Real Estate Financial Modeling Accelerator (Updated January 2026)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

Excel Pro Forma for Flipping Houses (Updated Sept 2025)

Before moving to the principal side of the business, I began my career as a self-described real estate investment specialist, largely working as a land broker but dabbling in other areas including the popular "single-family flip" space. In all…

A.CRE Apartment Development Model (Updated Sept 2025)

For several years now, our library of real estate models has been lacking a robust ground-up apartment development model. Sure, our All-in-One (Ai1) model has the capability to model multifamily development deals, but it's more a generalist…

Watch Me Solve a REPE Technical Interview Modeling Test (Updated Sept 2025)

What better way to spend some free time over the Thanksgiving holiday, than to record myself completing a real estate private equity technical interview exercise! While I've offered help with the real estate technical interview in the past,…

A.CRE Self Storage Development Model (Updated Aug 2025)

We've received numerous requests over the years for a Self Storage Development Model in Excel. With strong investment and development activity in this niche property type, I recognize a self storage model on A.CRE is long overdue. But with so…

Land Development Model – Multi-Scenario (Updated Aug 2025)

Over the years, we've shared eight development-focused real estate financial models and numerous development-specific tools to the A.CRE Library of Excel Models. Nevertheless, there's been a hole in the development offerings in our library.…

Understanding Stabilization Through The Lens Of Operating Expense Ratio

The term “stabilized” is deeply embedded in the language of real estate. It shows up frequently in financial models, offering memoranda, development strategies, and underwriting assumptions. So frequently, in fact, that its meaning is often…

A.CRE Build-to-Rent (BTR) Development Model (Updated Aug 2025)

Build-to-rent (BTR) has become more and more common in CRE and now accounts for a meaningful share of development. In the past, we've recommended A.CRE readers use our Apartment Development Model for BTR analysis. However, as we've received…

Multifamily (Apartment) Acquisition Model (Updated July 2025)

Our library of real estate Excel models has a variety of decent apartment models, including our All-in-One model and our Apartment Development Model - both robust models in their own right. However, if you're looking for a straight multifamily…

30/360, Actual/365, and Actual/360 – How Lenders Calculate Interest on CRE Loans – Some Important Insights (Updated July 2025)

(Updated August 7, 2019 to include a Watch Me Build video and Downloadable file)

Commercial real estate lenders commonly calculate loans in three ways: 30/360, Actual/365 (aka 365/365), and Actual/360 (aka 365/360). Real estate professionals…

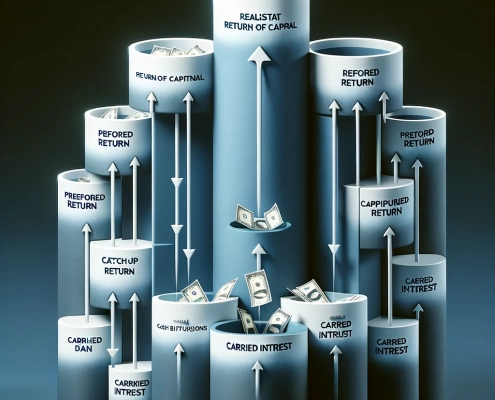

Real Estate Equity Waterfall Model – IRR and Equity Multiple Hurdles (Updated July 2025)

Over the years, this real estate equity waterfall with annual periods and IRR or Equity Multiple hurdles has been one of the most popular models in our library of real estate Excel models. It's been downloaded thousands of times and we've received…

Ground Lease Valuation Model (Updated July 2025)

The topic of ground leases has come up several times in the past few weeks. Numerous A.CRE readers have emailed to ask for a purpose-built Ground Lease Valuation Model. And I'm in the process of creating an Advanced Concepts Module for our real…

Residential Land Development Pro Forma (Updated July 2025)

As many of you know, I started my career in residential land development first as a broker and later as a principal. During that time, I built my fair share of residential land development Excel pro formas, modeling returns and forecasting cash…

Mixed-Use Development Model: Condo and Retail (Updated July 2025)

In this post, I walk you through the A.CRE Mixed Use Development Model for Condo and Retail projects. The model is basically a reworked and expanded version of the Condo Development Model, so if you are familiar with that, this should feel and…

Single Family Home Construction Pro Forma for Home Builders (Updated July 2025)

I'm often asked to share models centered around residential development and home building. This is an area of real estate I'm completely comfortable in, since I spent the first 10 years of my career in new residential development.

Not surprisingly,…

A.CRE Value-Add Apartment Acquisition Model (Updated Jun 2025)

We've shared a handful of apartment models over the years. Several of those are capable of analyzing apartment acquisitions but none was built for the express purpose of modeling value-add apartment deals. As a result, each has its limitations…