Tag Archive for: Tutorial

Real Estate Financial Modeling Accelerator (Updated April 2024)

Prior to launching the Accelerator program, Michael and I fielded email after email requesting a more structured real estate financial modeling training program on the site.

Over the years, we've covered hundreds of real estate modeling…

Las Funciones TIR y TIR.NO.PER en Excel – Explicados de Forma Completa y Sencilla

Cuando hablamos de análisis financiero, la capacidad de evaluar de manera precisa y eficiente la viabilidad y rentabilidad de los proyectos es, por supuesto, una herramienta indispensable para los economistas y profesionales del sector, y para…

The A.CRE Method for Doing Cap Rate Math in Your Head

In this post, I'd like to share a method that, with a little practice, will enable you to quickly do cap rate math in your head; whether it’s quickly figuring out what the sale or purchase price would be of a property based on the NOI and…

Scenario Analysis Tool using the Equity Waterfall Model (UPDATED MAY 2022)

I received a question this morning asking how to use scenario (or sensitivity) analysis with our Real Estate Equity Waterfall Model. I started to answer the question via email, decided to build an Excel file to go along with my answer, and ultimately…

A.CRE 101: How to Use the Income Capitalization Approach to Value Income-Producing Property (Updated Apr 2022)

In commercial real estate, there are a few generally accepted methods for appraising (or valuing) real property. The three most common are the Cost Approach, the Sales Comparison Method, and the Income Approach. The Income Approach includes…

Why Your IRR and XIRR are Different

This post was inspired by a recent question on our real estate financial modeling Accelerator forum. Additionally, Spencer and I frequently get emails asking about this very issue, which is 'why the IRR (internal rate of return) and XIRR (extended…

Watch Me Build a Multifamily Real Estate Model (Updated Feb 2020)

One way to become a better real estate financial modeling professional, is to watch other professionals model. I know in my career being able to physically see how others tackle different modeling problems has shaped my methods and made me better…

How to Create Dynamic, In-Cell Buttons and Toggles in Microsoft Excel

Creating intuitive, user-friendly, visually appealing models is one aspect of mastering real estate financial modeling. One way to make your models easy for people to use and more attractive in general is to use dynamic, theme-appropriate, in-cell…

Watch Me Build a 3-Tier Real Estate Equity Waterfall Model (Updated August 2019)

As I've mentioned in other Watch Me Build posts, one way to become a better real estate financial modeling professional, is to watch other professionals model. Thus, the more exposure you can get to other's methods, the more adept a real estate…

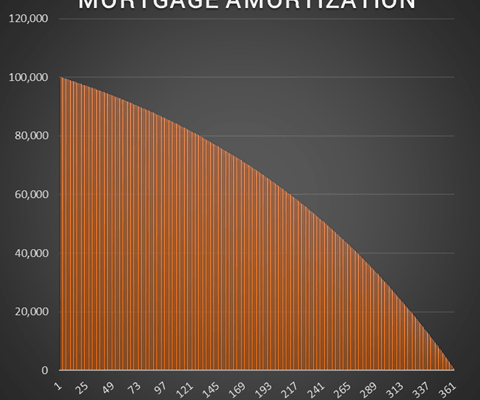

Watch Me Build a Dynamic Mortgage Amortization Table in Excel

There are a few basic, yet fundamental, real estate modeling skills you must master before anyone will take you seriously as a real estate professional. Building a mortgage amortization schedule is one of them.

Virtually every model you…

Create a Dynamic Real Estate Chart in Excel

Most of the real estate financial models we've shared over the years are dynamic to analysis period. Meaning, we've included an input to adjust the length of the analysis period, and the model will adjust the results accordingly.

This is…

How to Use the Apartment Acquisition Model’s Monte Carlo Simulation Module

You may recall that a couple of weeks ago, I began to explore Stochastic Modeling concepts, or the idea of adding probability into my models, to get a more complete picture of the risk-return metrics of an investment. I became interested in…

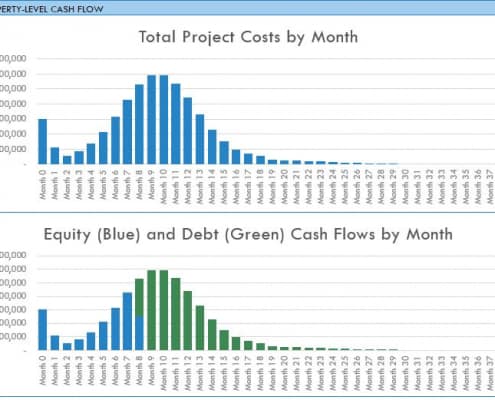

How to Use the Construction Draw and Interest Calculation Model

As promised, I've recorded a tutorial on how to use my construction draw and interest calculation model. The 20 minute tutorial walks you through how to use the model to forecast construction cash flows during your development period. The model…

Apartment Valuation Tutorial Using the Real Estate Acquisition Model

I promised a how-to video for my real estate apartment acquisition model, and so I thought I'd use an actual property to do so. I grabbed a property from Loopnet that is currently for sale, and dropped the information from the listing into…

How to Use My Real Estate Equity Waterfall Model

I took a few minutes this weekend, and created a video to help you use my real estate equity waterfall (IRR hurdle technique) model that I built in Excel. Again, keep in mind that the model is not standalone, but can be used with any of the…