Tag Archive for: IRR

Real Estate Financial Modeling Accelerator (Updated June 2025)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

Real Estate Equity Waterfall Model – IRR and Equity Multiple Hurdles (Updated June 2025)

Over the years, this real estate equity waterfall with annual periods and IRR or Equity Multiple hurdles has been one of the most popular models in our library of real estate Excel models. It's been downloaded thousands of times and we've received…

Why Your IRR and XIRR are Different (Updated June 2024)

This post was inspired by a question on our real estate financial modeling Accelerator forum. Additionally, Spencer and I frequently get emails asking about this very issue, which is 'why the IRR (internal rate of return) and XIRR (extended…

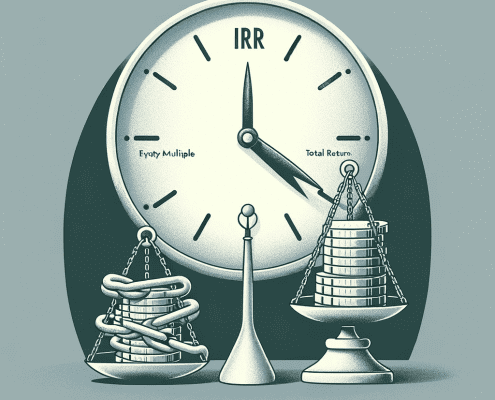

Limitations of IRR When Evaluating Real Estate Investments

The internal rate of return is one of the most commonly used return metrics to analyze real estate investment opportunities. Simply put, the IRR is the anticipated, project-determined discount rate an investor is expected to earn over the life…

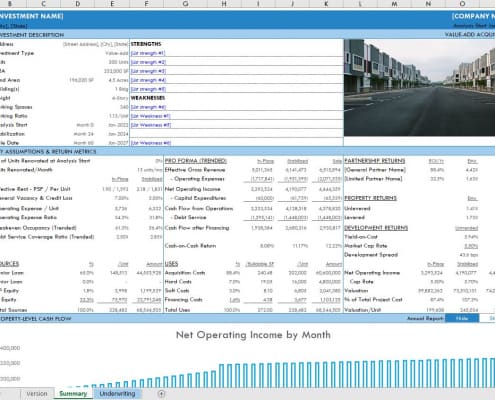

Using an IRR Matrix to Determine Hold Period (Updated Dec 2023)

When building a real estate financial pro forma, it's important to model for and include a summary of various return and risk metrics. Among the different return metrics, the internal rate of return (IRR) - both on an unlevered and levered…

Could You Be Exiting Too Early? Don’t Forget to Analyze Your Reinvestment Rate

When attempting to maximize the value of your money invested in real estate, the timing of your exit is key to maximize your return. Exit too early, and you might leave money on the table. Exit too late, and you might have better used that capital…

Watch Me Build – IRR Partitioning in Excel

In this post, I'd like to show you how to partition the internal rate of return of your real estate investment in Excel. I also throw in a quick equity multiple partition, to highlight how the time value of money affects your returns. I've recorded…

Deep Dive: The IRR and XIRR – Fully and Simply Explained (Part 2)

Part 2: The XIRR

(Click here for Part 1 where we cover the IRR)

This is Part 2 of our A.CRE Deep Dive - 2-part mini-series on the IRR and XIRR return metrics and functions in Excel. As stated in Part 1, these are some of the most commonly…

Deep Dive: The IRR and XIRR – Fully and Simply Explained

For my next post, I thought I would bring it back to some fundamentals and review the IRR and XIRR return metrics and functions in Excel. These are some of the most commonly used functions and return metrics in commercial real estate and they…