Tag Archive for: Module

Real Estate Financial Modeling Accelerator (Updated June 2025)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

Real Estate Equity Waterfall Model – IRR and Equity Multiple Hurdles (Updated July 2025)

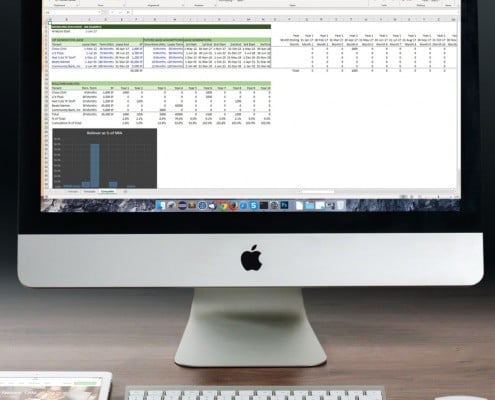

Over the years, this real estate equity waterfall with annual periods and IRR or Equity Multiple hurdles has been one of the most popular models in our library of real estate Excel models. It's been downloaded thousands of times and we've received…

Real Estate Debt Module in Excel (Updated May 2024)

I thought I'd share the real estate debt module I originally built for the ARGUS alternative in Excel. Most debt modules I've seen in real estate financial models only include the ability to model fully amortizing senior debt. Mike challenged…

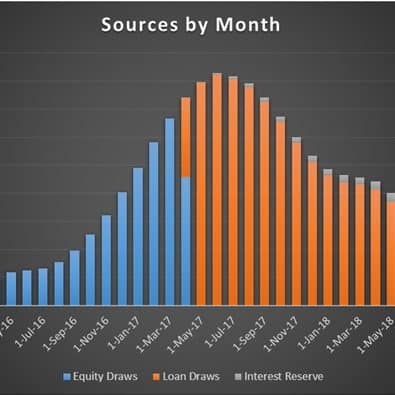

Construction Draw and Interest Calculation Model (Updated Feb 2024)

I originally uploaded this equity/construction loan draw and interest calculation tool to our library of real estate financial analysis models in 2016. Over the years, I've continued to update it as suggestions, comments, and requests…

Using an IRR Matrix to Determine Hold Period (Updated Dec 2023)

When building a real estate financial pro forma, it's important to model for and include a summary of various return and risk metrics. Among the different return metrics, the internal rate of return (IRR) - both on an unlevered and levered…

Refinance Risk Analysis Tool in Excel (Updated Nov 2023)

Generally speaking, equity real estate investors spend their time modeling the upside while their debt partners spend their time modeling the downside. Equity investors generally focus on an investment's internal rate of return, cash-on-cash…

Calculate Residual Land Value in Excel (Updated Jul 2023)

Here's the scenario. You're a real estate developer. You spot a prime parcel of land that would be perfect for your real estate project. So you approach the owner of the land about selling and she says, "Okay, bring me an offer." How much do…

Tenant Sales and Occupancy Cost in Retail Underwriting (UPDATED JUNE 2022)

When underwriting a retail investment, rollover risk is an incredibly important consideration. You, as a prospective debt or equity investor in the property, need to understand how secure the cash flows you're buying are; or in other words,…

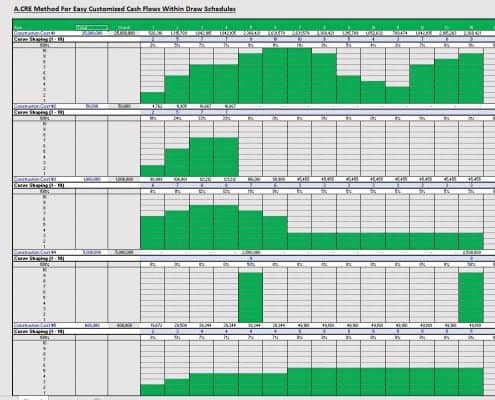

Development Draw Schedule – Visually Customize Each Line Item (UPDATED APR 2022)

Working a lot with development draw schedules, I have always been looking for a catch all solution as to how one could easily model all the unique ways cash actually flows over time during the process. The norm for many is to model cash flows…

Construction Draw Schedule: Accounting For True LTC (Updated Apr 2022)

When lenders provide debt for a development project, they lend based on a Loan-to-Cost ratio (LTC), which is simply the percent of the total budget the lender will agree to lend to the borrower. So, if a project costs $10MM, and a lender loans…

Real Estate Equity Waterfall Model – Monthly Periods (Updated Jul 2021)

When I decided to share my real estate equity waterfall model in Excel, I never imagined it would be as popular as it has. The model has been downloaded thousands times and many of you have written to extend your thanks for sharing. It is gratifying…

Watch Me Build a Tenant Rollover Analysis Model

The feedback has been positive on the ‘Watch Me Build a Multifamily Model’ video I recorded earlier this year. So I thought I’d follow that up with another. This time I build a Real Estate Tenant Rollover Analysis Model and talk through…

Waterfall Model For Real Estate Joint Ventures with Catch Up

I've just wrapped up a new JV waterfall model with catch up clause that I am excited to share on the site. This model was built as an addition to my back-of-the envelope retail/industrial/office acquisitions model I posted a few weeks back.…

Real Estate Waterfall Model – Equity Multiple Hurdles

I've created a companion to my real estate equity waterfall model to work with equity multiple hurdles, rather than IRR hurdles. It took me longer than I expected to build this, largely because I was over thinking it. I messed around with…