Real Estate Financial Modeling Accelerator (Updated January 2026)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

Watch Me Build – Modeling a Rent Schedule in Both Excel and Using AI (Updated May 2024)

In this Watch Me Build video I show you how to build a custom rent schedule module for long-term leases. The foundation of the module is a simple INDEX/MATCH combination that takes a rent schedule and models the rent cash flows across the entire…

Real Estate Capital Account Tracking Tool (Updated Apr 2024)

I'll be the first to admit that real estate asset management doesn't get the attention it deserves on AdventuresinCRE.com. The real reason for this is that we're not necessarily asset management experts. I spent some time working in asset management…

Hide and Unhide Tabs using Drop-down Menus in Excel (Updated Apr 2024)

I'd like to share a handy little trick I learned this week for hiding and unhiding tabs in Excel using drop-down menus. Now this method requires you to use some basic VBA code and to save the Workbook as a Macro-Enabled file but don't be intimidated…

Watch Me Build – American-Style Real Estate Equity Waterfall (Updated Apr 2024)

A few years ago, I recorded my screen as I built a 3-tier real estate equity waterfall model. What I didn't mention in that Watch Me Build video, is that the kind of waterfall I built is colloquially called a European-style equity waterfall.…

Advanced Mortgage Amortization Schedule – Custom GPT by A.CRE

At A.CRE, we've built dozens of custom GPTs for internal and external purposes. Some of the GPTs have general application, while others are custom GPTs specifically for commercial real estate. One such CRE-specific GPT that we recently built…

Multifamily Development Model (Updated April 2024)

Not to be confused with Spencer's masterpiece, The A.CRE Apartment Development Model, I decided to build a second option on our website for multifamily development with a different feel. For us true modeling nerds out there, we know that financial…

Commercial Mortgage Loan Analysis Model (Updated Mar 2024)

Over the years, I've received various requests to augment our library of real estate Excel models to include a model for underwriting and analyzing commercial mortgage loans. Specifically, people have asked for a tool to calculate the loan amount…

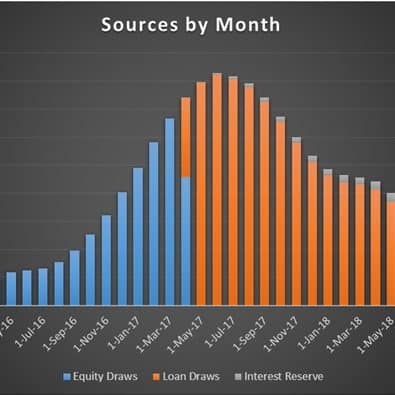

Construction Draw and Interest Calculation Model (Updated Feb 2024)

I originally uploaded this equity/construction loan draw and interest calculation tool to our library of real estate financial analysis models in 2016. Over the years, I've continued to update it as suggestions, comments, and requests…

Real Estate Sources and Uses of Capital Module (Updated Feb 2024)

An important component in any acquisition, development, and value-add model is the Sources and Uses of Capital section. Of course, how the sources and uses are modeled and how those cash flows are visualized will vary from one model to the next.…

Real Estate Development Tracker (Updated Feb 2024)

One of the many challenges of both analyzing real estate development deals and managing development projects is understanding and tracking the numerous differing but intertwining work streams. The more a development team takes the time…

Hotel Development Model (Updated February 2024)

Excited to share the new A.CRE Hotel Development Model with everyone. As evidenced by the numerous requests we have gotten for this over the years, this model is long overdue so I'm quite happy to get it out there finally.

At the core, the…

RV Park Development Model (Initial Release)

Created to underwrite one of my projects, RV@Olympic, the RV Park Development Model is something I built and have been working with frequently over the past year. What’s especially unique about this model is that the template you are getting…

Modeling a Property Tax Abatement in Real Estate (Updated Jan 2024)

We often field questions about how to model property tax abatements. It's a concept we cover in our the 'Advanced Modeling - Property and Portfolio' endorsement in our Accelerator real estate financial modeling training program and something…

A.CRE Geocoding Excel Add-in to Auto-Populate Latitude and Longitude in Excel (Updated Jan 2024)

The A.CRE Geocoding Excel Add-in uses the Google Geocoding API to automatically convert a given address to latitude and longitude coordinates, or to convert a given latitude and longitude coordinate to an address. The add-in makes auto-populating…

Using an IRR Matrix to Determine Hold Period (Updated Dec 2023)

When building a real estate financial pro forma, it's important to model for and include a summary of various return and risk metrics. Among the different return metrics, the internal rate of return (IRR) - both on an unlevered and levered…