Tag Archive for: Excel Model

Real Estate Financial Modeling Accelerator (Updated June 2025)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

Residential Land Development Pro Forma (Updated July 2025)

As many of you know, I started my career in residential land development first as a broker and later as a principal. During that time, I built my fair share of residential land development Excel pro formas, modeling returns and forecasting cash…

Single Family Home Construction Pro Forma for Home Builders (Updated July 2025)

I'm often asked to share models centered around residential development and home building. This is an area of real estate I'm completely comfortable in, since I spent the first 10 years of my career in new residential development.

Not surprisingly,…

Real Estate Equity Waterfall Model – IRR and Equity Multiple Hurdles (Updated June 2025)

Over the years, this real estate equity waterfall with annual periods and IRR or Equity Multiple hurdles has been one of the most popular models in our library of real estate Excel models. It's been downloaded thousands of times and we've received…

Multifamily (Apartment) Acquisition Model (Updated Apr 2025)

Our library of real estate Excel models has a variety of decent apartment models, including our All-in-One model and our Apartment Development Model - both robust models in their own right. However, if you're looking for a straight multifamily…

Simple Acquisition Model for Office, Retail, Industrial Properties (Updated Dec 2024)

A few years back, on a sleepy Saturday afternoon while my kids were busy eating Halloween candy, I decided to create a simple real estate acquisition model in Excel for office, retail, and industrial deals.

Since then, I've made various updates,…

Best Practices in Real Estate Financial Modeling (Updated Nov 2024)

Before you use one of our real estate financial models (i.e. Excel templates), or before you set out to build your own real estate analysis tool in Excel, it's important to keep in mind a few real estate financial modeling best practices. This…

Learning Real Estate Financial Modeling in Excel (Updated Oct 2024)

We're often asked by our readers how we learned to be proficient in real estate financial modeling. The question usually arises because the person wants to know how to model real estate in Excel to either land a job in commercial real estate…

Forecasting After-Tax Cash Flow in Real Estate Analysis (Updated May 2024)

When modeling real estate investments, industry practice is generally to stop at before-tax cash flow, rather than after-tax cash flow. And this makes sense in most instances. No two owners of real estate have the exact same tax situation and…

Real Estate Debt Module in Excel (Updated May 2024)

I thought I'd share the real estate debt module I originally built for the ARGUS alternative in Excel. Most debt modules I've seen in real estate financial models only include the ability to model fully amortizing senior debt. Mike challenged…

Multifamily Development Model (Updated April 2024)

Not to be confused with Spencer's masterpiece, The A.CRE Apartment Development Model, I decided to build a second option on our website for multifamily development with a different feel. For us true modeling nerds out there, we know that financial…

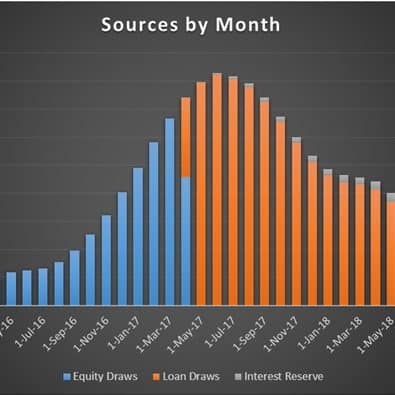

Construction Draw and Interest Calculation Model (Updated Feb 2024)

I originally uploaded this equity/construction loan draw and interest calculation tool to our library of real estate financial analysis models in 2016. Over the years, I've continued to update it as suggestions, comments, and requests…

Real Estate Development Tracker (Updated Feb 2024)

One of the many challenges of both analyzing real estate development deals and managing development projects is understanding and tracking the numerous differing but intertwining work streams. The more a development team takes the time…

Refinance Risk Analysis Tool in Excel (Updated Nov 2023)

Generally speaking, equity real estate investors spend their time modeling the upside while their debt partners spend their time modeling the downside. Equity investors generally focus on an investment's internal rate of return, cash-on-cash…

Calculate Residual Land Value in Excel (Updated Jul 2023)

Here's the scenario. You're a real estate developer. You spot a prime parcel of land that would be perfect for your real estate project. So you approach the owner of the land about selling and she says, "Okay, bring me an offer." How much do…

Single Family Residential Investment Analysis Model (Updated Apr 2023)

Pre-2008, I bought and sold my fair share of single family homes - both for investment purposes (rental or flips) and to live in. In those days, almost everyone was "investing" in residential real estate - hence the market crash. I personally…