Using OpenAI’s ChatGPT to Research Real Estate Data

The third blog post in this series on how to use ChatGPT in commercial real estate. The first step in real estate underwriting is the collection and aggregation of data or information. That data or information is then process, analyzed, and used to help make an investment decision. OpenAI’s GPT language model can be used to help collect data for real estate research and underwriting.

In this video tutorial, I use ChatGPT (an interface that uses the GPT language model) to collect real estate related data in a quick and efficient way.

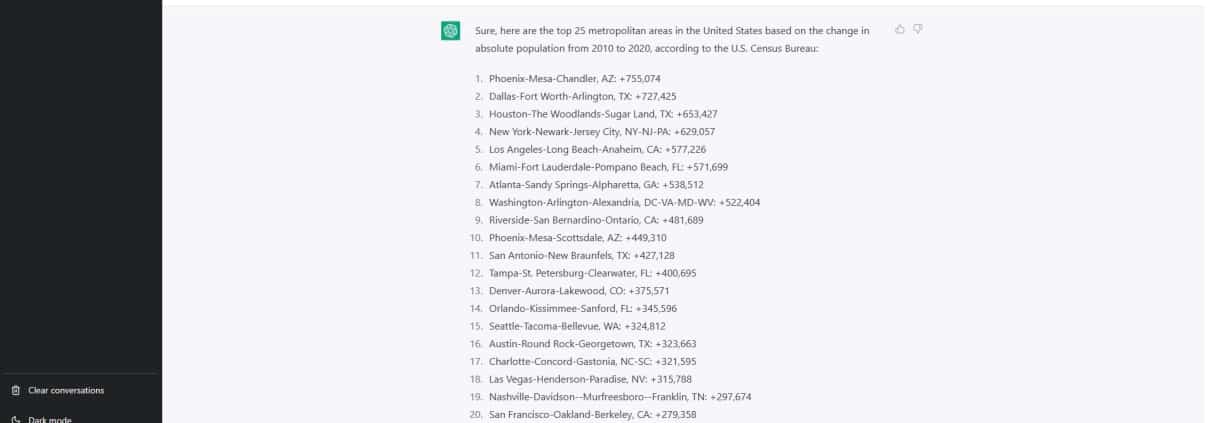

The output created from ChatGPT based on a series of prompts asking for a list of metro areas ordered by absolute population growth.

What is GPT, ChatGPT, and OpenAI?

First, some definitions to help you as you read and watch. If you’ve seen our other content on the subject, this will be review. I used ChatGPT to write the following definition (try it yourself!), with the prompt: What is GPT and its relationship to ChatGPT and OpenAI?

GPT is a language model developed by OpenAI. It is one of the largest and most powerful language models ever created, with 175 billion parameters. Like ChatGPT, GPT is designed to generate human-like responses to text-based prompts, and is trained on a massive dataset of text.

ChatGPT is a variant of GPT that has been fine-tuned for conversational interactions. It uses a smaller set of parameters (fewer than GPT) and has been optimized to generate more conversational responses, making it better suited for use in chatbot applications and other conversational AI systems.

GPT and ChatGPT are both products of OpenAI’s research efforts, and both are designed to showcase the power and potential of advanced language models. They are examples of how artificial intelligence can be used to create more sophisticated and effective conversational AI systems that can be used in a variety of applications, from customer service chatbots to personal assistants and more.

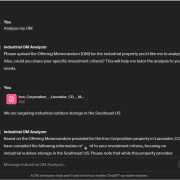

Should I use OpenAI’s GPT Playground or ChatGPT?

If you’ve been following this series, you know that I use both OpenAI’s GPT playground as well as OpenAI’s ChatGPT to produce my results. ChatGPT and GPT Playground are both AI language models that are trained to understand natural language and generate human-like responses. However, they differ in several ways.

ChatGPT is a specific instance of the GPT series of language models developed by OpenAI. It has been trained on a large corpus of text and can be fine-tuned for specific tasks such as question answering, language translation, and text summarization. ChatGPT is designed to respond to user input in a conversational format and can generate coherent and contextually appropriate responses.

In short, ChatGPT is more user friendly but has less flexibility.

