Real Estate Financial Modeling Accelerator (Updated January 2026)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

Multifamily Redevelopment Model (Updated June 2020)

This is an Excel model I originally built from scratch back in 2015 for quickly assessing multifamily redevelopment opportunities. It was designed to work best for scenarios where individual units will be rehabbed over the hold at varying times.…

The “Secret” to Learning Real Estate Financial Modeling

Just like any skill in life, there are tips and tricks to learning that skill. Some suggestions are more helpful than others, although all contribute in some way. In this episode, we share one of the more valuable tips - what our marketing team…

Ask a Pro: How to Hire Your Next CRE Attorney

If you are investing in real estate, it's only a question of when and not if you will need a lawyer. However, many clients do not always have significant experience in the past. As a commercial real estate attorney, I'm going to walk through…

From College to a Job Amidst the COVID-19 Recession

Many A.CRE readers are young professionals and college students trying to navigate the job market in a recession. Finding a job in commercial real estate amidst the craziness of the COVID-19 pandemic can be challenging, especially for those…

Watch Me Build – Capital Stack with Mezzanine Debt

One of the more difficult aspects of modeling a real estate development is figuring out how to handle equity and debt cash flows. This becomes all the more difficult when a second tranche of debt is introduced. In this Watch Me Build video,…

Multifamily Metrics and Strategies in a Post-COVID World

Commercial real estate is the business of building, leasing, managing and selling space. And the demand for and how that space is used is largely a function of human psychology and behavior. With the human-psyche turned on its head due to COVID-19,…

Real Estate Financial Modeling Using Google Sheets

Virtually every real estate firm in the world uses Microsoft Excel to analyze real estate. It's the industry standard and if you work in real estate you better know how to model real estate in Excel. So regardless of whether you love Excel or…

Permanently Remove “Update Links” Alert in Real Estate Excel Models

There are few Excel experiences more frustrating than getting that "this workbook contains links to one or more external sources" alert and not being able to find/break the external links causing it. In this tutorial, I teach you five steps…

Excel Tips: Index Match Match

In this post, I'm going to go over Index Match Match, which is a very useful Excel formula that is used in both the Hotel Valuation Model and the Hotel Acquisition Model - The Basic Model. This formula allows you to hone in on a specific target…

Watch Me Build a Tenant Rollover Analysis Model

The feedback has been positive on the ‘Watch Me Build a Multifamily Model’ video I recorded earlier this year. So I thought I’d follow that up with another. This time I build a Real Estate Tenant Rollover Analysis Model and talk through…

All-in-One (Ai1) Walkthrough #2 – Office, Retail, Industrial Rent Roll Tab

This walkthrough, our second in the series, will detail how to use the office/retail/industrial rent roll (see ORI-RR Tab). The rent roll tab is arguably the most important, and most complex, tab in the All-in-One model. Below we post a video…

LIHTC (Low Income Housing Tax Credits) Overview and Calculator

Below is an overview of how LIHTC (low income housing tax credits) are calculated and applied to affordable housing projects. At the bottom of the post you will find downloadable excel files that correspond with the videos.

LIHTC - An Overview

LIHTC…

Watch Me Build a Multifamily Real Estate Model (Updated Feb 2020)

One way to become a better real estate financial modeling professional, is to watch other professionals model. I know in my career being able to physically see how others tackle different modeling problems has shaped my methods and made me better…

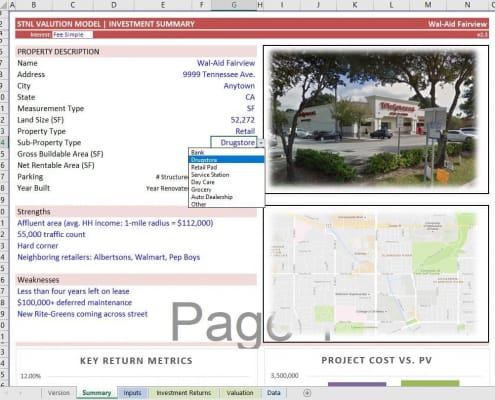

Create Dynamic Sub-Property Type Drop-Down Menus in Excel

A few years ago, I created a tutorial on building smart drop-down menus in Excel using dynamic named ranges and data validation lists. This offered a great way to have drop-down menus in your model that could be easily changed by the user to…

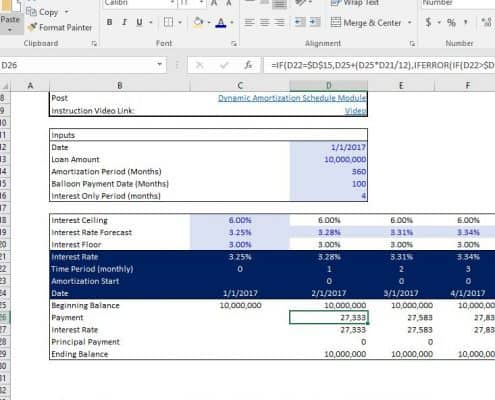

Dynamic Amortization Schedule (Updated 2.06.2020)

This is a dynamic amortization schedule for debt that gives the user the capability to model a loan with an interest only period up front and an amortizing floating rate debt repayment period once the interest only period is over. This module…