies as land improvements and how are they depreciated?

Land improvements include items like grading, drainage, sidewalks, or fencing. These are depreciated over 15 years using the 150% declining balance method. “Land improvements require a 150% declining balance method and a 15 year depreciation period.”

What is personal property in real estate and how is it depreciated?

Personal property includes non-structural items like appliances or furniture. These are depreciated using MACRS over 3, 5, or 7 years. “Personal property is… within the building or attached… but not a structural component.”

Is cost segregation worth doing retroactively?

Yes. “If you currently own property and didn’t use cost segregation… you can apply it retroactively.” You’ll need to consult with a CPA to determine the benefits and file the appropriate forms.

What happens at sale—how is depreciation recaptured?

Depreciation is recaptured and taxed at 25% when the property is sold for more than its adjusted basis. “The IRS taxes the depreciation taken… at 25%.” This can be deferred via a 1031 exchange.

When is using segmented depreciation and cost segregation not worth it?

These methods are only worth it “if you can immediately take advantage of the tax savings.” If you can’t use the losses or offsets now, the effort and cost may not be justified.