Real Estate Financial Modeling Accelerator (Updated April 2024)

Prior to launching the Accelerator program, Michael and I fielded email after email requesting a more structured real estate financial modeling training program on the site.

Over the years, we've covered hundreds of real estate modeling…

LIHTC (Low Income Housing Tax Credits) Overview and Calculator

Below is an overview of how LIHTC (low income housing tax credits) are calculated and applied to affordable housing projects. At the bottom of the post you will find downloadable excel files that correspond with the videos.

LIHTC - An Overview

LIHTC…

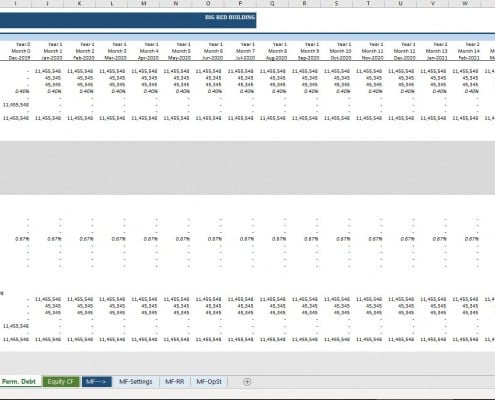

Watch Me Build a Multifamily Real Estate Model (Updated Feb 2020)

One way to become a better real estate financial modeling professional, is to watch other professionals model. I know in my career being able to physically see how others tackle different modeling problems has shaped my methods and made me better…

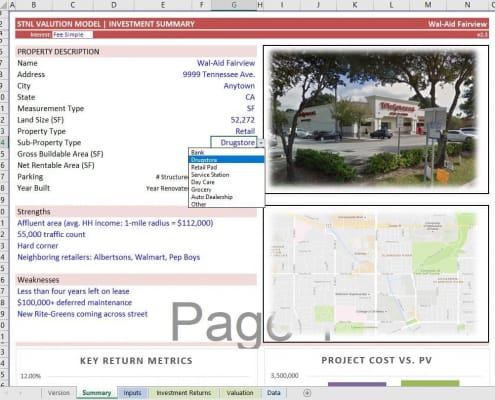

Create Dynamic Sub-Property Type Drop-Down Menus in Excel

A few years ago, I created a tutorial on building smart drop-down menus in Excel using dynamic named ranges and data validation lists. This offered a great way to have drop-down menus in your model that could be easily changed by the user to…

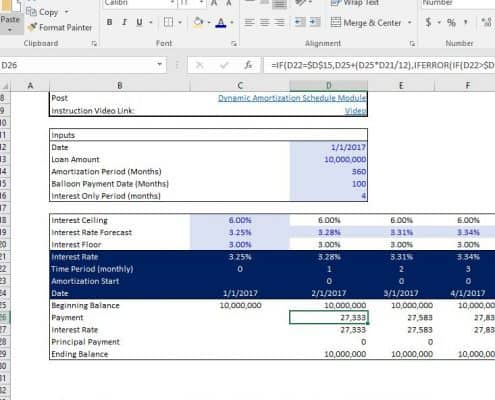

Dynamic Amortization Schedule (Updated 2.06.2020)

This is a dynamic amortization schedule for debt that gives the user the capability to model a loan with an interest only period up front and an amortizing floating rate debt repayment period once the interest only period is over. This module…

A.CRE Audio Series Season Two – Coming March 2020

Michael, Spencer, and series host Sam Carlson met in Frisco, TX Jan 18th - 20th to record the second season of the Adventures in CRE Audio Series. This new season includes 11 episodes with guest interviews, real estate financial modeling insights,…

Using VBA to Hide Rows in Excel

Over the next few minutes, I will show you two techniques for automatically hiding and showing rows in Excel using VBA code. These techniques I use regularly in my real estate financial models to make for a more intuitive user experience.

In…

Watch Me Build Data Tables For Real Estate Sensitivity Analysis

This is a 3 part mini-series on using data tables in Excel to perform real estate sensitivity analysis. In this series, I'll walk you through how to build both one-variable and two-variable data tables in parts 1 and 2. And in Part 3, I'll walk…

Modeling a Mortgage Loan Assumption Using the All-in-One

I recently had a discussion in the All-in-One support forum about how to model a mortgage loan assumption using my All-in-One Model for Underwriting Acquisitions and Development. Prior to version 0.77, this required manually overriding various…

Watch Me Build A Construction Draw Schedule (Updated Jan 2020)

In the following video, I record my screen and narrative my steps as I build a basic construction draw schedule. I've also included the template and completed worksheets from this Watch Me Build exercise.

Are you an Accelerator member? See…

Using SUMPRODUCT to Calculate Weighted Average in Real Estate

In my experience, using the SUMPRODUCT function in Excel to calculate weighted average is one of the most oft-used Excel techniques in real estate financial modeling. I learned this technique on day one of my first real estate internship and…

How to Create Dynamic, In-Cell Buttons and Toggles in Microsoft Excel

Creating intuitive, user-friendly, visually appealing models is one aspect of mastering real estate financial modeling. One way to make your models easy for people to use and more attractive in general is to use dynamic, theme-appropriate, in-cell…