Real Estate Financial Modeling Accelerator (Updated June 2025)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

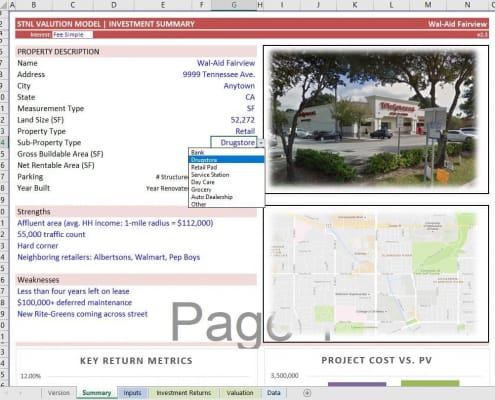

Create Dynamic Sub-Property Type Drop-Down Menus in Excel

A few years ago, I created a tutorial on building smart drop-down menus in Excel using dynamic named ranges and data validation lists. This offered a great way to have drop-down menus in your model that could be easily changed by the user to…

Using VBA to Hide Rows in Excel

Over the next few minutes, I will show you two techniques for automatically hiding and showing rows in Excel using VBA code. These techniques I use regularly in my real estate financial models to make for a more intuitive user experience.

In…

Watch Me Build Data Tables For Real Estate Sensitivity Analysis

This is a 3 part mini-series on using data tables in Excel to perform real estate sensitivity analysis. In this series, I'll walk you through how to build both one-variable and two-variable data tables in parts 1 and 2. And in Part 3, I'll walk…

How to Create Dynamic, In-Cell Buttons and Toggles in Microsoft Excel

Creating intuitive, user-friendly, visually appealing models is one aspect of mastering real estate financial modeling. One way to make your models easy for people to use and more attractive in general is to use dynamic, theme-appropriate,…

Using Conditional Formatting in Real Estate Financial Modeling

Your real estate financial models are only as good as their ability to be used by others. Or in other words, if others can't figure out how to use your model, it isn't worth much! So when building real estate financial model templates, besides…

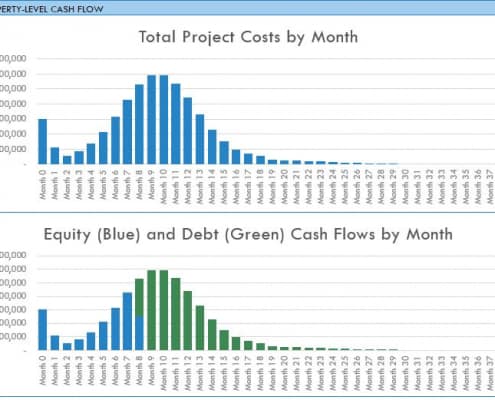

Roll Up Your Monthly Cash Flow Line Items Into Annual Periods Using Only One Formula For The Whole Sheet

While building out my hotel development model (currently underway), I decided to take a break and record a video about how I roll up the monthly cash flow line items on my Monthly Cash Flow sheet into annual cash flow line items on a separate…

Tutorials For The Hotel Valuation Model (Updated 07.23.19)

Welcome to the A.CRE Hotel Valuation Model's Tutorial Page. On this page you will find all the tutorials for the A.CRE Hotel Valuation model in Excel. There is a lot to learn within this model and over time, I'd like to show you both how to…

Using the Floating Summary Box in Real Estate Modeling

Over the next few minutes, I'll share a great modeling tip for efficiently visualizing the more salient metrics in your real estate models. Now I should mention, this is a tip I shared a few years ago. But given the complexity of many of the…

Using the OFFSET Function in Real Estate Financial Modeling

In a previous post, I showed you how to use the OFFSET function to create dynamic lists in Excel. As you become more comfortable using this function in real estate financial modeling, you'll find that it has almost infinite applications when…

A.CRE 101 – Create Smart Drop-Down Menus in Real Estate Modeling

One Excel feature real estate financial modeling professionals use often is the data validation list. Where data validation is a method of limiting the possible inputs of a cell, the data validation list limits those inputs to a pre-defined…

Create a Dynamic Real Estate Chart in Excel

Most of the real estate financial models we've shared over the years are dynamic to analysis period. Meaning, we've included an input to adjust the length of the analysis period, and the model will adjust the results accordingly.

This is…

A Few Indispensable Keyboard Shortcuts for Moving Quickly Around Excel

The more time you spend modeling real estate in Excel, the more important keyboard shortcuts become. It's partly about speed - using keyboard shortcuts is much faster than using the mouse. But it's also about impressing your peers; whether you…

Excel Speed Tip – Insert or Delete a Row or Column Without a Mouse

Using keyboard shortcuts is essential to improving the speed and efficiency at which you model real estate in Excel. One thing you'll learn early in your CRE career, the more proficient you become in using your keyboard without a mouse to navigate…

Deep Dive: The IRR and XIRR – Fully and Simply Explained (Part 2)

Part 2: The XIRR

(Click here for Part 1 where we cover the IRR)

This is Part 2 of our A.CRE Deep Dive - 2-part mini-series on the IRR and XIRR return metrics and functions in Excel. As stated in Part 1, these are some of the most commonly…

Deep Dive: The IRR and XIRR – Fully and Simply Explained

For my next post, I thought I would bring it back to some fundamentals and review the IRR and XIRR return metrics and functions in Excel. These are some of the most commonly used functions and return metrics in commercial real estate and they…