Real Estate Financial Modeling Accelerator (Updated January 2026)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

Eventos Inmobiliarios en Latinoamérica – Agosto 2025

Los eventos inmobiliarios en Latinoamérica son clave para conocer las últimas tendencias, regulaciones y oportunidades de inversión en la región. Para los profesionales del sector, estar al tanto de los principales eventos inmobiliarios…

The Conditional Weighted Average – SUMPRODUCT with SUMIF (Updated July 2025)

Consider this scenario: you have a 50 tenant rent roll, consisting of various tenant types (i.e. small inline, large inline, junior anchor, anchor, etc.), and you want to calculate the weighted average rent for each tenant type. If I asked you,…

Eventos Inmobiliarios A.CRE | IA en Construcción y el Futuro del Sector

Mi atención al evento "Ecosistemas Inteligentes: IA, Construcción y Experiencias", organizado por Construtech en alianza con Naska Digital, representó una valiosa oportunidad para profundizar en el estado actual y futuro de la transformación…

Exploring Latin America’s Real Estate Markets: Chile

The real estate market in Latin America continues to offer a landscape of economic and urban realities that invite strategic analysis. In our previous installment, we explored the case of Argentina, a complex market but full of opportunities…

Multifamily (Apartment) Acquisition Model (Updated July 2025)

Our library of real estate Excel models has a variety of decent apartment models, including our All-in-One model and our Apartment Development Model - both robust models in their own right. However, if you're looking for a straight multifamily…

Modelo de Desarrollo de Uso Mixto – Condominio y Comercio Minorista (Retail) en Excel (Actualizado Julio 2025)

Uno de los escenarios de desarrollo más comunes en muchas partes del mundo, incluyendo Latinoamérica, es el de los proyectos inmobiliarios que combinan unidades residenciales en forma de condominios con espacios comerciales minoristas (Retail).…

30/360, Actual/365, and Actual/360 – How Lenders Calculate Interest on CRE Loans – Some Important Insights (Updated July 2025)

(Updated August 7, 2019 to include a Watch Me Build video and Downloadable file)

Commercial real estate lenders commonly calculate loans in three ways: 30/360, Actual/365 (aka 365/365), and Actual/360 (aka 365/360). Real estate professionals…

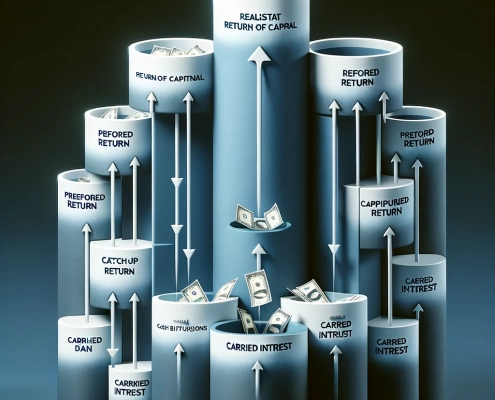

Real Estate Equity Waterfall Model – IRR and Equity Multiple Hurdles (Updated July 2025)

Over the years, this real estate equity waterfall with annual periods and IRR or Equity Multiple hurdles has been one of the most popular models in our library of real estate Excel models. It's been downloaded thousands of times and we've received…

A.CRE 101: Buenas prácticas para construir modelos financieros inmobiliarios

En esta entrega de la serie A.CRE 101, exploramos tres pilares fundamentales del modelado financiero inmobiliario, necesarios para construir modelos sólidos y auditables. Desde el uso de pronósticos dinámicos (rolling forecast, forecasting…

Ground Lease Valuation Model (Updated July 2025)

The topic of ground leases has come up several times in the past few weeks. Numerous A.CRE readers have emailed to ask for a purpose-built Ground Lease Valuation Model. And I'm in the process of creating an Advanced Concepts Module for our real…

Cómo Utilizar el Rendimiento de la Deuda y el Índice de Cobertura del Servicio de la Deuda Para Calcular el Importe de un Préstamo (Actualizado Julio 2025)

En nuestro glosario de términos inmobiliarios comerciales, encontraremos 2 conceptos bastante interesantes, que a su vez son métricas y vías para evaluar la factibilidad de un proyecto inmobiliario en última instancia.

Por su parte, la…

Residential Land Development Pro Forma (Updated July 2025)

As many of you know, I started my career in residential land development first as a broker and later as a principal. During that time, I built my fair share of residential land development Excel pro formas, modeling returns and forecasting cash…

AI and the Future of Commercial Real Estate: A Conversation with Ron Rohde

Our very own Spencer Burton recently joined Ron Rohde - CRE attorney, investor, and longtime guest contributor to A.CRE - for a forward-looking discussion about how artificial intelligence is transforming commercial real estate.

Why now?…

Mixed-Use Development Model: Condo and Retail (Updated July 2025)

In this post, I walk you through the A.CRE Mixed Use Development Model for Condo and Retail projects. The model is basically a reworked and expanded version of the Condo Development Model, so if you are familiar with that, this should feel and…

Modelo De Desarrollo De Condominio en Excel (Actualizado Julio 2025)

Después de la publicación del “Módulo de Efectivo en Cascada”, Kyle Holmberg me comentó que mi próximo reto sería construir un modelo diseñado para analizar la viabilidad financiera de un proyecto de condominio en venta, se trataba…