Tag Archive for: Debt

Real Estate Financial Modeling Accelerator (Updated June 2025)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

Watch Me Build a Dynamic Mortgage Amortization Table in Excel (Updated September 2024)

There are a few basic, yet fundamental, real estate modeling skills you must master before anyone will take you seriously as a real estate professional. Building a mortgage amortization schedule is one of them.

Virtually every model you…

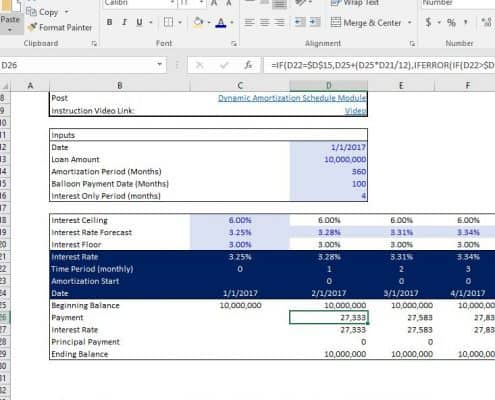

Advanced Mortgage Amortization Module (Updated May 2024)

In recent months, I've been working on an advanced real estate investment amortization table with interest-only capability, fixed and variable interest rates, multiple interest calculation methods (i.e. 30/360, Actual/Actual, Actual/365, Actual/360),…

Real Estate Debt Module in Excel (Updated May 2024)

I thought I'd share the real estate debt module I originally built for the ARGUS alternative in Excel. Most debt modules I've seen in real estate financial models only include the ability to model fully amortizing senior debt. Mike challenged…

Commercial Mortgage Loan Analysis Model (Updated Mar 2024)

Over the years, I've received various requests to augment our library of real estate Excel models to include a model for underwriting and analyzing commercial mortgage loans. Specifically, people have asked for a tool to calculate the loan amount…

LBO vs CRE Acquisition Models and Using LBO Structure to Acquire CRE

In the world of investment and finance, models play an integral role in guiding decision-making processes, evaluating risk, and forecasting returns. Two such influential models are the Leveraged Buyout (LBO) Model and the Commercial Real Estate…

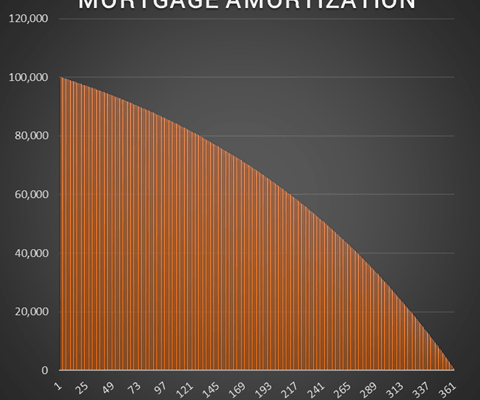

Dynamic Amortization Schedule (Updated 2.06.2020)

This is a dynamic amortization schedule for debt that gives the user the capability to model a loan with an interest only period up front and an amortizing floating rate debt repayment period once the interest only period is over. This module…

30/360, Actual/365, and Actual/360 – How Lenders Calculate Interest on CRE Loans – Some Important Insights

(Updated August 7, 2019 to include a Watch Me Build video and Downloadable file)

Commercial real estate lenders commonly calculate loans in three ways: 30/360, Actual/365 (aka 365/365), and Actual/360 (aka 365/360). Real estate professionals…

3-Tiered Acquisition Debt Module

This is a 3-tiered debt module that will allow the user to add one to three tiers of debt to his or her real estate DCF model. Includes the option to layer in senior debt, secondary debt, and mezzanine debt; calculate interest on either…