Real Estate Financial Modeling Accelerator (Updated June 2025)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

A.CRE at the Smart City Expo Bogotá 2024

A year ago, my A.CRE colleague Arturo Parada and I attended our first real estate event in Bogotá, Smart City Expo Bogotá 2023, where we had the opportunity to connect with industry leaders and explore emerging trends in urban development…

Check Out Ackman Ziff’s AZ Educate Program

I wanted to share with everyone a great (and free, but selective) learning opportunity from both a person and company I really respect. Ackman Ziff has launched a new program called A|Z Educate that I think could provide significant value to…

Best Practices in Real Estate Financial Modeling (Updated Nov 2024)

Before you use one of our real estate financial models (i.e. Excel templates), or before you set out to build your own real estate analysis tool in Excel, it's important to keep in mind a few real estate financial modeling best practices. This…

Learning Real Estate Financial Modeling in Excel (Updated Oct 2024)

We're often asked by our readers how we learned to be proficient in real estate financial modeling. The question usually arises because the person wants to know how to model real estate in Excel to either land a job in commercial real estate…

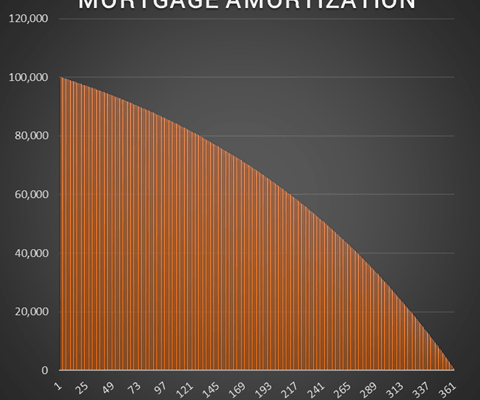

Watch Me Build a Dynamic Mortgage Amortization Table in Excel (Updated September 2024)

There are a few basic, yet fundamental, real estate modeling skills you must master before anyone will take you seriously as a real estate professional. Building a mortgage amortization schedule is one of them.

Virtually every model you…

Deep Dive – Land Acquisition and Assemblage (Updated September 2024)

This is a topic I'm all too familiar with. You see, I cut my teeth in real estate largely sourcing and negotiating residential and mixed-use land acquisition opportunities. I've put land deals together both as a fiduciary and as a principal,…

Watch Me Build a 3-Tier Real Estate Equity Waterfall Model (Updated Aug 2024)

As I've mentioned in other Watch Me Build posts, one way to become a better real estate financial modeling professional, is to watch other professionals model. Thus, the more exposure you can get to other's methods, the more adept a real estate…

Exploring Tokenization in Commercial Real Estate

I have always been interested in developing technology trends, and, in the spirit of exploring future possibilities in our industry, I wanted to discuss a developing trend of tokenization in commercial real estate. If you're not yet familiar…

A.CRE 101: How To Use The Discounted Cash Flow (DCF) Method To Value Income Producing Property (Updated Aug 2024)

The Discounted Cash Flow Method is a method to value a project by taking all future projected cash flows of the project and discounting them back to time zero (date of purchase) using a predetermined discount rate (the discount rate when used…

How to Run Monte Carlo Simulations in Excel (Updated Aug 2024)

So you want to run Monte Carlo simulations in Excel, but your project isn't large enough or you don't do this type of probabilistic analysis enough to warrant buying an expensive add-in. Well, you've come to the right place. Excel's built-in…

Through The Entitlement Process: Identifying Risks and Strategies For Mitigation (Updated Aug 2024)

Investing in and developing an unentitled site, broadly speaking, is one of the riskiest, yet rewarding, endeavors in the commercial real estate industry. The entitlement process, in particular, is fraught with the potential for setbacks and…

Analyzing Value-Add Investments in Real Estate Using Yield-on-Cost (Updated Aug 2024)

So a question recently came in around why a commercial real estate investor would use the Yield-on-Cost metric to assess a value-add real estate investment. This question came on the heals of several other questions also related to development…

Using SUMPRODUCT to Calculate Weighted Average in Real Estate (Updated Aug 2024)

In my experience, using the SUMPRODUCT function in Excel to calculate weighted average is one of the most oft-used Excel techniques in real estate financial modeling. I learned this technique on day one of my first real estate internship and…

Using the Cash-on-Cash Return in Real Estate Investment Analysis (Updated Aug 2024)

I’ve fielded a handful of Cash-on-Cash (CoC) return questions of late. So, I thought it would be worthwhile to write a post on what the Cash-on-Cash return metric tells me about a potential real estate investment. This article is a primer,…

LinkedIn Job Search 101 for CRE Professionals (Updated Aug 2024)

Our goal with this post is to help you use LinkedIn most effectively in your job search. It's the first post in a series of a LinkedIn 101 networking series to help you get the most out of this resource. Because commercial real estate is such…