Real Estate Financial Modeling Accelerator (Updated June 2025)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

Single Tenant NNN Lease Valuation Model (Updated May 2025)

I originally built this single tenant net lease (NNN) valuation Excel model back in 2016. Based on some feedback from a few of our readers, I've since made quite a few updates (see v2.0 updates video below). This model is an attempt to re-think…

How I Built a Real Estate DCF Web App with AI in Five Minutes

Over the past year, we've been experimenting heavily with (and successfully using) AI coding tools to push the boundaries of what's possible in commercial real estate. We've used v0 to quickly scope frontend designs, and we've spun up various…

Excel Shortcuts For Real Estate Financial Modeling (Updated May 2025)

One of the lesser talked about—yet most impactful—skills in real estate financial modeling is keyboard efficiency. If you’ve ever watched one of our tutorials or Accelerator sessions, you’ve probably seen the models flying by, with formulas…

Self Storage Acquisition Model (Updated May 2025)

I've spent the past few weekends working on a purpose-built Self Storage Acquisition Model, and I'm now happy to share the result of that work with you. This is a model that's been requested by quite a few A.CRE readers over the past few years.…

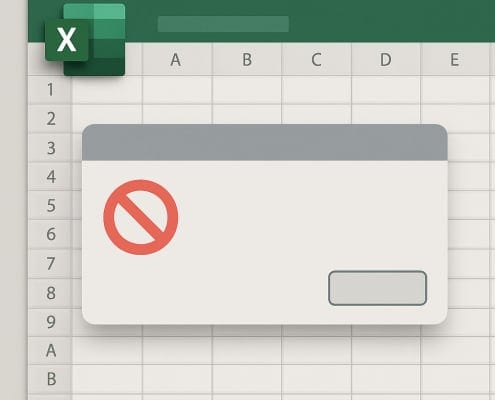

Microsoft has blocked the macros in my A.CRE model – What now?

When downloading and opening an Excel model from A.CRE, some users may get the ominous message: "Microsoft has blocked macros from running because the source of this file is untrusted." If you've received this message, you're probably asking,…

Residential Land Development Pro Forma (Updated Apr 2025)

As many of you know, I started my career in residential land development first as a broker and later as a principal. During that time, I built my fair share of residential land development Excel pro formas, modeling returns and forecasting cash…

Short-Term Rental Acquisition Model

In today’s real estate landscape, short-term rentals (STRs) stand out as one of the most dynamic and potentially high-yield asset classes. From compact urban units serving business travelers to luxury vacation homes attracting high-net-worth…

Multifamily (Apartment) Acquisition Model (Updated Apr 2025)

Our library of real estate Excel models has a variety of decent apartment models, including our All-in-One model and our Apartment Development Model - both robust models in their own right. However, if you're looking for a straight multifamily…

Ground Lease Valuation Model (Updated Mar 2025)

The topic of ground leases has come up several times in the past few weeks. Numerous A.CRE readers have emailed to ask for a purpose-built Ground Lease Valuation Model. And I'm in the process of creating an Advanced Concepts Module for our real…

Tutorial on How to Model Irregular Growth Rates in Real Estate

When building a real estate financial model, managing income and expense growth is rarely as simple as applying a fixed growth rate year over year. In real estate investment analysis, growth assumptions need to be flexible, dynamic, and reflective…

Supercharge Excel with the ‘Excel 4 CRE’ Add-In – Now with AI (Updated Mar 2025)

Today, we're thrilled to share with the A.CRE community a new timesaving (and free) Excel tool: the 'Excel 4 CRE' Add-in! Over the past few years, we at A.CRE (together with our new favorite companion, ChatGPT!) have been developing and sharing…

A.CRE Audio Series – Season Five

Real Estate Asset Management Model

Many of you have run into this scenario: you build out a detailed acquisitions model at purchase. Everything looks great—market rents, lease-up timing, exit cap, all in line. The acquisitions team is convinced this is going to be a home run.…

Introducing the New Accelerator 3.0 Platform

In 2018, Michael and I designed and built the A.CRE Accelerator program. Our goal was to create the preeminent tool for mastering real estate financial modeling—a program that would provide a clear path to expertise and give Accelerator Graduates…

Excel Pro Forma for Flipping Houses (Updated Jan 2025)

Before moving to the principal side of the business, I began my career as a self-described real estate investment specialist, largely working as a land broker but dabbling in other areas including the popular "single-family flip" space. In all…