Tag Archive for: Tax

Real Estate Financial Modeling Accelerator (Updated June 2025)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

Understanding Low-Income Housing Tax Credit (LIHTC) Investments

In this article, we explore Low-Income Housing Tax Credit (LIHTC) investments, a key component in the affordable housing sector. Established to encourage private investment, the LIHTC program offers tax credits to developers for creating and…

Forecasting After-Tax Cash Flow in Real Estate Analysis (Updated May 2024)

When modeling real estate investments, industry practice is generally to stop at before-tax cash flow, rather than after-tax cash flow. And this makes sense in most instances. No two owners of real estate have the exact same tax situation and…

1031 Exchange – List of Concepts and Terms

Welcome to our comprehensive list of concepts and terms common to the 1031 Tax-Deferred Exchange. This resource is crafted to help professionals, investors, and others understand the terms used as part of a 1031 exchange in real estate.

The…

Understanding Taxes Series: Part 2 – Exceptions to The PAL Rules

The PAL Rules - A Brief Background

The PAL Rules, or Passive Activity Loss Rules, were enacted in 1986 to curb rampant abuses from people using real estate and businesses to generate huge losses to offset income taxes. It used to be that you…

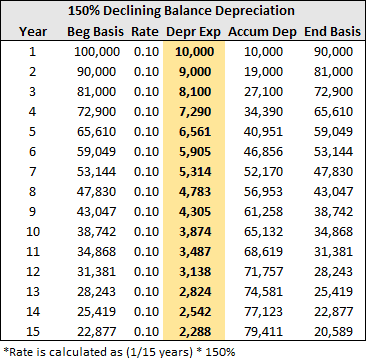

Understanding Taxes Series: Part 1 – Depreciation

Investing in real estate provides some tremendous tax incentives in the USA compared to other investments and is an important component to understanding real estate investing. Given the positive response I've received to my Understanding Leases…