Real Estate Financial Modeling Accelerator (Updated April 2024)

Prior to launching the Accelerator program, Michael and I fielded email after email requesting a more structured real estate financial modeling training program on the site.

Over the years, we've covered hundreds of real estate modeling…

Introducing the New Accelerator 2.0 Learning Platform

In 2018, Michael and I designed and built the A.CRE Accelerator program. We sought to build the preeminent tool for learning and mastering real estate financial modeling. It was intended to provide a clear path to real estate financial modeling…

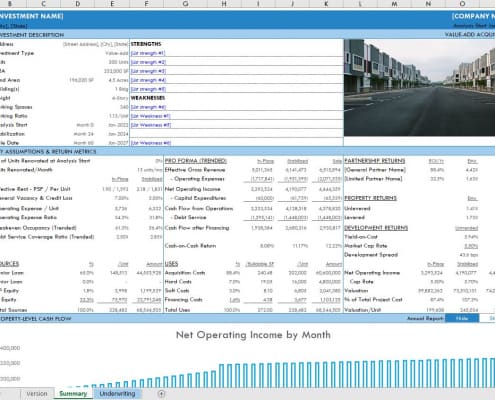

Pro Forma For Multifamily Renovation (Updated 11.17.2021)

I'm excited to share the Pro Forma for Multifamily Renovation model with all of you. This multifamily renovation model is made to analyze value add apartment acquisition opportunities and has a lot of functionality that is meant to provide you…

Watch Me Solve a REPE Technical Interview Modeling Test (Updated Nov 2021)

What better way to spend some free time over the Thanksgiving holiday, than to record myself completing a real estate private equity technical interview exercise! While I've offered help with the real estate technical interview in the past,…

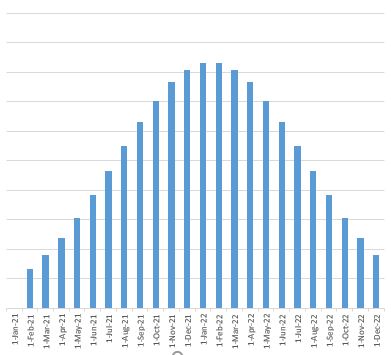

S-Curve Forecasting in Real Estate Development (Updated Sep 2021)

One of the reasons Michael and I blog, is to force ourselves to be continually learning. I built the first version of my real estate waterfall model, because I wanted to better understand the mechanics of modeling an equity waterfall with IRR…

Bite-Sized CRE Lessons – A.CRE 30 Second Video Tutorials

As we continue to build out our A.CRE 101 series and our Glossary of Commercial Real Estate terms, we've started to supplement these initiatives with short (<30 second) video clips on how to do various CRE calculations and modeling tasks…

Real Estate Equity Waterfall Model With Cash-on-Cash Return Hurdle (Updated Sep 2021)

Over the years, Michael and I have built and shared numerous real estate equity waterfall models, all multi-tiered and most with internal rate of return (IRR) hurdles. And as our readers have downloaded those models, I've received dozens of…

Real Estate Equity Waterfall Model – Monthly Periods (Updated Jul 2021)

When I decided to share my real estate equity waterfall model in Excel, I never imagined it would be as popular as it has. The model has been downloaded thousands times and many of you have written to extend your thanks for sharing. It is gratifying…

Watch Me Build – Custom Rent Schedule Module

In this Watch Me Build video I show you how to build a custom rent schedule module for long-term leases. The foundation of the module is a simple INDEX/MATCH combination that takes a rent schedule and models the rent cash flows across the entire…

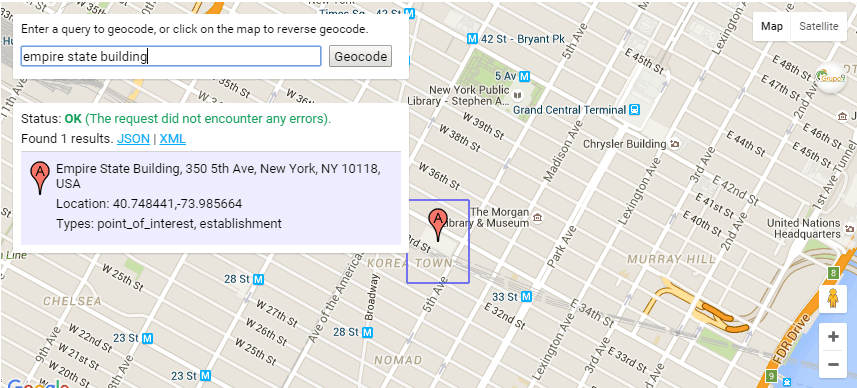

A.CRE Geocoding Excel Add-in to Auto-Populate Latitude and Longitude in Excel (Updated Jul 2021)

The A.CRE Geocoding Excel Add-in uses the Google Geocoding API to automatically convert a given address to latitude and longitude coordinates, or to convert a given latitude and longitude coordinate to an address. The add-in makes auto-populating…

Custom Function to Auto-Populate Latitude and Longitude in Excel (Updated 2021)

When analyzing real estate investments in Excel, it's often necessary to include the latitude and longitude coordinates of the properties we're modeling. To do this, most of us open up Google Maps, or some other mapping tool, and find the…

Deep Dive – Land Acquisition and Assemblage

This is a topic I'm all too familiar with. You see, I cut my teeth in real estate largely sourcing and negotiating residential and mixed-use land acquisition opportunities. I've put land deals together both as a fiduciary and as a principal,…

Could You Be Exiting Too Early? Don’t Forget to Analyze Your Reinvestment Rate

When attempting to maximize the value of your money invested in real estate, the timing of your exit is key to maximize your return. Exit too early, and you might leave money on the table. Exit too late, and you might have better used that capital…

Tutorials for A.CRE Value-Add Apartment Acquisition Model

As promised, I'm following up the release of the A.CRE Value-Add Apartment Acquisition model with a series of walk-throughs and tutorials to help you better understand the various elements of the model. The tutorials start with the basics -…

Real Estate Equity Waterfall Model with Catch Up and Clawback (Updated May 2021)

A question came up recently in the A.CRE Accelerator's real estate waterfall modeling course regarding how to model GP Catch Up (i.e. Sponsor Catch Up) and LP Clawback provisions. I put together a quick video tutorial in response to that question,…

Keyboard Shortcuts I Use Constantly When Modeling in Excel (Formatting)

The more you model real estate in Microsoft Excel, the faster and more accurate you become - and hopefully as a consequence the more valuable you become to real estate employers and investors. Part of the process of mastering real estate financial…