Understanding Leases: Office Buildings – Part 2a

Grossing Up Operating Expenses – What, How, Why, and its impact on the Three Common Bill-back Methods

A common practice in office leases is to gross up the variable portion of the reimbursable expenses. Grossing up expenses is when the owner of a property takes the annual actuals and figures out what the variable reimbursable expenses in the given year would be if the building was 95%-100% leased up. The expenses are then billed back to the tenants who pay their pro rata share based on the gross up.

Why?

During the lease up period or when a building is not stabilized or fully occupied, variable operating expenses will be much lower and thus, tenants (and landlord in a base-year lease scenario) would realize a benefit of paying uncharacteristically low expense reimbursements. Since the tenants do not experience any lack of services or any inability to service their customers due to the high vacancy, and landlords are almost always operating at a loss during this period, many in the industry feel the building owners, not the tenants, should be the ones realizing the benefit of the low operating expenses. Tenants should still be paying their full pro rata share of expenses regardless of how many vacant suites there are because the utility they are receiving is not diminished. As a result, grossing up expenses is common practice in the industry.

How to Gross Up Expenses and Its Impact on the Three Bill-Back Approaches

In triple net lease and expense-stop lease scenarios, the gross up favors the landlord, but in the base-year scenario it favors the tenant. To illustrate why, let’s do a simplified example of a gross up and how it impacts a tenant’s expense reimbursements in each bill-back scenario.

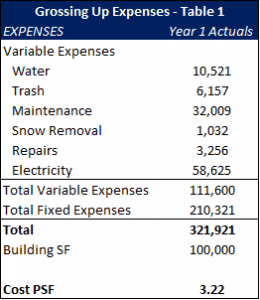

Let’s say we have a 100k SF building that is 45% leased with the following year 1 actual expenses:

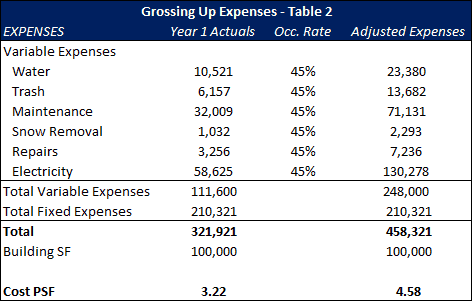

As we can see, the current expense reimbursement per square foot is $3.22. To gross up the expenses to a building that is 100% occupied, we can simply divide each of the actual variable expenses by the occupancy rate of 45% as illustrated in Table 2 below.

As shown in Table 2, total expenses and cost psf have gone up 42% to a number that is more reflective of what the reality would be if the property is stabilized.

It is important for tenants to make sure the landlord is only grossing up variable items and should ensure through the lease that they have the right to view what specific items or portions of items are being grossed up.

Impact on Triple Net Lease

The tenant will now be paying $4.58 psf as opposed to $3.22 psf. Although it is not going to completely cover the expenses in the first year, the additional $1.36 psf will help cover some of the fixed expenses that would have otherwise come out of the landlord’s pocket.

Impact on Base-Year Lease

Without the gross-up provision, the landlord would benefit significantly from an extremely low base year stop. If the landlord got away with paying $3.22 for the first year, in the remaining years, the tenant would be responsible for the additional $1.36 psf plus inflation and other uncontrollable increases in costs. The gross-up provision creates the intended effect of the base-year lease, which is that landlord pays the fair cost of the first year expenses, which in this case is $4.58 psf, while the tenant covers all increases as time goes on.

Impact on the Expense Stop

If the expense-stop was set at $4.45, then the tenant would not have to pay any additional money for the reimbursable expenses and leave the landlord with the full brunt of the expenses. If the gross up was unfortunately set too high, as in this scenario, this might impact returns for a few years to come due to not realizing any additional revenue through reimbursed expenses.

Check out: Understanding Leases: Office Buildings – Part 1

Check out: Understanding Leases: Office Buildings – Part 2b

Frequently Asked Questions about Grossing Up Operating Expenses in Office Leases

What is “grossing up” operating expenses?

Grossing up is the practice of adjusting variable operating expenses as if the building were 95%-100% leased. “Grossing up expenses is when the owner… figures out what the variable reimbursable expenses… would be if the building was 95%-100% leased up.”

Why do landlords gross up expenses in office leases?

Landlords gross up expenses so tenants don’t benefit from artificially low costs during periods of high vacancy. “Tenants should still be paying their full pro rata share… because the utility they are receiving is not diminished.”

What types of expenses should be grossed up?

Only variable expenses should be grossed up—not fixed ones. “Tenants… should ensure through the lease that they have the right to view what specific items or portions of items are being grossed up.”

How does grossing up impact tenants in a triple net lease?

Tenants pay more to help cover fixed expenses, which benefits the landlord. “The tenant will now be paying $4.58 psf as opposed to $3.22 psf… [which] will help cover some of the fixed expenses…”

How does grossing up affect tenants in a base-year lease?

It protects tenants from future inflated reimbursements due to an artificially low base year. “The gross-up provision creates the intended effect of the base-year lease… the landlord pays the fair cost of the first year expenses.”

What happens if the gross-up is too high in an expense stop lease?

The landlord might fail to recoup any expense reimbursements, harming their return. “If the gross up was unfortunately set too high… this might impact returns… due to not realizing any additional revenue.”

Who benefits from grossing up expenses?

It depends on the lease type. “In triple net lease and expense-stop lease scenarios, the gross up favors the landlord, but in the base-year scenario it favors the tenant.”