Real Estate Financial Modeling Accelerator (Updated June 2025)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

Setting Up a New Real Estate Financial Model – Date and Period Headers Plus Formatting (Updated Apr 2022)

We've spent a lot of time here discussing and sharing different real estate models, and we've received a ton of feedback from our readers as a result. In some of that feedback we've received, several people have asked what period and date rows…

Convert Monthly Cash Flows to Quarterly and Annual Cash Flows (Updated Mar 2022)

Over the past few years, I've been working to build an ARGUS DCF alternative in Excel - or otherwise known here as the A.CRE All-in-One (Ai1) Model. As I've worked on that model, I've been jotting down modeling techniques I use and think would…

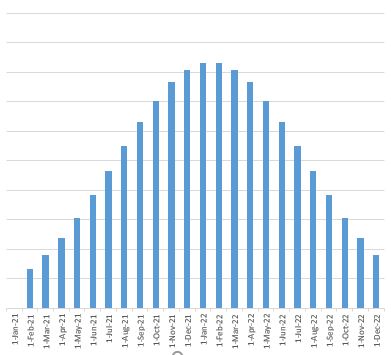

S-Curve Forecasting in Real Estate Development (Updated Sep 2021)

One of the reasons Michael and I blog, is to force ourselves to be continually learning. I built the first version of my real estate waterfall model, because I wanted to better understand the mechanics of modeling an equity waterfall with IRR…

Bite-Sized CRE Lessons – A.CRE 30 Second Video Tutorials

As we continue to build out our A.CRE 101 series and our Glossary of Commercial Real Estate terms, we've started to supplement these initiatives with short (<30 second) video clips on how to do various CRE calculations and modeling tasks…

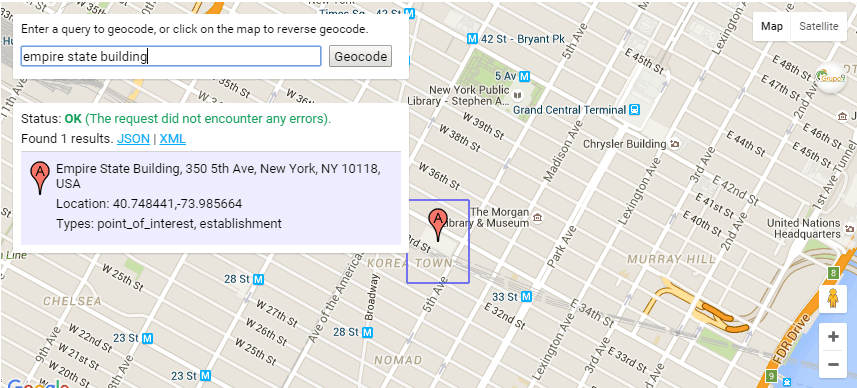

Custom Function to Auto-Populate Latitude and Longitude in Excel (Updated 2021)

When analyzing real estate investments in Excel, it's often necessary to include the latitude and longitude coordinates of the properties we're modeling. To do this, most of us open up Google Maps, or some other mapping tool, and find the…

Keyboard Shortcuts I Use Constantly When Modeling in Excel (Formatting)

The more you model real estate in Microsoft Excel, the faster and more accurate you become - and hopefully as a consequence the more valuable you become to real estate employers and investors. Part of the process of mastering real estate financial…

Using Boolean Logic to Model Multiple Generations of Tenant Improvements

Arguably the most powerful, and least appreciated and understood, functionality in Excel is its use of boolean logic. Or in other words, the use of TRUE and FALSE binary logic. This form of logic can be used to dramatically simplify formulas…

Create Printable and PDF Reports in Excel for Real Estate Financial Modeling

A common question we've been getting recently is, how do I create printable reports from a real estate financial model in Excel? In this written and video tutorial, I share the three basic steps for creating printable and PDF reports in any…

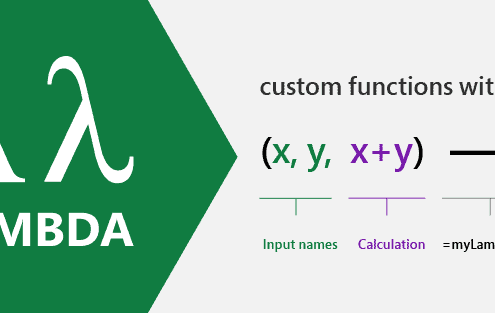

Using Excel’s New LAMBDA Feature to Create Custom Functions for Real Estate Financial Modeling

In December 2020, Excel rolled out a new featured called LAMBDA as part of the Office Insiders (i.e. beta) program. This feature allows the user to create custom functions, which can greatly reduce duplicative formulas and reduce errors.

Well…

DateDif: The “Secret” Excel Formula (Updated 11.14.2020)

For one reason or another, there is a perfectly functioning and pretty valuable formula that can be utilized in Excel that Microsoft has chosen to exclude from Excel's list of functions: the DateDif function. This function is a valuable…

Watch Me Build – IRR Partitioning in Excel

In this post, I'd like to show you how to partition the internal rate of return of your real estate investment in Excel. I also throw in a quick equity multiple partition, to highlight how the time value of money affects your returns. I've recorded…

Permanently Remove “Update Links” Alert in Real Estate Excel Models

There are few Excel experiences more frustrating than getting that "this workbook contains links to one or more external sources" alert and not being able to find/break the external links causing it. In this tutorial, I teach you five steps…

Excel Tips: Index Match Match

In this post, I'm going to go over Index Match Match, which is a very useful Excel formula that is used in both the Hotel Valuation Model and the Hotel Acquisition Model - The Basic Model. This formula allows you to hone in on a specific target…

Watch Me Build a Tenant Rollover Analysis Model

The feedback has been positive on the ‘Watch Me Build a Multifamily Model’ video I recorded earlier this year. So I thought I’d follow that up with another. This time I build a Real Estate Tenant Rollover Analysis Model and talk through…

Watch Me Build a Multifamily Real Estate Model (Updated Feb 2020)

One way to become a better real estate financial modeling professional, is to watch other professionals model. I know in my career being able to physically see how others tackle different modeling problems has shaped my methods and made me better…