Tag Archive for: Analysis

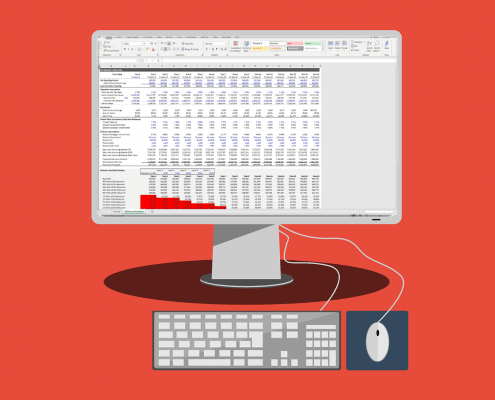

Real Estate Financial Modeling Accelerator (Updated June 2025)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

Analyzing a Real Estate Investment from the Perspective of an LP

We received a question from an A.CRE reader this week that I thought warranted a thorough response. The question was, and I paraphrase, "I am an LP looking for models to help vet syndication deals. Do you have any models that can be used to…

How to Use Debt Yield to Calculate Loan Amount (Updated July 2024)

In our glossary of commercial real estate terms, we recently answered the question: what is debt yield? As a follow up to that entry, I thought I’d expand on the concept of debt yield by showing you how lenders use debt yield to come up with…

Understanding Low-Income Housing Tax Credit (LIHTC) Investments

In this article, we explore Low-Income Housing Tax Credit (LIHTC) investments, a key component in the affordable housing sector. Established to encourage private investment, the LIHTC program offers tax credits to developers for creating and…

From Data to Decisions: Analyzing Real Estate Trends to Forecast Market Growth

Real estate market trend analysis is crucial for experienced professionals to identify up-and-coming neighborhoods. On a gut level, driving the streets of a community and engaging with residents, even for just an hour or two, can provide a clear…

Using Generative AI to Outperform Humans at Financial Statement Analysis

Researchers at the University of Chicago recently released the results of an important study that evaluated GPT-4's financial analysis capabilities by predicting future earnings from financial statements. By using Chain-of-Thought (CoT) reasoning,…

Quick Thoughts on Evaluating Real Estate Investments Without Opening Excel

In our industry (commercial real estate), the ability to quickly evaluate investment opportunities is crucial for staying competitive. I know I've found in my professional career, that having a clear framework for evaluating - and then either…

Forecasting After-Tax Cash Flow in Real Estate Analysis (Updated May 2024)

When modeling real estate investments, industry practice is generally to stop at before-tax cash flow, rather than after-tax cash flow. And this makes sense in most instances. No two owners of real estate have the exact same tax situation and…

Using an IRR Matrix to Determine Hold Period (Updated Dec 2023)

When building a real estate financial pro forma, it's important to model for and include a summary of various return and risk metrics. Among the different return metrics, the internal rate of return (IRR) - both on an unlevered and levered…

Refinance Risk Analysis Tool in Excel (Updated Nov 2023)

Generally speaking, equity real estate investors spend their time modeling the upside while their debt partners spend their time modeling the downside. Equity investors generally focus on an investment's internal rate of return, cash-on-cash…

A.CRE 101: CRE Risk Profiles (Updated May 2023)

In this post we will go into detail about the four CRE risk profiles commonly ascribed to commercial real estate opportunities. In order of least risky to most risky, they are as follows:

Core

Core Plus

Value Add

Opportunistic

This…

Create A Dynamic Revenue Row to Calculate Multiple Tenant Leases (Updated Nov 2022)

I recently received an email from one of our readers asking how to create a dynamic revenue row for a pro forma that can capture rent changes for multiple tenants. I thought that this would make a great post for the site and would be a good…

Streamlining Commercial Real Estate Asset Management with Dottid | S3SP11

In this special episode of the A.CRE Audio Series, we feature Kyle Waldrep, founder of Dottid, and Senecca Miller, its CTO and COO. Dottid is a commercial real estate asset management optimization platform. It's an operating tool for office,…

Why Manufactured Housing Communities (MHCs) are the safest investment in real estate with Brandt Foster | S3SP10

In this special episode of the A.CRE Audio Series, we feature Brandt Foster, Director at Northwestern Mutual Real Estate, one of the largest institutional real estate investors in the nation. In this conversation, Brandt discusses all the various…

Leveraging Data & Technology to Streamline Real Estate Debt Procurement With Yaakov Zar and Sammy Greenwall | S3SP9

In this special episode of the A.CRE Audio Series, we feature Yaakov Zar and Sammy Greenwall, the founders of Lev Capital, a commercial mortgage marketplace for capital market advisors. Spencer, Michael, and Sam speak with Yaakov and Sammy about…

Day in the Life of a Capital Markets Associate with Daniel Greenblum

In this Day in the Life of a Commercial Real Estate Professional post, we hear from Daniel Greenblum, a capital markets Associate at a real estate loan broker, Lev Capital.

Daniel has been kind enough to share his typical daily routine and…