Real Estate Financial Modeling Accelerator (Updated January 2026)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

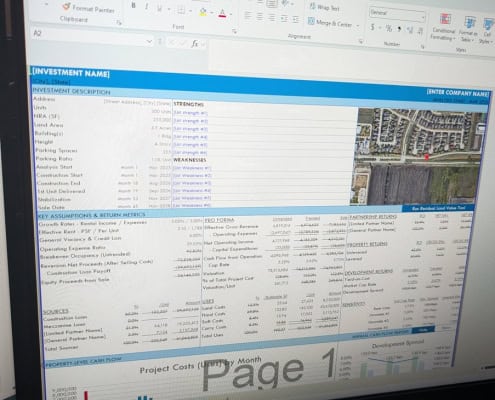

Land Development Model – Multi-Scenario (Updated Aug 2025)

Over the years, we've shared eight development-focused real estate financial models and numerous development-specific tools to the A.CRE Library of Excel Models. Nevertheless, there's been a hole in the development offerings in our library.…

Cómo Calculan los Prestamistas el Interés de los Préstamos en los Bienes Raíces Comerciales (Actualizado Agosto 2025)

En esta primera entrega de nuestra serie sobre préstamos hipotecarios para bienes raíces comerciales, exploramos cómo los prestamistas realizan el cálculo de intereses hipotecarios que aplican a los préstamos en este sector. Además, haremos…

Understanding Stabilization Through The Lens Of Operating Expense Ratio

The term “stabilized” is deeply embedded in the language of real estate. It shows up frequently in financial models, offering memoranda, development strategies, and underwriting assumptions. So frequently, in fact, that its meaning is often…

A.CRE Build-to-Rent (BTR) Development Model (Updated Aug 2025)

Build-to-rent (BTR) has become more and more common in CRE and now accounts for a meaningful share of development. In the past, we've recommended A.CRE readers use our Apartment Development Model for BTR analysis. However, as we've received…

Excel’s Stale Value Formatting: What It Means and Why It Matters (Updated Aug 2025)

We recently received an email from an A.CRE reader using one of our real estate financial models with a curious question. He explained that many of the cells in his model suddenly had a strikethrough applied to the text. Naturally, he wondered…

Eventos Inmobiliarios en Latinoamérica – Agosto 2025

Los eventos inmobiliarios en Latinoamérica son clave para conocer las últimas tendencias, regulaciones y oportunidades de inversión en la región. Para los profesionales del sector, estar al tanto de los principales eventos inmobiliarios…

The Conditional Weighted Average – SUMPRODUCT with SUMIF (Updated July 2025)

Consider this scenario: you have a 50 tenant rent roll, consisting of various tenant types (i.e. small inline, large inline, junior anchor, anchor, etc.), and you want to calculate the weighted average rent for each tenant type. If I asked you,…

Eventos Inmobiliarios A.CRE | IA en Construcción y el Futuro del Sector

Mi atención al evento "Ecosistemas Inteligentes: IA, Construcción y Experiencias", organizado por Construtech en alianza con Naska Digital, representó una valiosa oportunidad para profundizar en el estado actual y futuro de la transformación…

Exploring Latin America’s Real Estate Markets: Chile

The real estate market in Latin America continues to offer a landscape of economic and urban realities that invite strategic analysis. In our previous installment, we explored the case of Argentina, a complex market but full of opportunities…

Multifamily (Apartment) Acquisition Model (Updated July 2025)

Our library of real estate Excel models has a variety of decent apartment models, including our All-in-One model and our Apartment Development Model - both robust models in their own right. However, if you're looking for a straight multifamily…

Modelo de Desarrollo de Uso Mixto – Condominio y Comercio Minorista (Retail) en Excel (Actualizado Julio 2025)

Uno de los escenarios de desarrollo más comunes en muchas partes del mundo, incluyendo Latinoamérica, es el de los proyectos inmobiliarios que combinan unidades residenciales en forma de condominios con espacios comerciales minoristas (Retail).…

30/360, Actual/365, and Actual/360 – How Lenders Calculate Interest on CRE Loans – Some Important Insights (Updated July 2025)

(Updated August 7, 2019 to include a Watch Me Build video and Downloadable file)

Commercial real estate lenders commonly calculate loans in three ways: 30/360, Actual/365 (aka 365/365), and Actual/360 (aka 365/360). Real estate professionals…

Real Estate Equity Waterfall Model – IRR and Equity Multiple Hurdles (Updated July 2025)

Over the years, this real estate equity waterfall with annual periods and IRR or Equity Multiple hurdles has been one of the most popular models in our library of real estate Excel models. It's been downloaded thousands of times and we've received…

A.CRE 101: Buenas prácticas para construir modelos financieros inmobiliarios

En esta entrega de la serie A.CRE 101, exploramos tres pilares fundamentales del modelado financiero inmobiliario, necesarios para construir modelos sólidos y auditables. Desde el uso de pronósticos dinámicos (rolling forecast, forecasting…

Ground Lease Valuation Model (Updated July 2025)

The topic of ground leases has come up several times in the past few weeks. Numerous A.CRE readers have emailed to ask for a purpose-built Ground Lease Valuation Model. And I'm in the process of creating an Advanced Concepts Module for our real…