Tag Archive for: Development

Real Estate Financial Modeling Accelerator (Updated April 2024)

Prior to launching the Accelerator program, Michael and I fielded email after email requesting a more structured real estate financial modeling training program on the site.

Over the years, we've covered hundreds of real estate modeling…

Stablewood Properties – A.CRE Real Estate Sponsor Series

In this article, we feature Stablewood Properties as our fourth addition to a new series at A.CRE, our Real Estate Sponsor Series. This series aims to catalog the various real estate investors across the country. For this article, we interviewed…

Transitioning From Employee to Commercial Real Estate Entrepreneur with Kyle Keene | S3SP14

In this newest special episode of the A.CRE Audio Series, Sam and Michael talk with Kyle Keene from Keene Development Group about his transition from an employee in the industry to a commercial real estate entrepreneur. Kyle transitioned from…

MarketSpace Capital – A.CRE Real Estate Sponsor Series

Here we feature MarketSpace Capital in the third article of a new series at A.CRE, our Real Estate Sponsor Series. This series aims to catalog the various real estate investors across the country. For this article, we interviewed Sohail Hassan,…

Streamlining Asset Management with RE Analytics | S3SP13

In this newest special episode of the A.CRE Audio Series, Sam, Michael, and Spencer talk asset management with George Burchlaw and Carol Ann Flint from Re Analytics Business Development. RE Analytics is a service that partners with real estate…

How This Land Aggregation Strategy Helps Developers Raise More Debt and Scale Up Fast

Let's talk land aggregation strategy. Consider this, you have put together a portfolio of some great opportunistic development deals, each with immense upside potential. All you need is the initial big chunk of investment in land to get started.…

Impact Development – Doing Good While Doing Well with Brian Murray | S3SP12

In this special episode of the A.CRE Audio Series, Sam, Michael, and Spencer talk to Brian Murray, the CEO of Shift Capital, about impact development. Shift Capital is a B-certified impact real estate group. A B-certification is a designation…

Módulo de Flujo de Efectivo en Cascada – Base Anual y Múltiples Niveles de TIR en Excel

Cuando estaba trabajando en la publicación del “Modelo de Desarrollo Industrial”, pensé en la idea de explicar uno de los temas más interesantes del “Acelerador de Modelos Financieros”, se trataba del “Modelo de Cascada” también…

Modelo de Desarrollo Industrial en Excel

Antes de la publicación del “Mírame Construir el Modelo de Flujo de Efectivo Descontado” Spencer Burton ya me había informado que el siguiente reto para mí sería la construcción de un modelo diseñado para analizar oportunidades de…

How to draw-up 3-part Financial Statements from your CRE Financial Model

Sometimes, your investors will want to see financial statements. Though this is usually something left to accounting, it's not a difficult thing for you to draft up on your own. It actually just takes the simple steps of familiarizing yourself…

Modelo de Desarrollo de Terreno – Multi-escenarios en Excel

Luego del lanzamiento del “Modelo de Adquisición de Apartamento de Valor Agregado” Spencer ya tenía en mente un nuevo reto para mí, se trataba de su “Modelo de Desarrollo del Terreno”, construido con el propósito de analizar una…

Why CRE Deals May be Better Off Following a Project Finance Structure

In this article, we discuss the anatomy of two business structures - Project Finance and Corporate Finance - and why a Project Finance Structure is best suited for CRE deals by making the fund management process more investor friendly.

How…

Modelo de Adquisición de Apartamento de Valor Agregado en Excel

Todo comenzó a finales del año pasado cuando Spencer Burton me contactó y entendí en un primer momento que la principal función de A.CRE es la de educar en la elaboración de modelos financieros inmobiliarios, confieso que era imposible…

Using Geometric Mean (or CAGR) as an Alternative to IRR

The internal rate of return (IRR) and compound annual growth rate (CAGR) are both metrics used to analyze investment returns. They're both commonly used in commercial real estate financial modeling, but what's the difference? When should you…

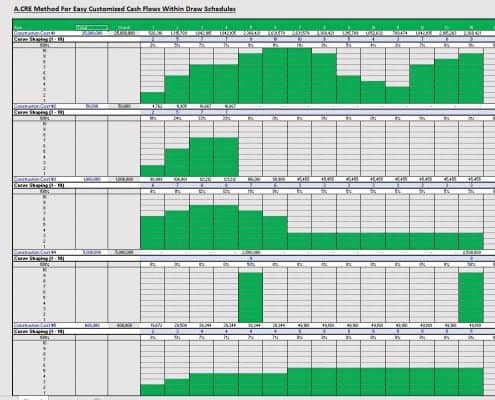

Development Draw Schedule – Visually Customize Each Line Item (UPDATED APR 2022)

Working a lot with development draw schedules, I have always been looking for a catch all solution as to how one could easily model all the unique ways cash actually flows over time during the process. The norm for many is to model cash flows…

Construction Draw Schedule: Accounting For True LTC (Updated Apr 2022)

When lenders provide debt for a development project, they lend based on a Loan-to-Cost ratio (LTC), which is simply the percent of the total budget the lender will agree to lend to the borrower. So, if a project costs $10MM, and a lender loans…