How to Use My Real Estate Equity Waterfall Model

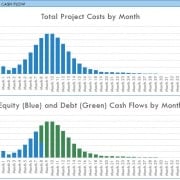

I took a few minutes this weekend, and created a video to help you use my real estate equity waterfall (IRR hurdle technique) model that I built in Excel. Again, keep in mind that the model is not standalone, but can be used with any of the Excel models in our library or with your own real estate investment Excel models. Here is the video:

If you’re interested in learning more, I found this great article from the CCIM on the IRR hurdle structure. This structure is definitely one of the more commonly used structures in the industry for splitting profits between a sponsor and his limited partners. It is a concept you should understand if you’re going to be working in institutional real estate investment.

If you have any comments about this model, or would just like to chat real estate, feel free to reach out to Spencer.

Frequently Asked Questions about Using the Real Estate Equity Waterfall Model

What is the Real Estate Equity Waterfall Model used for?

The model is used to apply an IRR hurdle technique to split profits between a sponsor and limited partners in a real estate investment.

Is the model standalone or does it integrate with others?

The model is not standalone—it is designed to be used with any of the Excel models in the Adventures in CRE library or with your own investment Excel models.

Where can I watch the tutorial on how to use this model?

A video tutorial was created by Spencer Burton and is linked in the blog post to demonstrate how to use the model.

Why is understanding IRR hurdle structures important in real estate?

The IRR hurdle structure is one of the most commonly used methods in the industry for profit splits. “It is a concept you should understand if you’re going to be working in institutional real estate investment.”

Where can I learn more about the IRR hurdle structure?

The blog references a helpful article from CCIM that explains the IRR hurdle structure in detail.

Who created the model and tutorial?

Spencer Burton, Co-Founder and CEO of CRE Agents, created the model and video tutorial. He has over 20 years of CRE experience and has underwritten over $30 billion in real estate deals.

Can I contact the author with questions about the model?

Yes. Spencer encourages users to reach out if they have comments about the model or want to chat real estate.