GPT Playground, on the other hand, is an online tool that allows users to interact with the GPT language model developed by OpenAI. It offers a user-friendly interface where users can input text prompts and receive AI-generated responses. However, GPT Playground is not fine-tuned for specific tasks and its responses may be less coherent or contextually appropriate than those generated by ChatGPT.

Alternatively, the ability to fine-tune the language model via the Playground gives the user greater visibility into the accuracy of the model’s outputs.

In summary, both ChatGPT and GPT Playground have their own strengths and weaknesses, and the choice between them will depend on the specific use case and personal preference.

Collecting Real Estate Information for Research – Then and Now

Before GPT, the process of collecting data and information was a manual process. The real estate professional would generally rely on data sources stored by their firm, data stored within tools they licensed, or information that they could find on the internet.

Once they knew where to find the information, they would then have to clean and organize the data to make it useful for their specific use case. In some cases this would be quick, and in other cases it could take hours (or days) to properly clean and organize the data for use.

With the new language models available, collecting, cleaning, and organizing some data is now automated. I say some data, because the information available to GPT is limited to what is publicly available. This means that proprietary or licensed data (e.g. what you might pull from CoStar) is unavailable while public data (e.g. consensus data) is available.

I would hope that eventually proprietary data providers like CoStar will improve their frontend to use natural language models like ChatGPT to make collecting and using data much easier.

Similarly, OpenAIs data models can be trained to pull in proprietary data. Therefore, the day is coming where your firm can feed its proprietary data into the model and make the job of sourcing data (e.g. the closing date for an asset you manage) as quick as asking the model for that information.

Note that as of Feb 2023, the information available in the latest version of OpenAI’s tools is a bit stale (i.e. from 2021). But for many data collection use cases, that doesn’t matter much.

Check out the video below where I use ChatGPT to create an easy-to-use list of US cities and metros, organized by population. A list of US states and their counties, in a format that can quickly be pasted into Excel. And a list of US metros by population growth rate and by change in absolute population.

Using GPT in Commercial Real Estate – Research Real Estate Data

I continue to explore other use cases for this technology in commercial real estate. In this video, I show you a use case whereby I leverage GPT and ChatGPT to quickly grab real estate specific information for research and underwriting.

Frequently Asked Questions about Using ChatGPT to Research Real Estate Data

How can ChatGPT help with real estate data research?

ChatGPT can be used to collect publicly available real estate data quickly and efficiently. For example, it can generate lists such as metro areas ranked by population growth or states and counties formatted for Excel, saving time previously spent manually searching and formatting data.

What types of real estate data can GPT access?

GPT can access and organize public data—such as census data, population metrics, and geographic information. However, it cannot access proprietary or licensed datasets like those from CoStar or other subscription-based platforms.

Is ChatGPT a replacement for licensed real estate data providers?

No. ChatGPT is not a replacement for proprietary data sources. It is best used as a complementary tool to streamline access to public data and to assist with organizing or preparing information for analysis.

What’s the difference between ChatGPT and GPT Playground for data tasks?

ChatGPT is user-friendly and optimized for conversation, making it ideal for basic queries. GPT Playground offers more flexibility and customization, allowing users to fine-tune prompts for more technical or advanced output—though it requires more expertise.

How has GPT changed the process of collecting real estate data?

Before GPT, collecting and organizing data could take hours or days. Now, professionals can use GPT to generate structured lists and insights in minutes, improving speed and reducing manual errors in the early underwriting process.

Can GPT be trained to use a firm’s proprietary data?

Yes. While not shown in this video, OpenAI’s models can be fine-tuned or connected to proprietary datasets, enabling internal teams to query firm-specific data through a natural language interface in the future.

What are the limitations of using ChatGPT for real estate research?

Limitations include the inability to access real-time or proprietary data, and occasional inaccuracies due to outdated knowledge (as of February 2023, GPT’s data was current only through 2021).

How does using ChatGPT improve efficiency in underwriting?

ChatGPT automates early-stage data collection and formatting tasks, allowing analysts to quickly gather and structure relevant information, freeing up more time for higher-level analysis and decision-making.