Tag Archive for: Excel Model

Real Estate Financial Modeling Accelerator (Updated June 2025)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

Real Estate Portfolio Valuation Model (Updated Aug 2022)

I built, and would like to share, a real estate portfolio model for valuing a portfolio of up to 30 properties. This is a "roll-up" model, meaning you will need to model your unlevered (before financing) property-level cash flows in a separate…

Tenant Sales and Occupancy Cost in Retail Underwriting (UPDATED JUNE 2022)

When underwriting a retail investment, rollover risk is an incredibly important consideration. You, as a prospective debt or equity investor in the property, need to understand how secure the cash flows you're buying are; or in other words,…

Physical Occupancy Calculation Model for Real Estate (UPDATED MAY 2022)

As many of you know, I'm in the midst of moving my family from Milwaukee to Dallas, and quite frankly I'm getting sick of eating out and sleeping in hotel rooms. So what better way to unwind from hours of whining kids and tiresome travel, than…

Real Estate Equity Waterfall Model – Monthly Periods (Updated Jul 2021)

When I decided to share my real estate equity waterfall model in Excel, I never imagined it would be as popular as it has. The model has been downloaded thousands times and many of you have written to extend your thanks for sharing. It is gratifying…

Apartment Acquisition Model with Monte Carlo Simulation Module (Updated Jan 2021)

We have a few stochastic modeling tools for real estate on the website, but none as robust as this Apartment Acquisition Model with Monte Carlo Simulation Module. I originally built the model in 2016 by taking my standard apartment acquisition…

Real Estate Acquisitions Model #2 for Office, Retail, Industrial (Updated Aug 2020)

I've decided to do a major overhaul of my last acquisitions model for office, industrial, and retail properties. There were a lot of things I wanted to change as well as add to the model and finally had a weekend to do it. This new and improved…

Multifamily Redevelopment Model (Updated June 2020)

This is an Excel model I originally built from scratch back in 2015 for quickly assessing multifamily redevelopment opportunities. It was designed to work best for scenarios where individual units will be rehabbed over the hold at varying times.…

Watch Me Build a Tenant Rollover Analysis Model

The feedback has been positive on the ‘Watch Me Build a Multifamily Model’ video I recorded earlier this year. So I thought I’d follow that up with another. This time I build a Real Estate Tenant Rollover Analysis Model and talk through…

Watch Me Build a Multifamily Real Estate Model (Updated Feb 2020)

One way to become a better real estate financial modeling professional, is to watch other professionals model. I know in my career being able to physically see how others tackle different modeling problems has shaped my methods and made me better…

Hotel Acquisition Model – The Basic Model (Updated 10.9.2019)

The initial goal for the original Hotel Acquisition Model was to design a hotel proforma that would enable users to get deep into the weeds of practically every line item in their hotel analysis. Although I am super happy with how that hotel…

3-Tiered Acquisition Debt Module

This is a 3-tiered debt module that will allow the user to add one to three tiers of debt to his or her real estate DCF model. Includes the option to layer in senior debt, secondary debt, and mezzanine debt; calculate interest on either…

Back-of-the-Envelope Office, Retail, Industrial Acquisition Model (Updated 10.1.2018)

I’ve built a new acquisition model that I am excited to share with our readers. This is a back-of-the-envelope (BOE) valuation model that can be used for retail, office, and industrial properties. The goal was to create a sleek and clean look…

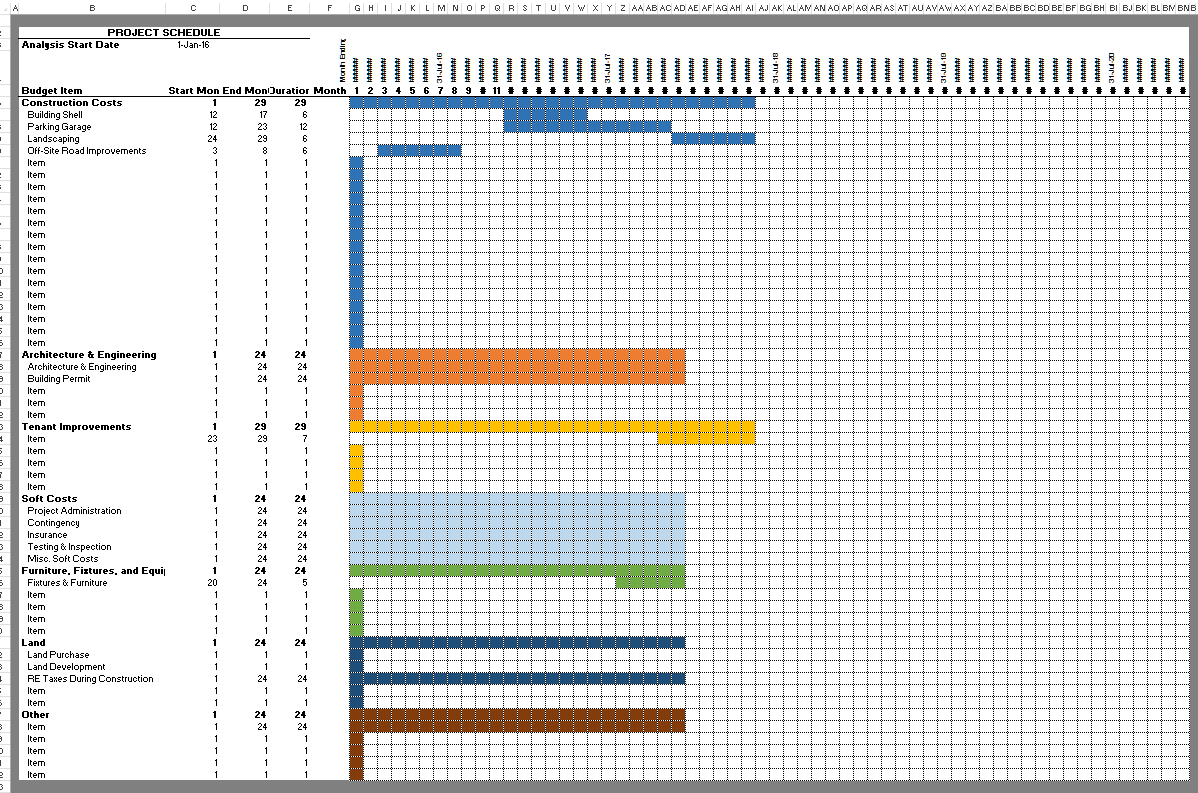

Bonus Content – Gantt Chart and Weighted Average with Multiple Conditions

I have two updates/improvements to previous posts I thought I'd share with our readers today; call it, bonus content! The first, is a dynamic Gantt Chart tool I recently added to my Construction Draw and Interest Calculation Model. The second,…

Waterfall Model For Real Estate Joint Ventures with Catch Up

I've just wrapped up a new JV waterfall model with catch up clause that I am excited to share on the site. This model was built as an addition to my back-of-the envelope retail/industrial/office acquisitions model I posted a few weeks back.…

Real Estate Waterfall Model – Equity Multiple Hurdles

I've created a companion to my real estate equity waterfall model to work with equity multiple hurdles, rather than IRR hurdles. It took me longer than I expected to build this, largely because I was over thinking it. I messed around with…