Understanding Leases: Office Buildings – Part 1

Billing Back Reimbursable Operating Expenses – Three Common Approaches for Office Buildings

(ARGUS video example to follow next week)

The three most common approaches to expense reimbursements in office leases are the (1) triple-net, (2) base-year, and (3) expense-stop approaches. In this post I hope to provide readers with a general understanding of each. In a post coming up in the following week, I will walk through how to model for them in ARGUS.

The Triple-Net Lease (NNN Lease)

A triple net lease is simply a lease that requires the tenant to pay for its pro rata share of reimbursable expenses (usually taxes, insurance, and CAM) without the landlord paying any portion of the reimbursable expenses at any point. Although the technical term for this would be an absolute net lease, most refer to it as a NNN lease. However, NNN leases can vary in their terms. Some may require the tenant to pay capital expenditures, while other leases might require the property owner to pay for them. There could be numerous minor variations to the NNN lease.

The Base-Year Lease

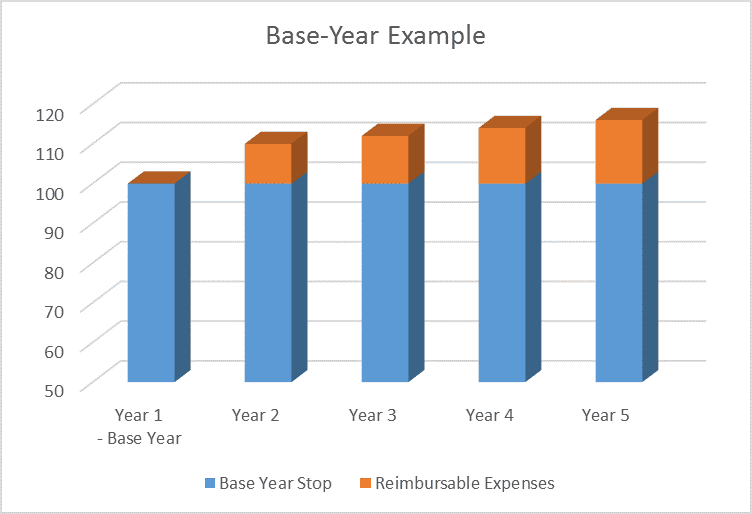

A base-year lease is when the landlord will pay up to the base-year amount of reimbursable operating expenses annually and the tenant must pay any additional expenses that go above the base-year amount in subsequent years. For example, if the total base-year reimbursable expenses in year 1 is $100, the landlord would pay the $100 on year 1 and up to $100 every year after. So if in year 2 reimbursable expenses were $110, the landlord would pay the base year amount ($100) and the tenant would be required to reimburse the landlord for the additional $10. The chart below helps to better illustrate this concept.

The base year expenses are usually based on either the current calendar year expenses when the lease is signed or the following calendar year expenses after the lease is signed.

Landlord tip: If possible, it is in the landlord’s favor to use the current calendar year when the lease is signed due to capturing extra months of reimbursable revenue and also avoiding paying a higher base-year amount due to expected inflation and the natural increases in costs.

Although the landlord is paying the base-year expenses, the landlord will attempt to account for this by building it into the rental rate. So as a result, the tenant will pay a much higher base rent than a tenant who has a triple net lease.

Tenant tip: Tenants should insist on having a clause in the lease the gives them the right to audit the books used to establish the base-year amount.

Expense-Stop Lease

Rather than paying for a portion of reimbursable expenses using the base-year approach, the property owner will estimate total expenses when the building is 95%-100% leased up and break the cost down by square foot to determine the expense-stop per square foot of the building. The owner will then multiply that by the tenant’s total square footage to determine the total expense-stop for that particular tenant. The tenant will then be responsible for its pro rata share of expenses above that.

For example, Property A is projected to have year 1 reimbursable operating expenses that come to $10 a square foot when fully occupied. Tenant A is leasing 10k SF. Landlord will then pay $100K ($10 * 10k) of the reimbursable expenses annually and Tenant A will pay its pro rata share of reimbursable expenses above $100k for the duration of the lease. Landlords should be careful not to set the expense stop too high because it could result in missing a lot of additional revenue from reimbursements. This will be further illustrated in Part 2 where I discuss grossing up expenses.

One of the benefits to a property owner using the expense stop approach over the base-year approach is that it enables the owner to realize some reimbursement revenue in the first year of the lease as opposed to a base-year lease, which, as mentioned above, needs to first establish the base stop using the actual expenses from a calendar year that either entirely includes, or partially includes, the time when the tenant is operating the space.

Coming Up Next Week: How to Model these Scenarios in ARGUS

I will upload a video that will walk through how to model each of these scenarios using ARGUS. To help readers follow along, there will be a word document with building expense assumptions and three tenants and their leasing assumptions. Stay tuned for that post.

Check out: Understanding Leases: Office Buildings – Part 2

Frequently Asked Questions about Billing Back Reimbursable Operating Expenses in Office Leases

What are the three common approaches to billing back operating expenses?

The three most common methods are (1) Triple-Net Lease, (2) Base-Year Lease, and (3) Expense-Stop Lease.

How does a triple-net (NNN) lease work?

In a triple-net lease, the tenant pays its full pro rata share of all reimbursable expenses—typically taxes, insurance, and CAM—without the landlord contributing to those costs at any point.

What is a base-year lease and how does it benefit the tenant?

In a base-year lease, the landlord pays for operating expenses up to the amount incurred in a designated base year. The tenant pays only the amount above that base-year amount in future years. “If in year 2 reimbursable expenses were $110, the landlord would pay the base year amount ($100) and the tenant would… reimburse… the additional $10.”

How is the base year determined?

The base year is usually either the calendar year in which the lease is signed or the following year. Landlords typically prefer the current calendar year “due to capturing extra months of reimbursable revenue and also avoiding paying a higher base-year amount.”

What should tenants be cautious about in base-year leases?

Tenants should include a lease clause that gives them the right to audit the books used to establish the base-year amount.

How does an expense-stop lease function?

In an expense-stop lease, the landlord sets a fixed dollar-per-square-foot expense limit (the “stop”) based on full occupancy. The tenant pays their share of expenses above that amount. For example, if the stop is $10/SF and expenses rise to $12/SF, the tenant pays $2/SF.

Why might a landlord prefer an expense-stop lease over a base-year lease?

Expense-stop leases allow landlords to realize some reimbursement revenue in the first year, unlike base-year leases which first require a full-year expense history to set the base.

What is a key risk for landlords using the expense-stop method?

If the expense stop is set too high, the landlord may not recover any additional reimbursements for a period of time. “Landlords should be careful not to set the expense stop too high… could result in missing a lot of additional revenue.”