Real Estate Financial Modeling Accelerator (Updated June 2025)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

A.CRE Real Estate Financial Models Download Guide (Updated December 2024)

Since I started working with A.CRE, I wanted to find a way to easily find the different models, modules, tools, and tutorials the guys have shared from the Library of Excel Real Estate Financial Models. After some time helping out our readers…

Simple Acquisition Model for Office, Retail, Industrial Properties (Updated Dec 2024)

A few years back, on a sleepy Saturday afternoon while my kids were busy eating Halloween candy, I decided to create a simple real estate acquisition model in Excel for office, retail, and industrial deals.

Since then, I've made various updates,…

Using COUNTIFS, SUMIFS, and AVERAGEIFS Excel Functions in Real Estate Underwriting (Updated Dec 2024)

Why use COUNTIFS, SUMIFS, and AVERAGEIFS functions in real estate? When real estate analysts first start their careers, they're often required to work with large data sets and to transpose property and portfolio information from one format to…

Real Estate Equity Waterfall Model with Catch Up and Clawback (Updated Dec 2024)

A question came up recently in the A.CRE Accelerator's real estate waterfall modeling course regarding how to model GP Catch Up (i.e. Sponsor Catch Up) and LP Clawback provisions. I put together a quick video tutorial in response to that question,…

Excel’s Stale Value Formatting: What It Means and Why It Matters

We recently received an email from an A.CRE reader using one of our real estate financial models with a curious question. He explained that many of the cells in his model suddenly had a strikethrough applied to the text. Naturally, he wondered…

A.CRE Apartment Development Model (Updated Dec 2024)

For several years now, our library of real estate models has been lacking a robust ground-up apartment development model. Sure, our All-in-One (Ai1) model has the capability to model multifamily development deals, but it's more a generalist…

Best Practices in Real Estate Financial Modeling (Updated Nov 2024)

Before you use one of our real estate financial models (i.e. Excel templates), or before you set out to build your own real estate analysis tool in Excel, it's important to keep in mind a few real estate financial modeling best practices. This…

Industrial Real Estate Development Model (Updated Nov 2024)

Allow me to share my Industrial Development Model in Excel. Over the past few years, I've been working to add more specialty real estate models to our library. While our All-in-One model certainly has its place, oftentimes really digging into…

Real Estate Case Studies Creator Assistant – Custom GPT by A.CRE (Updated Oct 2024)

If you've spent any time following us here at A.CRE you know that AI applications in real estate financial modeling is a topic we are fascinated (and excited) about! As a consequence, we're underway with several initiatives to explore AI in…

Learning Real Estate Financial Modeling in Excel (Updated Oct 2024)

We're often asked by our readers how we learned to be proficient in real estate financial modeling. The question usually arises because the person wants to know how to model real estate in Excel to either land a job in commercial real estate…

Introducing the A.CRE AI Assistant Custom GPT (Updated Oct 2024)

Since Michael and Spencer started A.CRE in grad school over 10 years ago, we've been fielding and responding to questions from our readers. With every question, our mission is to provide an answer that adds unique value to our reader.

As…

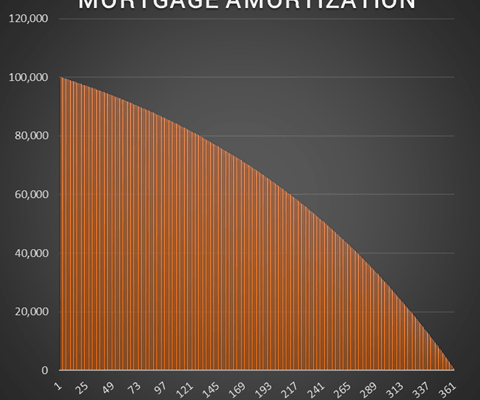

Watch Me Build a Dynamic Mortgage Amortization Table in Excel (Updated September 2024)

There are a few basic, yet fundamental, real estate modeling skills you must master before anyone will take you seriously as a real estate professional. Building a mortgage amortization schedule is one of them.

Virtually every model you…

Deep Dive – Land Acquisition and Assemblage (Updated September 2024)

This is a topic I'm all too familiar with. You see, I cut my teeth in real estate largely sourcing and negotiating residential and mixed-use land acquisition opportunities. I've put land deals together both as a fiduciary and as a principal,…

Watch Me Build a 3-Tier Real Estate Equity Waterfall Model (Updated Aug 2024)

As I've mentioned in other Watch Me Build posts, one way to become a better real estate financial modeling professional, is to watch other professionals model. Thus, the more exposure you can get to other's methods, the more adept a real estate…

A.CRE 101: How To Use The Discounted Cash Flow (DCF) Method To Value Income Producing Property (Updated Aug 2024)

The Discounted Cash Flow Method is a method to value a project by taking all future projected cash flows of the project and discounting them back to time zero (date of purchase) using a predetermined discount rate (the discount rate when used…